Embarking on an international adventure and becoming an expat, whether temporarily or permanently, involves saying goodbye to many aspects of your old life. If you’re one of the 43.6 million Americans who currently hold student debt, you’ll likely wonder whether moving abroad also means leaving behind student loans.

There’s a lot to consider when transitioning to life overseas. Understandably, the last thing you want to worry about is how to navigate the world of out-of-country student loans. But, understanding how residing abroad impacts your student debt repayment plan can actually be a financial asset! In this article, we will guide you through how to manage your student loans overseas so you can focus your energy on the other more exciting aspects of your new life abroad.

Average student debt in the US

Holding student debt is a very common reality for the American taxpayer. Currently, the average student debt amount is $40,499 per borrower, with a total of $1.766 trillion accrued overall.1 This significant financial reality has far-reaching implications and influences many important financial decisions, such as buying a home, starting a family, or pursuing a move abroad

Student debt may seem challenging to navigate and seem like a prohibitive factor in pursuing expat life. However, as we hinted above, in some scenarios moving abroad may be beneficial to your student debt status.

Federal vs. private student loans

When financing higher education, many students must decide between federal loans and private loans. Each loan type has distinct features that will have an overall impact on their financial situation for future years.

Federal student loans are backed by the government. They typically offer more borrower-friendly terms, such as lower interest rates and flexible repayment plans. In contrast, private loans’ terms vary based on creditworthiness.2

If you’re planning to spend time abroad, federal loans are typically advantageous due to their borrower protections and income-based repayment options. Ultimately, the decision between federal and private student loans should be made after careful consideration of your individual circumstances. Ideally, this consideration is taken in consultation with someone who can help you see the bigger financial picture, such as a financial planner.

Moving to another country may affect your student loans

Relocating abroad, either temporarily or permanently, affects your student loan repayment. Many go abroad with the intention to stay. Others might enjoy a gap year after graduation, enjoying au pair work, Workaway, teaching assistant programs, or other short-term opportunities. It’s important for US taxpayers to know that student debt doesn’t need to stand in the way of having these experiences.

Is moving overseas a viable strategy to mitigate student loan debt?

Some people joke about moving to “escape” their student loans overseas. However, this blind approach is ill-advised for several compelling reasons, such as potential harm to your credit score and the long-term financial consequences of failing to repay debt.

Instead of turning a blind eye to your debt, we strongly advise exploring a more informed and empowered pathway. You might begin your research process by exploring options to lessen the financial burden of your payments such as consolidating your student loans into one streamlined monthly payment.3

Additionally, negotiating income-based repayment plans can be an effective avenue, allowing your payments to be adjusted based on your financial situation. This is where living abroad can bring potential financial benefits to your student debt situation.

Pro tip:

A compelling reason to negotiate an income-based repayment plan is its flexibility – you can apply for an income-driven repayment plan at any time, especially if you experience changes in your financial situation while living abroad.

Using the Foreign Earned Income Exclusion (FEIE) to reduce student loan payments

Now let’s explore how living abroad can assist in reducing, delaying, or even eliminating your student loan debt.

Meeting certain criteria on your annual US tax return may qualify you for the Foreign Earned Income Exclusion (FEIE). This expat tax provision allows expats to exclude foreign earnings from taxable income up to an amount that is adjusted annually. ($120,000 for 2023 income, up from $112,000 last year.) Eligible expatriates can significantly reduce their US taxable income by applying this exclusion, which is then factored into your Modified Adjusted Gross Income (MAGI).

To qualify for the Foreign Earned Income Exclusion, your tax home must be in a foreign country, and you must either:

- be a bona fide resident for an uninterrupted period that includes an entire tax year (Bona Fide Residence Test)

or

- be physically present in that country for at least 330 full days during any period of 365 consecutive days (Physical Presence Test).4

This exclusion becomes particularly advantageous when used in conjunction with income-based loan repayment plans. Why? An income-based loan repayment evaluates your ability to pay back your student debt, based on the income on your US tax return. When using the Foreign Earned Income Exclusion you are reducing the income on your US return. This signals a lower income to your debt servicer and results in a lower (or nonexistent) monthly payment.

