If someone were to ask you to name a Mediterranean country whose coastline joined the Adriatic Sea, would Albania come to mind? Most likely not, as Italy, Greece, and Croatia tend to dominate tourism in the region. And yet, for many reasons, this fascinating Balkan country should be added to any list of hospitable, affordable, and beautiful digital nomad destinations.

Snapshot of expat life in Albania

Population: 2,800,000

Capital city: Tirana

Currency: Albanian Lek (ALL)

Official language(s): Shqip

Approximate number of American expats: <500

Formalizing the Unique Permit, aka the Albania digital nomad visa

In 2021, Albania approved a legislative framework commonly referred to as a digital nomad visa but officially called the Unique Permit. As it’s currently presented, qualifying holders of this permit are allowed to live and work in Albania for up to one year tax-free, so long as their work is not tied to an Albanian company. In the initial proposal, the permit could be renewed for another year and for another five years after that. Essentially, digital nomads seeking to base out of Albania may be able to do so for up to seven years. However, in September 2022, discussions around the permit stalled, and it has not been officially approved to date.

Read on to learn about what we know about this likely-forthcoming digital nomad visa (the “Unique Permit”) for Albania and what it means for digital nomads.

Requirements and process to obtain the Albania digital nomad visa

Applying for and obtaining a visa requires careful organization. Below, we break down eligibility for the pending Albanian Unique Permit as well as what materials are required for the application process.

Application eligibility

Although commonly referred to as the digital nomad visa, the Unique Permit offers the possibility of residency to a much bigger group of people than remote workers. Those who are eligible to apply for the Unique Permit include:

- Foreign digital nomads employed abroad

- Self-employed individuals who can work remotely

- Students and researchers

- Contractors and investors

- Seasonal and cross-border workers

- Retirees and real estate owners

Visa requirements and duration

In order to receive the Unique Permit, digital nomads will likely need to be able to produce the following documents:

- Valid employment contract with a foreign company

- Service contract with a foreign contractor

- Proof of sufficient income to support their stay and their dependents

- Health insurance

- Clean criminal record

- Albanian bank account where they will receive their funds from income sourced abroad.

- Contract of accommodation in Albania

- For pensioners, proof of annual pension of at least $9,800.

- Private health insurance coverage (such as from SafetyWing)

Pro tip:

Currently, foreigners seeking to live in Albania are required to send two separate applications. One to the Labor Office and another from the Border and Migration Police. Under the proposed regulations for the Unique Permit, all applications would be processed by one government entity.

Albania digital nomad visa application process

- Gather the required documents

- Make an appointment at your nearest Albania consulate/embassy1

- Submit your documents in person

- Pay the application fee (information pending on this point)

- Receive approval

- Book your travel to Albania

- Apply for a residency permit at the nearest Aliens and Immigration Department of the Decentralized Administration office

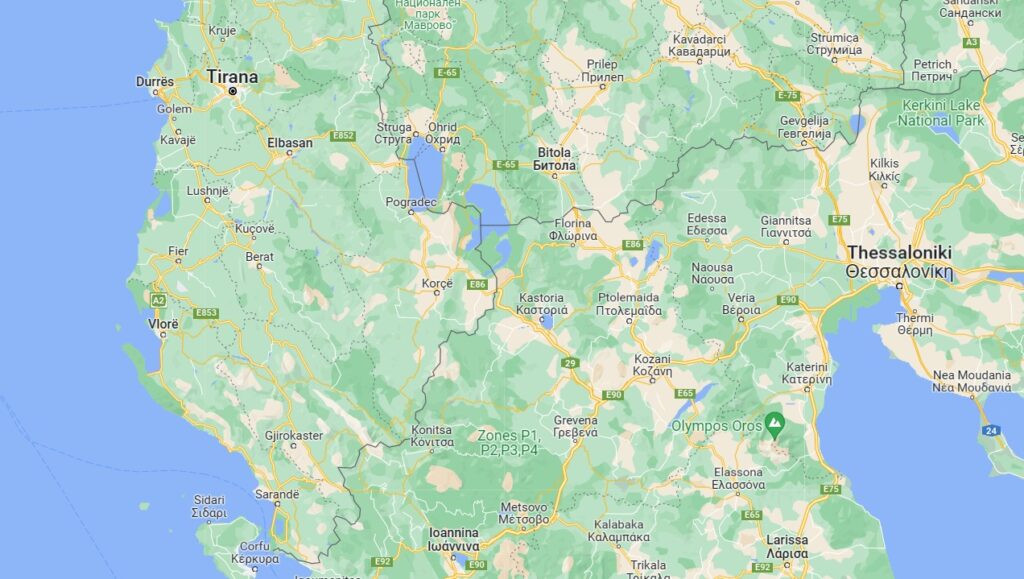

Where to live in Albania

Albania is full of natural beauty. However, the country’s infrastructure is in constant development. So, slow travel and careful planning will be the name of the game here. That said, the affordability factor is huge – on average, digital nomads in Albania can expect to spend just $1000-$1500 per month in total.2 This rough figure includes living expenses, as well as rent, food, and entertainment. Below, we’ve rounded up the top three cities to base out of if you’re a digital nomad seeking to base out of Albania.

Note: The economy in Albania is very cash-oriented, so be sure to come prepared to pay accordingly.

