Due to the increased availability of work-from-anywhere jobs, more and more Americans are choosing to live and work abroad. Given the many benefits of raising children abroad, such as a lower cost of living, great schools and public services, and foreign language and cultural immersion, it’s no surprise that many of these folks are parents.

It’s worth noting that all US citizens and permanent residents are required to file a US tax return. This is the case even when living abroad, provided that they meet the income reporting threshold that year. Although filing an annual US tax return can be cumbersome, expat parents will be excited to learn that they often qualify for the same child tax breaks abroad as they would in the US. In some cases, this can make tax season a veritable boon for their wallets rather than a drain on them.

But, what exactly are these tax credits, who qualifies for them, and how can you claim them?

📋 Key Updates for Child Tax Credit in 2025

- Expats can still qualify for the Child Tax Credit if their children meet the requirements, such as being under 17, living with the parent for more than half the year, and being claimed as a dependent.

- The CTC can reduce tax liabilities, but it is only partially refundable in 2024 (up to $1,700 per child), meaning expats can receive a limited refund if their tax bill is less than the full credit amount.

- Expats need to carefully evaluate how the Child Tax Credit interacts with other tax benefits like the Foreign Earned Income Exclusion (FEIE). Claiming the FEIE may exclude income from taxation, but it also makes the taxpayer ineligible for the CTC.

What is the US Child Tax Credit (CTC)?

The Child Tax Credit allows parents, including expats, to claim a tax credit of up to $2,000 for each of their qualifying children or dependents (as of the 2024 tax year). So an expat with a US tax bill of $7,000 and three qualifying children could reduce their tax bill by up to $6,000 through the Child Tax Credit.

In order to qualify, your child or dependent must:

- Have been under 17 at the end of 2024

- Be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (such as a grandchild, niece, or nephew)

- Have contributed no more than 50% toward their own financial support

- Have lived with you for over half the year

- Have been claimed as a dependent

- Be a US citizen, national, or resident alien with a Social Security Number

In addition, you must have earned taxable income you can claim on your return. To qualify for the full amount of the Child Tax Credit, your income must be no more than $200,000 if filing individually or $400,000 if filing jointly. If your income exceeds that, you may still be eligible to claim a partial credit. If you’re unsure of whether or not you can claim the Child Tax Credit, the IRS’s Interactive Tax Assistant can help provide some clarity.

Is the US Child Tax Credit refundable in 2024?

Unlike last year, the Child Tax Credit for tax year 2024 is only partially-refundable rather than fully-refundable. This means that claiming the Child Tax Credit allows you to reduce your tax bill, but if the credit exceeds what you owe in taxes, you can receive a limited amount (up to $1,700 per child for the 2024 tax year) rather than the full amount of up to $2,000 per child. If this is the case for you, you would claim the Additional Child Tax Credit to take advantage of the refundable portion.

