Americans are almost unique in still having to file home country taxes from overseas. While this requirement has been US law since the Civil War, the interconnectedness of today’s global banking and tax systems have only recently allowed the IRS enforce it. They can even revoke expats’ US passports if they believe that they owe more than $50,000 in back taxes, including penalties and interest.

Thankfully, in 2014 the IRS introduced a modified amnesty program called the Streamlined Procedure that allows expats who are behind with their US tax filing to catch up without facing any penalties, while also allowing them to retro-claim the exemptions designed to prevent double taxation such as the Foreign Earned Income Exclusion and the Foreign Tax Credit that mean that they often end up owing no taxes at all, although they still have to file.

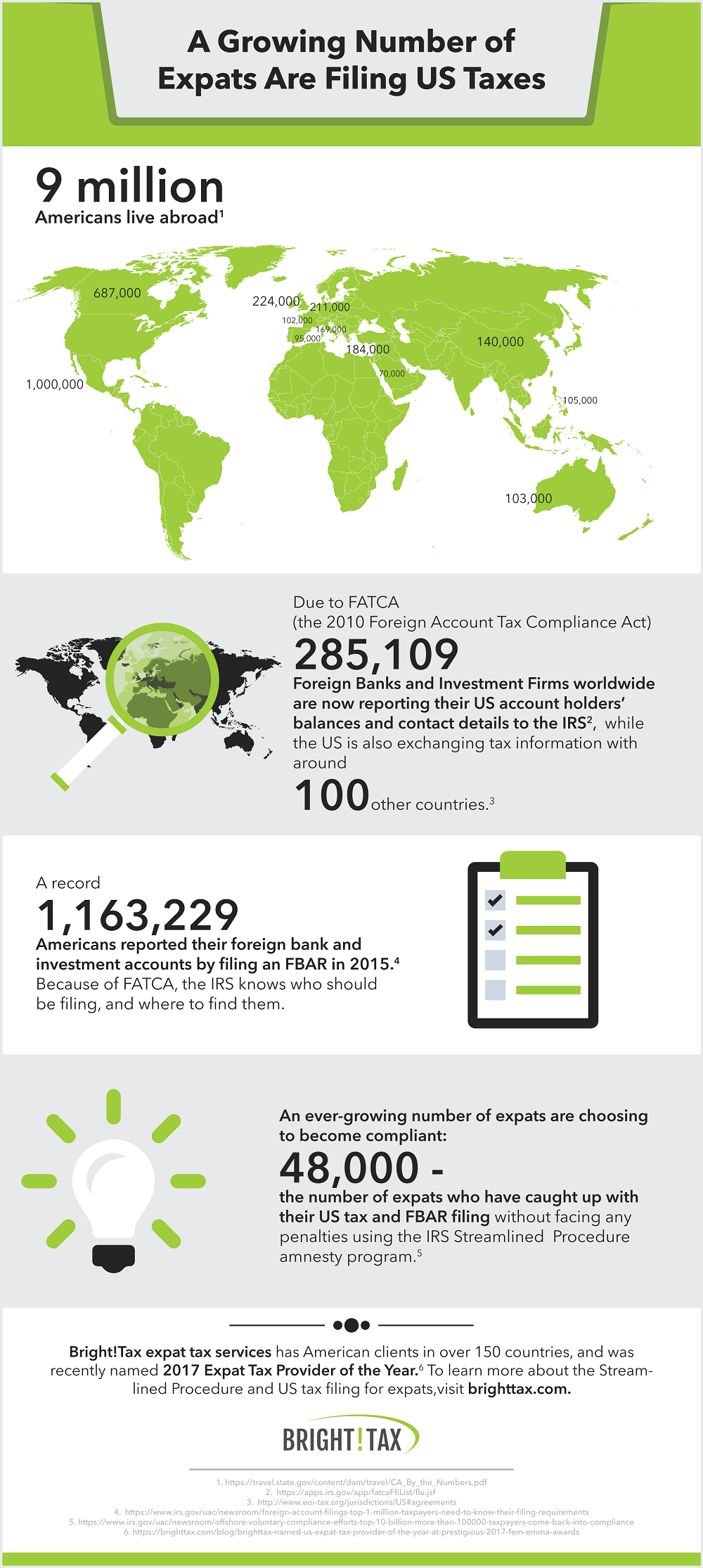

Since the Streamlined Procedure was introduced, more and more American expats have been catching up with their US filing. The numbers speak for themselves.

The IRS Streamlined Procedure is an amnesty program that allows expats who weren’t previously aware that they had to file US taxes to catch up with their US tax and FBAR filing without facing any penalties.

So if you’re an American living overseas and you haven’t been filing a US tax return – don’t panic! We can help.

Find out more about the Streamlined Procedure IRS amnesty program here.