Tirana

As the country’s capital, Tirana is essentially the historic heartbeat of the country. Information on the country’s turbulent past is readily at hand, and coffee shops, bars, and coworking options3 with opportunities to connect with other digital nomads abound. If you’re looking for a neighborhood to start your accommodation search, we hear good things about Blloku.4

Berat

Filled with traditional Ottoman houses and divided by the River Osum, this lovely city nestled in the mountains is known as the “City of a Thousand Windows.” The nickname derives from the way the homes along the river are built as if stacked on top of one another due to the hilliness of the region, thus giving the impression of a wall of windows rising along the river.

Saranda

Nestled along the country’s southern border, Saranda is perfect for digital nomads seeking low-key seaside living. Additionally, the city is just a hop, skip, and a jump away from Greece.

Digital nomad life in Albania

5 things that should be on your Albania bucket list5

- Visit Berat Castle, Albania’s oldest castle dating back to the 13th century.

- Take a road trip to explore the roughly 295 miles (476 kilometers) of beautiful coastline and beaches along the Albania Riviera.

- Explore Butrint National Park, an impeccably preserved area with landscape and architecture wonderfully preserved by the UNESCO World Heritage Foundation.

- Indulge in the incredible gastronomy scene throughout the country, including baked local cheeses, fresh seafood, and local wine. Thanks to the country’s rich history and warm climate, a plethora of culinary adventures await food enthusiasts.

- Shop at the Gjirokaster Bazaar, an ancient center for commerce that bustles with activity and artisan goods for sale to this day.

Taxes in Albania for remote workers and digital nomads

- Primary tax forms: Annual Personal Income Tax Statement

- Tax deadline: April 30th6

- Reporting website: E-albania.al7

- Administrative language(s): Shqip

- Tax treaty: No

- Totalization agreement: No

Who qualifies as a tax resident in Albania?

According to PwC,8 “An individual is deemed to be a resident of Albania if one has a permanent home in Albania or if one stays in Albania, either consecutively or intermittently, for more than 183 days in a calendar year irrespective of one’s citizenship or center of interests.”

Moreover, Albanian law applies the principle of worldwide taxation, meaning that if you qualify as a tax resident of Albania, the country taxes you on your income regardless of where in the world it’s derived from.

For example, if you work as a freelance graphic designer and receive payment from a Canadian client and qualify as a tax resident in Albania, Albania gets first “dibs” on taxing that income. As a US expat, you must then carefully apply the correct provisions to your US income tax return to ensure you are not double-taxed.

Pro tip:

Foreigners can live up to one full year in Albania without becoming tax residents, which has potentially huge savings implications for US expats relocating to the country.

Income taxes in Albania

Effective January 31, 2021, all individuals qualifying as tax residents of Albania were broken into two income tax brackets.9

| Income | Tax rate |

|---|---|

| Up to 14 million ALL (around $142,000) | 0% |

| Above 14 million ALL (around $143,000+) | 15% |

Important to note: Although income taxes are not applied until a certain threshold, the minimum filing threshold is much lower – just 2 million Leks, or about $20,200.

VAT in Albania

The standard VAT rate in Albania in 2023 is 20%.

Do US expats living in Albania also have to file US taxes?

America’s tax system requires all citizens and permanent residents to file a federal tax return (provided that they meet the minimum income reporting threshold) regardless of where in the world they live.

Common tax deductions available for expats in Albania

Living in Albania can bring US tax reporting headaches for expats. However, the IRS does provide some measure of relief for those who are able to dig up the correct resources. Below are some of the additional reporting obligations and tax breaks expats should read up on.

Foreign Earned Income Exclusion (FEIE)

The FEIE allows you to exclude a certain amount of foreign-earned income from taxation ($112,000 for tax year 2022, $120,000 for tax year 2023). To be eligible, you need to pass either the Physical Presence Test or Bona Fide Residence Test. If you qualify, you’re also eligible for the Foreign Housing Exclusion/Deduction, which allows you to write off qualifying housing expenses like rent and utilities.

Foreign Tax Credit (FTC)

The Foreign Tax Credit allows you to subtract what you pay in income taxes to a foreign government from what you owe the US government in income taxes. Given the exceptionally high minimum income threshold before Albanian taxes kick in, however, this option may not be the most effective tool for those living in Albania.

Foreign Bank Account Report (FBAR)

If you have $10,000 or more in foreign bank accounts at any point in the year, you’ll need to report the contents of those accounts to the Financial Crimes Enforcement Network (FinCEN) via FinCEN Report 114.

Child Tax Credit (CTC)

If you have qualifying dependents living with you in Argentina, you can file the Child Tax Credit just as you would in the US to get as much as $2,000 in partially-refundable credits.

Foreign Account Tax Compliance Act (FATCA)

As someone who resides abroad by IRS definition, if you have over $200,000 in foreign assets by the last day of the tax year, or over $300,000 in foreign assets at any point during the tax year, FATCA requires you to file Form 8938.

Working remotely in Albania as a digital nomad - FAQ

-

I’ve lived in Albania for years and never filed a US tax return. Do I owe past US tax returns?

Yes. In theory, the IRS could reach out at any time to request information on unfiled returns. At that point, you could face potential financial penalties. To avoid this, we recommend exploring an IRS provision called the Streamlined Procedure (SLP), an IRS provision designed to allow US expats to catch up on filing their past tax returns penalty-free. However, it’s important to commence the SLP before the US government contacts you, in which case you may no longer be eligible. Learn more by connecting with a Bright!Tax expert on a free consultation call.

-

Does Albania have a tax treaty with the US?

No, the US and Albania do not have a tax treaty.

Connect on LinkedIn

Connect on LinkedIn