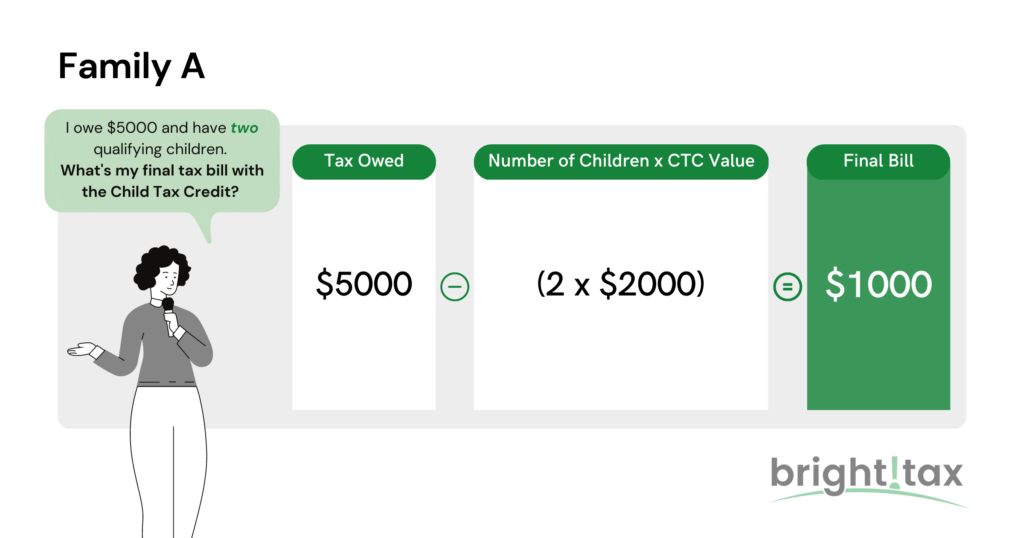

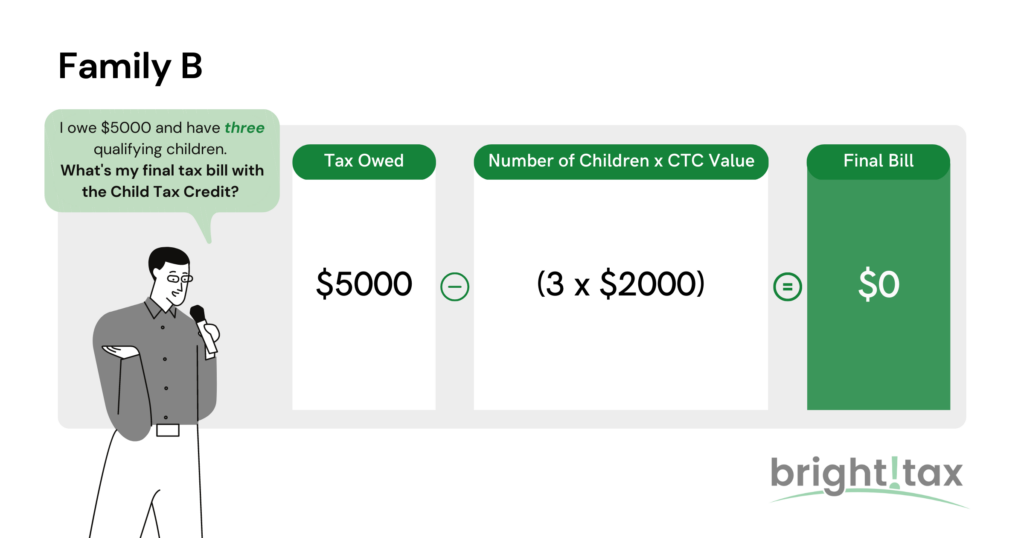

Let’s take a hypothetical look at two different expat families claiming the Child Tax Credit.

Family A owes $5,000 in taxes and has two children that qualify for the Child Tax Credit. Because their tax bill ($5,000) is bigger than the amount they’ll receive through the Child Tax Credit ($4,000), they receive the full value of $2,000 per child — and end up owing $1,000 in taxes before any other deductions or credits are claimed.

Family B owes $5,000 in taxes and has three children. Confused as to why Family B isn’t receiving a $1,000 refund? Unfortunately, the amount of Child Tax Credits the taxpayer is eligible for in this situation is capped at $5,000 because that’s how much tax is owed.

So, the taxpayer would receive $2,000 for each of the first two children ($4,000 total). However, the credit for the third child is limited by the remaining balance due in this example. The upside here is that although the taxpayer does not receive the full $2,000 for their third child, they do succeed in eliminating their total tax due. The downside is that no refundable credit is available after this stage, meaning that the family is owed $0 from the IRS.

Considerations When Claiming the Child Tax Credit

Before claiming the this credit on your return, however, there are some things you’ll want to consider.

The Child Tax Credit & the Foreign Earned Income Exclusion

The Foreign Earned Income Exclusion is one of the most common (and beneficial) tax breaks for Americans living abroad, but it may not be the best way to lower your tax bill for low- to moderate-earners who want to claim the Child Tax Credit.

When expats claim the Foreign Earned Income Exclusion, they are excluding their income from US taxation rather than reducing their tax bill through a credit or deduction. The Foreign Earned Income Exclusion allows expats to exclude up to $126,500 in earned income per person from taxes — that means if you earn $126,500 or less, you can exclude it all from taxation, bringing your earned taxable income to zero. And with no earned taxable income, you would be ineligible for the Child Tax Credit.

In another scenario, you may be better off claiming the Foreign Tax Credit — but it’s always worth checking with a professional to make sure, as other factors can influence which one is right for you.

The Child Tax Credit vs. the Child & Dependent Care Credit

They may sound similar, but the Child Tax Credit and Child & Dependent Care Credit are two separate credits. While the Child Tax Credit is granted based on the number of qualifying children or dependents you provide for financially, the Child & Dependent Care Credit (as its name suggests) is designed specifically to offset a portion of the cost spent on child and dependent care. It is non-refundable, meaning that you can only use it to lower your tax bill; you cannot receive a refund if you don’t owe anything in taxes.

With the Child & Dependent Care Credit, you can write off anywhere from 20% to 35% of qualifying childcare expenses up to $3,000 per qualifying individual, or $6,000 for one qualifying couple filing jointly. The exact percentage that you are able to claim depends on your income, as illustrated in the table below. As you can see, the more you earn, the smaller the proportion of your childcare expenses is covered.

| Income | % of Qualifying Expenses |

|---|---|

| Under $15,000 | 35% |

| $15,000-$17,000 | 34% |

| $17,001-$19,000 | 33% |

| $19,001-$21,000 | 32% |

| $21,001-$23,000 | 31% |

| $23,001-$25,000 | 30% |

| $25,001-$27,000 | 29% |

| $27,001-$29,000 | 28% |

| $29,001-$31,000 | 27% |

| $31,001-$33,000 | 26% |

| $33,001-$35,000 | 25% |

| $35,001-$37,000 | 24% |

| $37,001-$39,000 | 23% |

| $39,001-$41,000 | 22% |

| $41,001-$43,000 | 21% |

| $43,000+ | 20% |

Qualifying for the Child & Dependent Care Credit

In order to qualify, the care must be provided to children under 13 or dependents who are physically or mentally unable to look after themselves during hours when their parent or guardian is at work or actively looking for work.

