Last updated April 25, 2023.

All US expats must file a US tax return to report their worldwide income. This is due to the citizenship-based taxation schema that the US uses, which makes US expats liable to pay US taxes, even on foreign-earned income. Fortunately, there are many exclusions and exemptions available that can often reduce US tax owed to $0. However, filing does become more complicated when foreign financial assets are involved.

IRS filing requirements for US expats include the reporting of foreign assets. This regulation is related to the Foreign Account Tax Compliance Act (FATCA).

As part of complying with FATCA regulations, US expats must also take care to complete Form 8938: Statement of Specified Foreign Financial Assets when they meet the requirements and financial threshold. In the following article, we’ll break down FATCA and do a deep dive into understanding when to complete Form 8938.

What are foreign financial assets?

Foreign financial assets are basically any financial accounts or investments that you hold outside of the United States. This can include things like bank accounts, investment accounts, mutual funds, or stocks and bonds that you’ve invested in overseas. Some other common examples include foreign pension funds, ownership in foreign businesses (corporations, partnerships), foreign trusts, or foreign real estate held in a foreign company. All of these assets are subject to reporting each year to the IRS.

What is FATCA1?

FATCA stands for Foreign Account Tax Compliance Act. Passed in 2010, FATCA was enacted to crack down on offshore tax evasion. The law requires foreign financial institutions (FFIs) to report information about financial accounts held by U.S. taxpayers to the Internal Revenue Service (IRS). Unfortunately, in practice, it tends to place frustrating filing requirements and foreign financial banking obstacles in the way of millions of ordinary US expats.

Some examples of FFIs include:

- banks

- investment funds

- insurance companies.

FFIs are required to identify and report certain information about U.S. account holders. This information includes their names, addresses, tax identification numbers, and account balances. Also, FATCA requires U.S. taxpayers to report their foreign financial accounts and assets on their annual tax returns. Failure to do so can result in significant penalties.

FATCA reporting requirements for US expats

For Americans who live in the US, the minimum total value of foreign assets that must be reported on Form 8938 is $50,000. However, qualifying expats must report their foreign assets if the total value of their foreign-held assets is over $200,000 on the last day of the tax year or over $300,000 at any time during the tax year.

These figures are per person. If you are filing a joint return, the figures double to $400,000 on the last day of the tax year or over $600,000 at any time during the year.

Form 8938 Thresholds for 20232

| Single, Head of Household, Married Filing Separately | Married Filing Jointly |

| $200,000 on the last day of the tax year or more than $300,000 at any time during the year | $400,000 on the last day of the tax year or more than $600,000 at any time during the year |

A US citizen or Green Card holder qualifies as an expat for FATCA reporting requirements if they meet either of the tests used to evaluate eligibility for the Foreign Earned Income Exclusion:

- The Bona Fide Resident test or

- The Physical Presence Test

Important note: even if you are not using the Foreign Earned Income Exclusion in your tax return filing, these tests still apply to determining your Form 8938 threshold.

Form 89383 Filing Requirements

Whether you’ll need to file Form 8938 depends on all three factors listed below:

- Your US citizenship and immigration status

- Whether you have an interest in a specified foreign financial asset

- Whether you meet the reporting threshold

Citizenship status

Generally, you’ll need to file Form 8938 if you’re an American citizen or a resident alien (also known as a Green Card holder) for any part of the tax year.

You may also meet the filing requirement if you meet the substantial presence test.

Financial reporting threshold

If you’re an American expat living abroad, you will file Form 8938 if the value of your specified foreign assets is more than $200,000 on the last day of the tax year — or more than $300,000 at any time during the year. These amounts double if filing a “Married Filing Jointly” return. So, the thresholds are $400,000 on the last day of the tax year or more than $600,000 at any time during the year.

For those in the US, the thresholds are much lower: foreign assets of $50,000 for single-filers.

How do I file Form 8938?

Form 8938 is a two-page document with six parts.

Below, we walk you through an example.