It’s important to note that the effectiveness of this strategy relies on the borrower’s ability to maintain an income-based repayment plan. This type of plan may be subject to updates and changes, especially with loan payments resuming as of October 1, 2023. Stay informed by periodically checking out studentaid.gov or the US Department of Education website.

Risks involved in this approach

The risks to the Foreign Earned Income Exclusion-based approach to reducing your student loan repayments are minimal if you plan to stay overseas long-term and consistently remain eligible for your Income-Based Repayment plan. Any outstanding balance on your loan may be forgiven if you haven’t repaid your loan in full after 20 years (loans for undergraduate study) or 25 years (loans for postgraduate or professional study)).5

There are potential risks, though, if your financial situation changes or you return to the US after having planned to invoke the FEIE until the loan is forgiven. These risks include increased accrued interest during income-driven repayment plans and potential retirement challenges like limited savings or contributions to a Roth IRA. Also, note that federal loan programs may change over time. It’s crucial to devise a plan tailored to your specific situation.

You will still owe something, even if the loan is forgiven

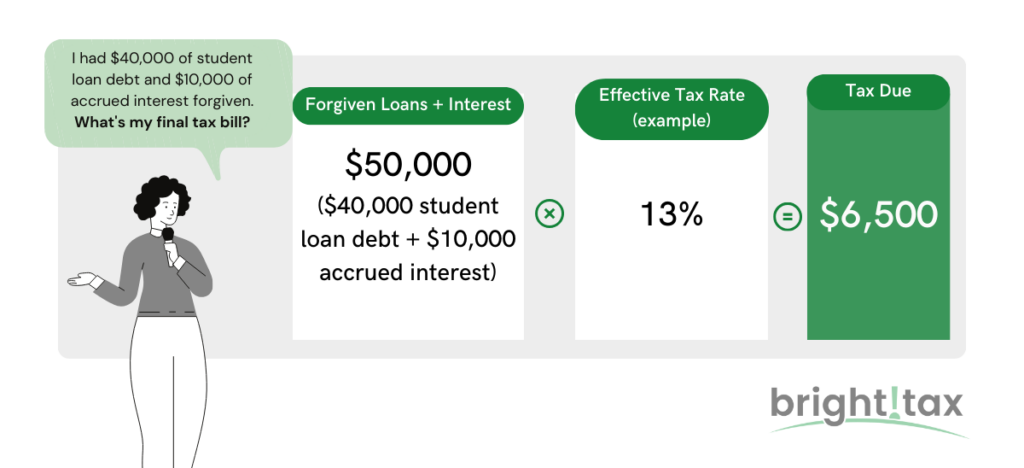

If your student loan is eventually forgiven, the total value of the loan, along with the accrued interest, is considered taxable income for you. As a result, there will be a one-off hit to your income tax bill that you should be prepared to pay.

While the value of the income tax owed will be much less than the total value of the loan and interest you would have otherwise paid, the tax will be due and payable to the IRS immediately. It may push you into a higher tax bracket for that year.

For example:

How marriage can affect your student loans when you live overseas

While marriage is often romanticized, expats understand that this life-changing event brings tax considerations. Below, we describe how marriage may impact your student loans, depending on whether your partner is a non-US citizen or a US citizen.

Marriage to a nonresident alien (NRA)

Marrying an NRA is a common reason many choose to move or stay abroad. In tax terms, an NRA is someone who is not a US taxpayer, but to you, it may just be your French husband. Or your Colombian wife. (You get the picture.) However, navigating the financial terrain of student loans and taxes while in an international marriage to an NRA introduces a unique set of considerations. Let’s delve into a few of them here:

Tax Filing Status

Your choice of tax filing status is important and not always straightforward when married to an NRA. The default option, “Married Filing Separately,” may be prudent if both spouses are earning income. This will ensure the NRA spouse is left out of the tangles of US tax obligations.