Qualifying types of care include:

- Fees and costs associated with out-of-home care (e.g. daycare centers, preschools, day camps, disability care centers)

- Wages for employees providing in-home care or cooking/light housework directly related to the care of a qualifying child or dependent

- Beyond gross wages, any taxes you must pay on those wages (e.g. Social Security, Medicare, payroll, etc.) as well as costs associated with meals and lodging for the employee all qualify as well

Expenses that do not qualify include:

- Care provided by the spouse, dependent, or child (under 19 years old) of the person filing the tax return

- Free child care through programs like Head Start or state-subsidized Pre-K

- Educational costs for children from kindergarten and above

- Transportation costs to and from the care center

- Overnight camp

If you qualify for the Child and Dependent Care Credit, you can claim it in addition to the Child Tax Credit — you don’t have to choose one over another.

The Child Tax Credit: Frequently Asked Questions

Still have additional questions about the Child Tax Credit? Here are a few answers to the most commonly-asked questions.

Why is the Child Tax Credit for 2024 lower than it was for 2021?

In March 2021, President Biden passed the American Rescue Plan stimulus package in response to the economic fallout resulting from the COVID-19 pandemic. One of the measures in the package was an expanded Child Tax Credit worth $3,000 per child between ages 6 and 17, and $3,600 for children under age 6.

This full increased amount was available to parents with a Modified Adjusted Gross Income of up to $75,000 per person, with the amount phased out beyond that income cap. Furthermore, it was fully refundable — meaning that even those with a $0 tax bill still claim the full payment as a refund — and available through advanced monthly payments.

However, this expanded tax credit was initially offered for the 2021 tax year only and was not extended beyond that

A highly relevant note for Americans Abroad regarding the American Rescue Plan was that only taxpayers with a residence in the US for more than six months of 2021 were eligible. And though many received the advanced payment by check or direct deposit starting in July 2021 as part of the initiative, they received the unpleasant surprise that they were expected to repay it when filing their 2021 US tax return.

I didn’t know I was eligible! Can I claim the CTC retroactively?

The Child Tax Credit can be claimed for up to three years after the filing due date. Expats who previously claimed the Foreign Earned Income Exclusion because they were unaware of the refundable Child Tax Credit can file amended returns to retroactively claim it.

Expats who missed out on the 2021 expanded Child Tax Credit described above may be able to retroactively claim it through an amended return as well, as long as they spent at least half of the year in the US. Otherwise, they can still retroactively claim the standard 2021 credit of $2,000 per child or dependent or, if they eliminated their US tax bill by claiming the Foreign Tax Credit, a $1,400 refund per child.

“I used to file my tax returns myself but always worried I was missing something. (I was right!) My CPA found Child Tax Credits I had missed, adding an extra $1,400 to my refund. Bright!Tax’s attention to detail really paid off.”

— Bright!Tax Client

I’m behind on my taxes. Am I still eligible for the Child Tax Credit?

Expats who haven’t filed taxes or FBARs in recent years because they weren’t aware they were required to from abroad may be eligible for the IRS’s Streamlined Procedure amnesty program. The Streamlined Procedure allows qualified individuals to not only catch up on their taxes penalty-free, but also claim any previous tax credits they were eligible for.

This includes the 2021 expanded CTC and even any stimulus payments you may have missed out on. For a family with two eligible children that qualified for all three rounds of stimulus payments, this could add up to a $13,000 total IRS refund — although of course, the amount you receive will depend on your particular circumstances.

The Child Tax Credit - FAQS

-

Why was the Child Tax Credit higher in 2021?

In 2021, the Child Tax Credit was temporarily increased under the American Rescue Plan Act, a stimulus package passed in response to the economic impact of the COVID-19 pandemic. The credit was expanded to $3,000 per child for children aged 6–17 and $3,600 per child for children under age 6. It was also made fully refundable and distributed through advanced monthly payments to provide immediate financial relief to families.

-

What is the Child Tax Credit amount for 2024?

For the 2024 tax year, the Child Tax Credit has reverted to the pre-2021 levels of $2,000 per qualifying child under age 17. Unlike the expanded 2021 credit, the 2024 credit is only partially refundable, and income thresholds for eligibility are similar to prior years.

-

Why did the Child Tax Credit decrease after 2021?

The expanded Child Tax Credit was a temporary measure included in the American Rescue Plan Act and only applied to the 2021 tax year. After 2021, Congress did not extend the expanded provisions, so the credit returned to its standard amount of $2,000 per child, as set by the Tax Cuts and Jobs Act of 2017.

Connect on LinkedIn

Connect on LinkedIn