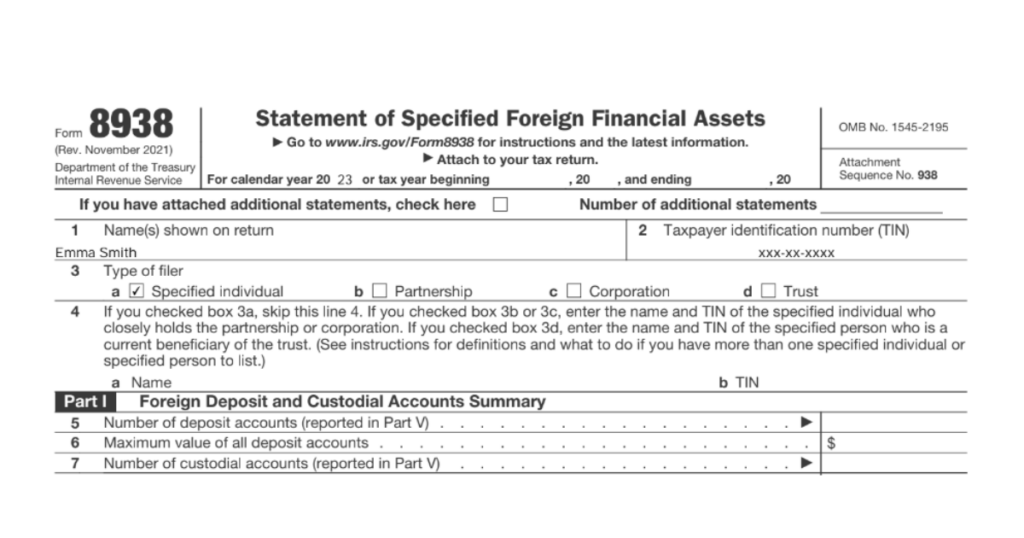

Identifying information

This is the preliminary section. You’ll enter details like your name, SSN (or ITIN), and type of filer, whether an individual or business.

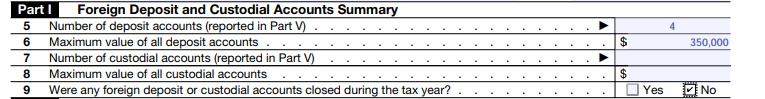

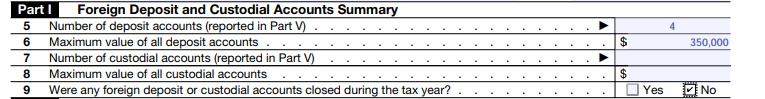

Part I. Foreign Deposit and Custodial Accounts Summary

This is where you’ll enter a summary of your foreign accounts, including the number, type, and value.

This same information will appear in more detail in other parts of the form.

What is a deposit and custodial account?

A deposit account refers to any financial account that holds funds for safekeeping. For example: checking accounts, savings accounts, time deposits, or certificates of deposit. Essentially, deposit accounts are accounts that hold cash or cash equivalents that can be readily accessed by the account holder.

On the other hand, a custodial account refers to a financial account that holds assets that are managed by a third-party custodian. This can include assets such as stocks, bonds, mutual funds, and other securities. With a custodial account, the account holder entrusts the assets to the custodian for safekeeping, and the custodian is responsible for managing the assets according to the account holder’s instructions.

Part II. Other Foreign Assets Summary

Here’s where you’ll enter the other foreign financial accounts you didn’t include in Part I. A perfect example includes foreign stock or securities.

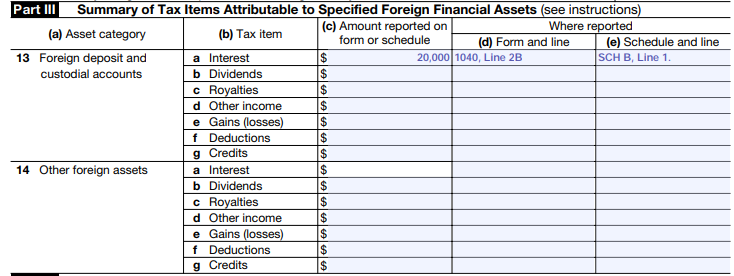

Part III. Summary of Tax Items Attributable to Specified Foreign Financial Assets

Here’s where you enter the foreign assets which carry a tax obligation and for which a relevant return is filed.