Alternatively, if you are married to an NRA and have dependent children, “Head of Household” status may be a better choice. This status can offer favorable tax benefits, in addition to protecting your spouse from US tax obligations.

Note: While the option of filing jointly with your NRA spouse exists, it rarely proves advantageous. Check out our article on US expats with a foreign spouse for more guidance on how to file with your spouse.

Impact on Income-Driven Repayment Plans

If you have a federal student loan, marital status, and household income play a role in determining eligibility and payment amounts for repayment plans. If you’re filing separately, as it stands, only individual income is considered under income-based repayment.6

Marriage to a US citizen

If you are married to a US citizen or green card holder abroad, both of you must file US taxes. This is typically done jointly or separately. Your income and choice of tax status can affect your student loans similarly to living in the U.S. Additionally, both of you can benefit from the FEIE regardless of filing status. Let’s look at the impact of marriage to a US citizen on US student loans:

Loan Repayment

Your marital status can affect your eligibility for certain income-driven repayment plans and your monthly payment amounts due to a combined assessment of household income.

Loan Forgiveness

Changes to your income or family size due to marriage may affect the timing and amount of loan forgiveness. (Note that married U.S. citizens living abroad still qualify for student loan forgiveness programs.) The current income limit for student loan forgiveness when filing jointly is $250,000.7

Foreign Earned Income Exclusion (FEIE)

Couples can exclude up to $240,000 of earned income from US income tax when filing jointly if both spouses qualify for the FEIE. This could reduce or eliminate earned income on your US taxes.8

How do student loans affect US taxes?

All US citizens and permanent residents must pay taxes on their worldwide income if they meet the minimum income thresholds. Living abroad long term while still holding student debt can feel overwhelming to navigate, and that’s before factoring in the annual tax filing requirement.

Fortunately, you do have resources at your disposal to mitigate your US tax liability further, and in some cases, you may even be eligible for refundable tax credits.

Below, we recap some of the most important tax breaks that offer relief for expats, in addition to general requirements.

Standard US tax provisions and requirements for US taxpayers overseas

- Foreign Tax Credit (FTC): Allows you to subtract what you’ve paid in foreign income taxes from what you owe the US government.

- Foreign Bank Account Report (FBAR): Requires anyone with over $10,000 in aggregate in foreign accounts to file FinCEN Report 114.

- Child Tax Credit (CTC): Allows you to claim up to $1,500 in partially refundable credits for each of your qualifying dependents.

- Foreign Account Tax Compliance Act (FATCA): Requires anyone with over $200,000 in foreign assets on the last day of the tax year — or over $300,000 at any point in the year — to file Form 8938. (These thresholds vary based on filing status and for those residing in the US.)

References

- Student Loan Debt Statistics [2023]: Average + Total Debt

- Federal Versus Private Loans | Federal Student Aid

- Student Loan Consolidation | Federal Student Aid

- Foreign Earned Income Exclusion | Internal Revenue Service

- Repayment Plans | Federal Student Aid

- 4 Things to Know About Marriage and Student Loan Debt

- Income Limits on Biden Student Loan Forgiveness Plan — Here’s Where Things Stand

- Figuring the Foreign Earned Income Exclusion | Internal Revenue Service

Student Loans When You’re a US Expat - FAQ

-

Is defaulting on your student loans a bad idea, even if you permanently reside abroad?

Yes. While living abroad might make it more challenging for lenders to pursue the debt, defaulting on student loans is a serious decision with potential long-term consequences. Defaulting on student loans, even when living abroad, can severely damage your U.S. credit score, lead to increased debt due to accumulating fees and interest, and have potential tax implications.

-

Can I still get the first stimulus check?

Yes, US taxpayers who have not claimed their first stimulus check are still eligible to do so. You can claim the Recovery Rebate Credit by filing your 2020 tax return. The period of eligibility closes on April 15, 2024, for those who lived in the US as of April 15, 2021. Eligibility extends two months to June 15, 2024, for those living outside of the US as of April 15, 2021.

Connect on LinkedIn

Connect on LinkedIn