As a US expat working and living abroad, it’s important to understand how to follow Form 1116 Instructions. This IRS form allows US expats to claim the Foreign Tax Credit, one of the most useful tax provisions for US taxpayers filing from abroad.

Tax credits are more valuable than tax deductions. Credits offset the amount of tax you owe dollar for dollar. Deductions, on the other hand, reduce your taxable income. As a US expat, you’re subject to taxes by the US and your country of residence, meaning you may find yourself facing taxes both in your country of residence and in the United States.

But, thanks to the IRS Foreign Tax Credit and tax treaties, you can offset the taxes you’ve paid or accrued in your country of residence against your US income tax bill.

As noted at the beginning, the Foreign Tax Credit (FTC) is claimed with Form 1116.

In this article, we’ll walk you through the instructions for filling out Form 1116.

Instructions for Form 1116

The Foreign Tax Credit is one of the most common IRS tax provisions for US expats. If you’re still trying to understand how this credit works and whether it’s the best choice for you, read our comprehensive article for full background on the Foreign Tax Credit.

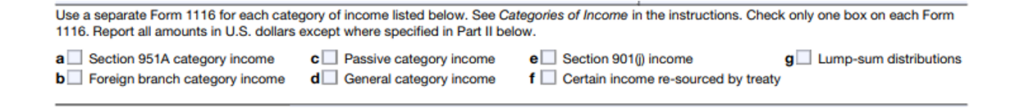

Step 1: Categorize your income

There are seven different income categories for IRS Form 1116.1

The IRS requires you to use a separate Form 1116 for each income category. So, when preparing Form 1116 you must categorize your income to understand how many Forms 1116 to use.

For example, if your total income falls into three categories, you’ll need to use three separate Forms 1116.

Categories of income

Once you’ve identified your income category, it’ll be time to move on to the next section.

Important callout for employees and small business owners:

US expat employees or small business owners are likely to use only one form: d. General Category Income.

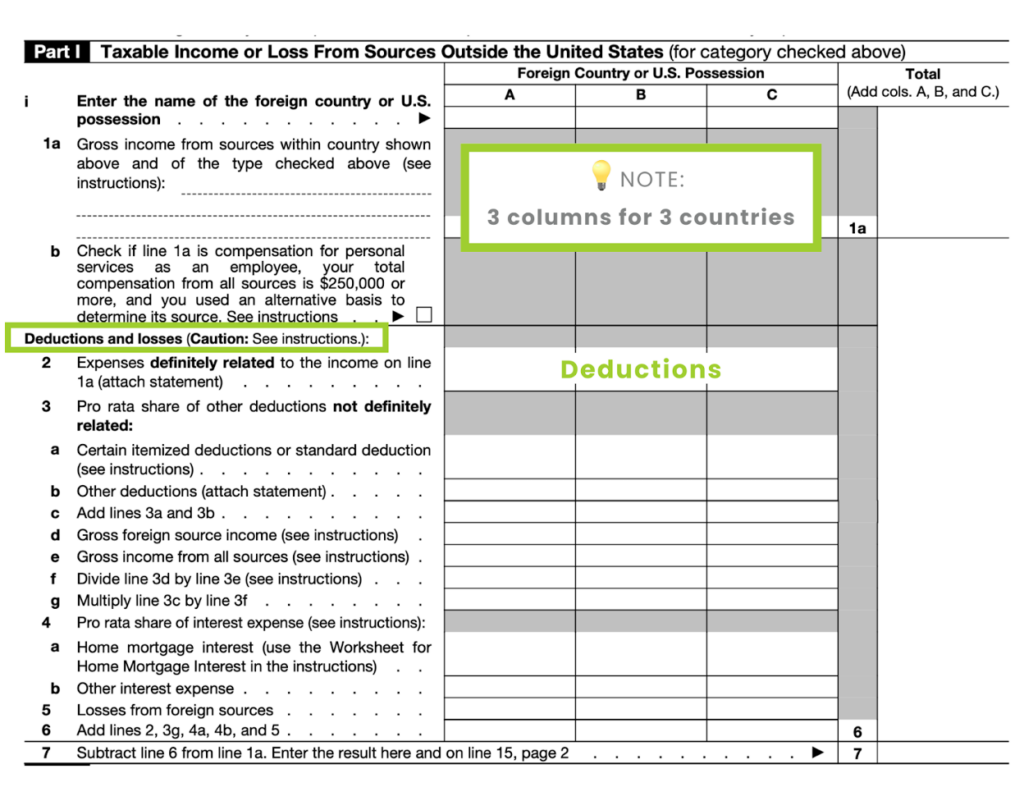

Step 2: Fill in your taxable income (Part 1 of Form 1116)

