This article was updated on March 2, 2023.

Giving cash or presents to the important people in your life can feel like a win-win for everyone. But as the old saying goes: No good deed goes unpunished. When it comes to gifting, a generous spirit can create additional tax filing requirements with the IRS. Depending on how much you give and to whom determines whether you’ll need to file a US gift tax return.

Keep reading to learn about gift taxes and the US gift tax return, Form 709.

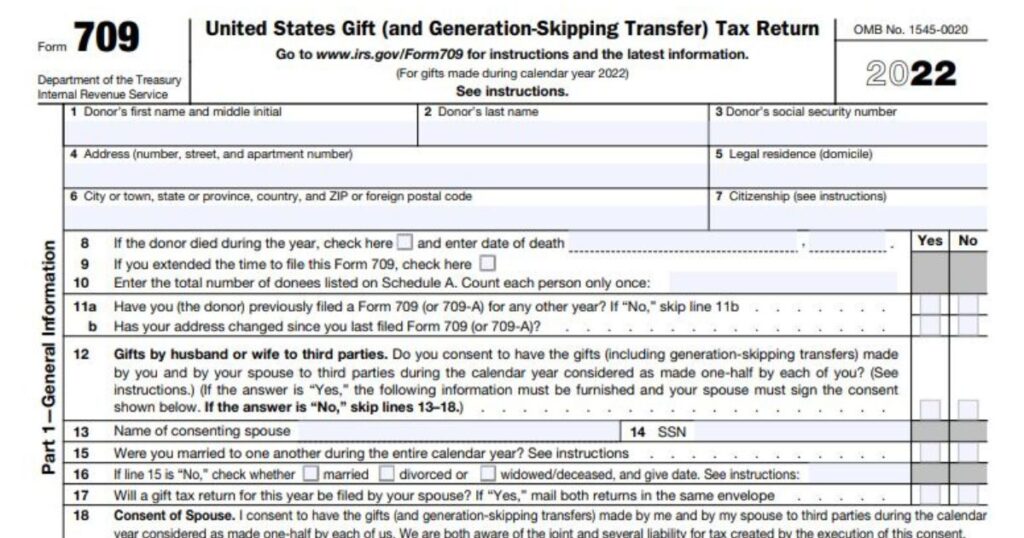

What is Form 709?

IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, is an annual tax form to report taxable gifts made during a taxpayer’s lifetime. This includes US expats and Americans living state-side.

In general, if you give someone cash or property valued at more than $17,000 in a calendar year, you’ll have to file Form 709 with your individual tax return.

What is a gift for US tax?

The IRS lets taxpayers give away a certain amount each year tax-free. This includes transfers of cash or property.

The IRS defines a gift as a transfer of property from one person to another without receiving anything (or something of lesser value) in return.

This parameter includes more than cash. A gift can take the form of:

- Financial assets, like stocks, bonds, and investments

- Tangible property, like a car, house, or jewelry

- Digital assets, like NFTs or cryptocurrency

- Interest-free loans

- Debt forgiveness

It’s important to note that the intention or arrangement behind the gift is irrelevant to the IRS. For example, if you give your child $20,000 to install a new roof on their home and they informally promise to pay you back, the IRS considers that a gift because it falls above the $17,000 a year threshold.

That being said, there is an important caveat here. You as an individual can give up to $17,000 to anyone, and there is no limit to the number of people to whom you can give $17,000. So, to return to our previous example, you could send $15,000 directly to your child who needs money for a new roof, and $5,000 to your other child to then send along to their sibling as a separate gift. Under this arrangement, the IRS would not need to be made aware of the cash gifting because US gift taxation and reporting apply only to the person gifting, not the recipient.

Who has to file IRS Form 709?

Form 709 is for US citizens and permanent residents who meet the filing threshold and requirements. Expats should use Form 709 to report:

- Gifts (both cash and property) of more than $17,000 to anyone other than your spouse in a calendar year

- Gifts to a foreign spouse of over $175,000 in a calendar year

Are gifts to an American spouse reportable to the IRS?

No, gifts to an American spouse are not reportable, regardless of the dollar amount.

Are certain types of gifts excluded from the Form 709 reporting requirement?

Yes, certain types of gifts are excluded from Form 709 reporting, including:

- Gifts to qualifying political organizations or certain exempt organizations

- Payments that qualify for the educational exclusion

- Payments that qualify for the medical exclusion

Do you pay taxes if you file Form 709?

Not necessarily. However, although gift tax may not be due, you’ll still need to report your taxable gifts to the IRS so they can track how much you’re giving away and prevent you from skirting estate tax rules. At present, the federal lifetime exemption amount is $12,920,000, so most US taxpayers will likely not owe tax on their gift tax return in 2023.

Can Form 709 be filed electronically?

Not entirely. As a result of the COVID-19 pandemic, the IRS now accepts electronic signatures on Form 709. However, the agency still requires your handwritten signature on the form, so to complete your Form 709 filing, you will need to print a copy, sign it, and mail it to the IRS.

Is Form 709 complicated?

Form 709 is five pages long and generally considered fairly complicated to complete.

To complete the form yourself, you will want to gather all the information you’ll need for your Form 709, including:

- Name and address of the recipient

- A description of the gift, including the CUSIP number if it was a security

- The date you gave the gift

- Your basis for the gift

- Value at the date of the gift

Note: Completing the form becomes more complex if your gift skips a generation, such as if a grandparent gifts a reportable amount of cash or asset to their grandchild. In this context, the full name of Form 709 becomes clear: The Gift AND Generation-Skipping Transfer Tax Return.

It’s not uncommon for taxpayers to elect to outsource filing Form 709 to a trusted CPA. The Bright!Tax team specializes in filing tax forms such as these correctly and to your maximum advantage.

Form 709 – 2023 filing deadline

Generally, Form 709 is due by April 15th. But in 2023, accounting for weekends and federal holidays, you have until April 18, 2023, to file.

Additionally, US expats living abroad have an automatic two-month extension to June 15th to file.

Request an extension to file Form 709

As an expat, if you aren’t ready to file your Form 709 by June 15th, you can receive another four-month extension by filing Form 8892.

What happens if you fail to file Form 709?

Not filing your Form 709 when it’s required can result in paying penalties of up to 5% of any tax due for each month late. However, the total penalty won’t exceed 25%.

What if you need to catch up on filing US taxes in general?

Americans living abroad who are behind filing US tax returns because they weren’t aware they had to file can catch up without facing penalties using an IRS program called the Streamlined Procedure.

What’s the best way to avoid gift tax?

The easiest way to avoid gift tax is to avoid giving $17,000 to any one person in a year.

If you have a foreign spouse, arrange their gifts so that the total value does not exceed more than $175,000 a year.

How to file Form 709

If you need to file Form 709, start with these steps.

- Retrieve a copy of Form 709 from the IRS website to discover the information you’ll need to include on the form.

- Fill in the form online. Be sure to check all five pages because, depending on the type of gift, you may need to complete every page.

- Download, print, and sign it. Remember: You can’t e-file Form 709.

- Mail the signed form to the IRS’s Kansas City, Missouri office.

Feeling uncertain about whether you’ve filled Form 709 correctly? The Bright!Tax team would be happy to assist!

Our team is comprised of American CPAs, many of whom are expats just like you. We understand firsthand how challenging it can be to navigate tax filing requirements from abroad. If you need clarification on any questions on Form 709 and want to talk it out with an expert expat tax professional, you can schedule a CPA consultation to ensure you’re on track.

Alternatively, if you’d like to explore outsourcing your tax return to us, you can get started here. Whatever will bring you the most peace of mind is our priority!