In our example, Emma earned $20,000 in interest from her accounts listed in Part I.

Have a peek at the example below.

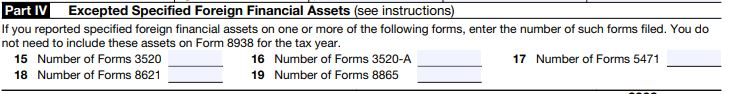

Part IV. Excepted Specified Foreign Financial Assets

If you already reported a specified foreign financial asset in forms such as Form 3520, 3520-A, 5471, 8621, or 8865, you only need to indicate the number of documents you filed in this section. You do not need to detail information about the individual assets.

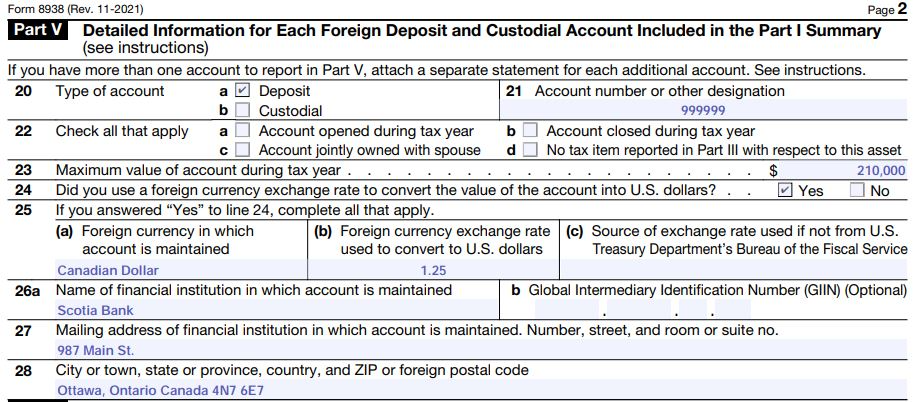

Part V. Detailed Information for Each Foreign Deposit and Custodial Account Included in the Part I Summary

This section is where you’ll provide the information on the accounts you summarized in Part I of the form.

You’ll need to provide the details on additional pages if you have multiple accounts.