Here’s where you’ll record all your income from foreign sources. If you have paid taxes in more than one foreign country, you need to segregate the earnings by country and enter them into separate columns.

Form 1116 provides three columns. But if you paid taxes in more than three countries, you’ll attach a separate sheet laid out in the same manner as Part 1. There’s no need to use an additional Form 1116.

When filling in your income details, there are a few things to remember:

- Include all your foreign income—even if all or some portion is not taxable by a foreign government.

- Income needs to be reported in US Dollars.

- You’ll need to adjust gross income (line 1a) for any foreign income that you’ve excluded with Form 2555 (the Foreign Earned Income Exclusion).

Then aside from your income, you’ll also input the amount of deductions usually used by the IRS to reduce your taxable income. This may be the standard deduction or itemized deductions for those with enough qualifying expenses.

These deductions include home mortgage interest as well as losses from foreign sources.

Here’s what this section of the form looks like.

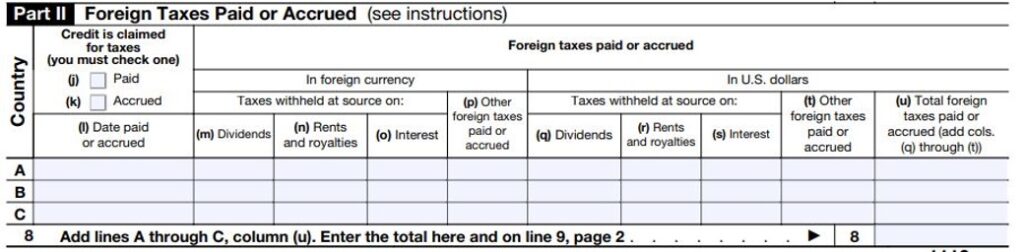

Step 3: List your foreign taxes paid (Part 2 of Form 1116)

Here’s where you’ll list the amount of foreign tax you either paid or accrued in the current tax year on your income reported in Part 1.

When reporting amounts:

You’ll need to report the amount of foreign tax paid or accrued in the foreign currency and the US dollar equivalent. For the conversion rate you use, you’ll need to include a statement to let the IRS know how you made the calculation.

Here’s what Part 2 of Form 1116 looks like.

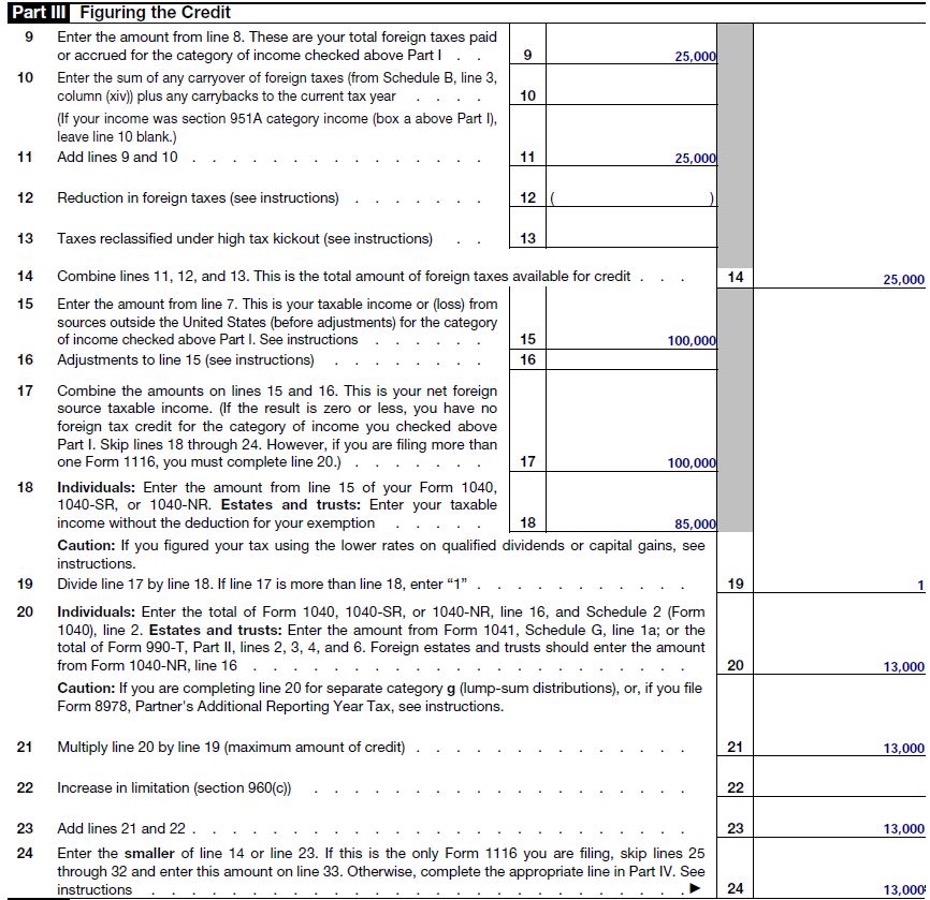

Step 4: Calculate your credit amount (Part 3 of Form 1116)

This is where you’ll calculate the amount of FTC to claim. Generally, the amount of your credit is not the tax you paid in your country of residence. Instead, it’s the amount of tax you’d have paid if the income was earned and taxed according to the US tax code.

Let’s try to simplify this.

1️⃣ Suppose you work in Italy and earn an annual salary of $100,000 (US dollar equivalent) in 2022. And you paid $25,000 (US dollar equivalent) to the Italian tax authorities.

However, when your salary ($100,000) is subjected to the US tax code, it will be treated like it was earned in the US. You’ll still generally be allowed to claim all the tax deductions you’re used to, whether it’s the standard deduction or itemizing.

2️⃣ Let’s say your total deductions are $15,000. Therefore, your taxable income will be $85,000 ($100,000 – $15,000).

3️⃣ Finally, assume the tax payable on $85,000 in the US is $13,000. This is the amount that’ll be treated as your Foreign Tax Credit, NOT the $25,000 you paid in Italy.

| Annual Salary | $100,000 |

| US Tax Deductions | ($15,000) |

| US Taxable Income | $85,000 |

| US Taxes | $13,000 |

| Italian Taxes | $25,000 |

| Foreign Tax Credit | $13,000 |

The good news is that if you paid more tax than allowed in the current year, you can carry forward the difference for up to ten years.

Alternatively, you can carry it back to the prior year in certain situations.

Here’s what this section of Form 1116 looks like using our hypothetical example from above.

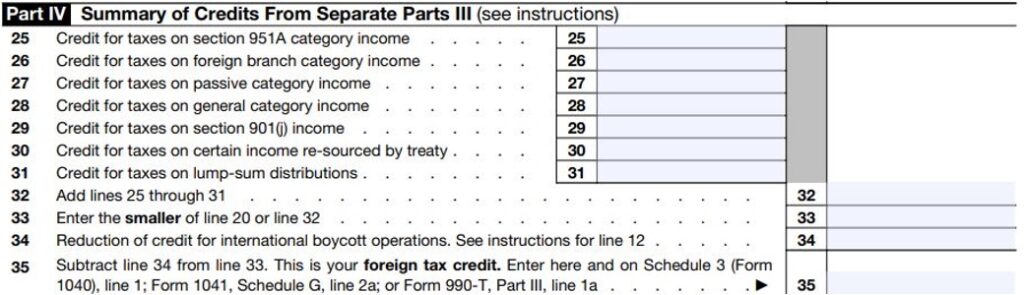

Step 5: Add up your total credit (Part 4 of Form 1116)

Finally, the last part. Plus, read on for a summary of all the foreign tax credits claimed in case you had other categories of income that we discussed in Step 1.

Here’s what it looks like.

References