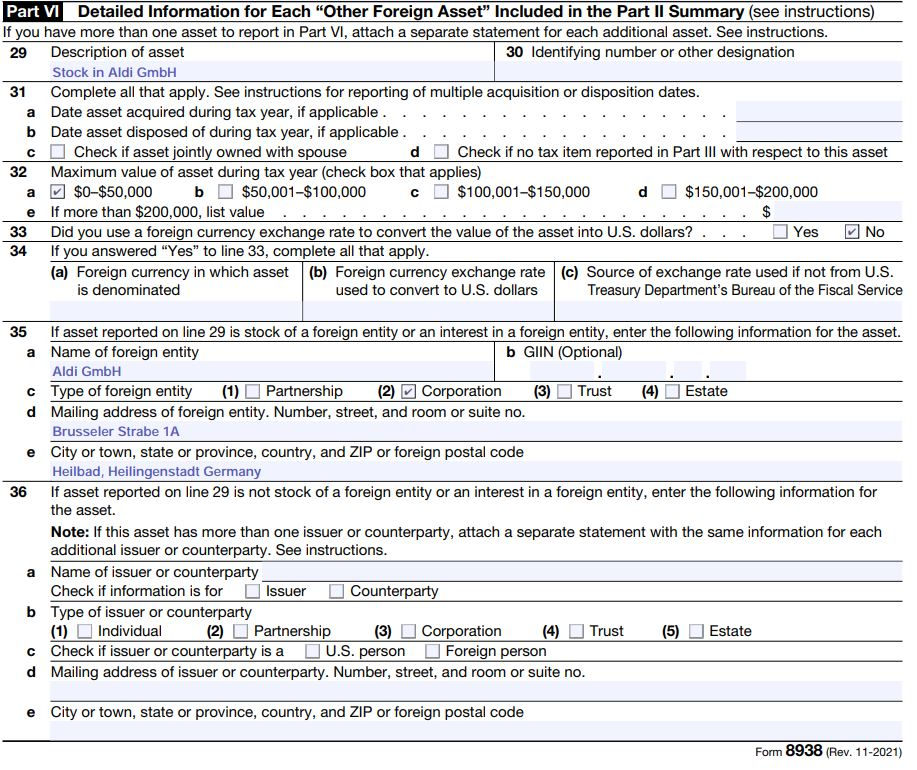

Part VI. Detailed Information for Each Other Foreign Asset Included in the Part II Summary

Just like in Part V, you’ll enter the details of your other foreign financial assets here.

As a reminder, qualifying assets in this section include

- a business that the taxpayer has an interest in

- investments

- foreign retirement plans and bank balances

- property besides a primary residence

- any assets in which the taxpayer has an interest – even if they are not owned in their name.

Note: this may include again one or more businesses, investments, or property owned by a trust or company that the taxpayer is a beneficiary of or signatory for.

Reporting foreign financial assets valued in foreign currency

In order to evaluate the filing threshold and report foreign financial assets accurately, you need to know both the highest fair market value at any time during the tax year, as well as the fair market value on the last day of the tax year, for each asset, in the currency that it is denominated in.

These figures should then be converted into US dollars using the official U.S. Treasury Bureau of the Fiscal Service foreign currency exchange rate for purchasing U.S. dollars.

The rates can be found on the Treasury website4.

Penalties associated with not filing Form 8938

There are several penalties that can be assessed for not filing Form 8938, or for filing an incomplete or inaccurate form.

Firstly, the IRS can assess a $10,000 penalty for failure to file Form 8938 by the due date (which is typically the same due date as your Form 1040). A penalty may also be assessed for filing an incomplete or inaccurate form. If the form is not filed within 90 days after the IRS issues a notice of failure to file, an additional penalty of $10,000 for each 30-day period of non-filing can be assessed, up to a maximum penalty of $60,000.

In addition, if the failure to file is deemed to be intentional, the penalty can be even more severe. For example, if the taxpayer is found to have willfully failed to file Form 8938, the penalty can be as high as $100,000 or 50% of the value of the foreign financial assets that should have been reported on the form, whichever is greater.

Moreover, the failure to report foreign financial assets may trigger additional penalties under other tax laws, such as the failure to report foreign bank accounts under the FBAR (FinCEN Form 114), which can carry even higher penalties.

It’s important to note that these penalties can add up quickly and can result in significant financial consequences. It’s always best to consult with a tax professional. Doing so will determine your specific reporting requirements and ensure that all foreign financial assets are properly reported on Form 8938 and other required tax forms.

Catch up on filing Form 8938 and US taxes with the Streamlined Filing Procedures

Given the high complexity of navigating US tax filing requirements associated with foreign financial assets, it’s quite common for taxpayers to fall behind. And with the intimidating penalties that failing to file implies, completing one US expat tax return can sometimes feel like an insurmountable task. But what if you’ve fallen behind and need to catch up?

If you’ve fallen behind on your taxes because you did not know you were required to file, there’s good news. The IRS created an amnesty program called the Streamlined Filing Procedures to alleviate the financial stress expats associate with late filing. If you qualify for this procedure, you can catch up and become completely compliant with the IRS with $0 in penalties.

There are certain qualifying conditions to meet here, so be sure to consult with your US expat tax expert on how to ensure you meet the eligibility requirements for this program. If you qualify, you may also be eligible to claim certain tax exclusions and credits retroactively, such as all three COVID-19 stimulus payments, the Child Tax Credit, and others.

Connect with Bright!Tax today to plan your most advantageous expat tax filing strategy

Bright!Tax are experts in US expat tax who have filed thousands of returns for over ten years for international clients. Many on our team are expats who personally understand the importance of discussing your financial situation an expert in US tax. If you’re ready for a seamless and personalized experience with professionals, get started today.

IRS Form 8938 Filing Requirements – FAQ

Do tangible assets need to be reported on Form 8938?

No. Tangible assets including foreign currency (held in cash rather than in a bank account), art, jewelry, antiques, cars, and gold don’t need to be reported.

What’s the difference between Form 8938 and an FBAR5?

Form 8938 and the FBAR differ in three key ways.

- Reporting thresholds: Form 8938 is filed with the taxpayer’s annual U.S. federal income tax return. The form applies to a broader range of foreign financial assets, including not only accounts but also other investments such as stocks, securities, and interests in foreign entities. The reporting threshold for Form 8938 varies depending on the taxpayer’s filing status and location, with the lowest threshold being $50,000 for single taxpayers residing in the U.S. or $100,000 for those living abroad or married filing jointly.

The FBAR, on the other hand, is a separate form filed with the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of Treasury. It applies only to foreign bank accounts, including checking and savings. Additionally, the reporting threshold is much lower ($10,000 in aggregate value at any time during the calendar year).

- Filing deadlines: Form 8938 is filed annually along with the taxpayer’s U.S. federal income tax return. This is typically due by April 15th of the following year (June 15th for those who reside abroad), with possible extensions. FBAR, on the other hand, has a separate deadline of April 15th, with an automatic extension in place until October 15th.

- Penalties: For Form 8938, the penalty starts at $10,000 for failure to file, with additional penalties for continued non-compliance. And FBAR penalties can be even more severe. Willful violations potentially result in civil penalties of up to the greater of $100,000 or 50% of the account balance and possible criminal penalties.

Read more about the FBAR in our comprehensive guide.

Do I need to file Form 8938 if I filed FBAR?

Filing the FBAR does not mean you’re exempt from filing Form 8938. Each form has its own requirements, and you may be required to file both.

The following two-point criteria can help you understand whether you must file Form 8938 if you’ve already filed FBAR.

- Threshold: You’ll need to file for FBAR if the value of your assets in foreign financial accounts was more than $10,000 at any time during the year.

On the flip side, you’re required to file Form 8938 if the value of your specified foreign assets is more than $200,000 on the last day of the tax year — or more than $300,000 at any time during the year. - Reportable asset: For the FBAR, you’ll need to report only financial accounts such as bank and brokerage accounts.

In Form 8938, you report on a broader range of foreign assets, including foreign securities, trusts, and certain foreign life insurance contracts.

There are many other nuances to consider, and this two-point criterion is not exhaustive. Here’s where you may want to give your expat tax CPA a call.

When is form 8938 due?

The deadline for filing Form 8938 is the same as filing the regular end-of-year Form 1040 – April 15. However, expats receive an automatic 2-month extension to file their tax return until June 15.

What are the penalties for not filing Form 8938?

Penalties for failing to file Form 8938, or incomplete or inaccurate filing, start at $10,000. Fines of up to $50,000 can be applied if you ignore IRS requests to file. Finally, the IRS can also tax undisclosed assets up to 40% of their value.

References

- Summary of FATCA Reporting for U.S. Taxpayers | Internal Revenue Service (irs.gov)

- Do I need to file Form 8938, Statement of Specified Foreign Financial Assets? | Internal Revenue Service (irs.gov)

- About Form 8938, Statement of Specified Foreign Financial Assets | Internal Revenue Service (irs.gov)

- Treasury Reporting Rates of Exchange

- Report of Foreign Bank and Financial Accounts (FBAR) | Internal Revenue Service (irs.gov)