Switzerland, aka the Playground of Europe, is a popular destination for American expats. Many find life in Switzerland so enjoyable that they stay, establishing careers and raising families along the way.

As with life anywhere, living in Switzerland comes with some bureaucratic and logistical hurdles – particularly for American citizens and Green Card holders. The IRS requires all citizens and Green Card holders to file an annual tax return and report their worldwide income, regardless of where they live in the world. This is called citizenship-based taxation, and the US is one of only two countries in the world to utilize this schema.

Many implications come with being required to file a US tax return as an expat

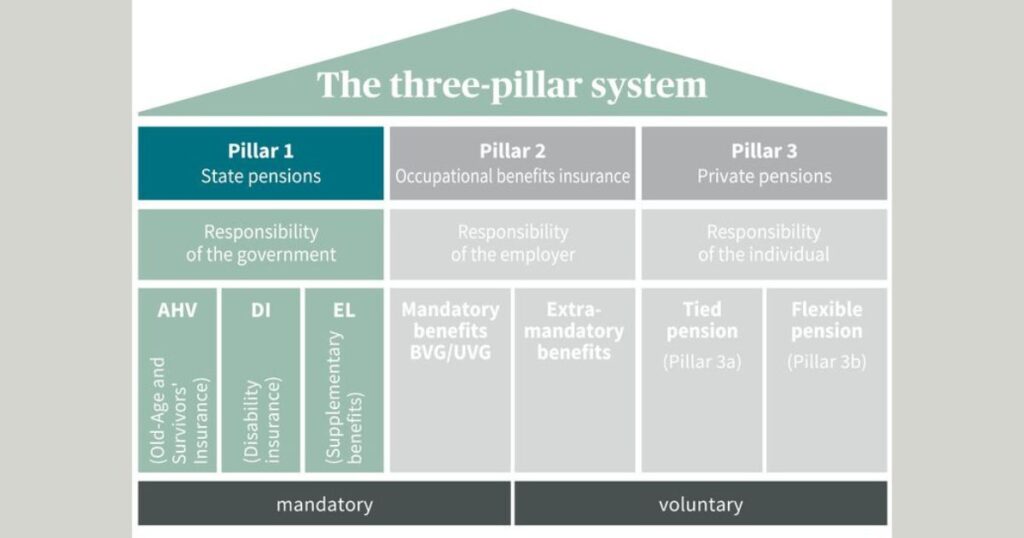

This is particularly important to bear in mind because the US often imposes harsh taxes on contributions and distributions made from a foreign pension. Therefore, it’s important to understand the foreign pension schemas you may have the opportunity (or be required) to pay into. In the case of Switzerland, there are three “pillars” to their pension system.

In the first of what will be a series of three articles, we will be principally focusing on Pillar 1, which most closely resembles US Social Security. Let’s dive in!

Pillar 1: State Pension Provision

As we mentioned, the State Pension Provision is most similar to the concept of US social security. This first pillar1 of the Swiss Pension System is comprised of three parts:

- Old-Age and Survivors’ Insurance (OASI, AHV/AVS)

- Disability Insurance (IV/DI)

- Supplementary Benefits (EL)

Old-Age and Survivors’ Insurance (OASI, AHV/AVS)

This is perhaps the most integral part of the first pillar. The OASI grants pension benefits to those reaching retirement age or the surviving family of an insured person. We will focus primarily on this part throughout the article.

Disability Insurance (IV/DI)

Swiss Disability Insurance is available to eligible individuals who are unable to work due to health reasons. Those who qualify may work up to 40% of the ‘standard’ work week and still retain this benefit. However, the amount of benefit received is unique to your specific situation.

Similarly, the US offers Social Security Disability Insurance (SSDI) for those unable to work due to a medical condition that is expected to last at least one year or result in death. While eligibility for the Swiss benefit is based on a percentage of time worked, the US benefit is dependent on your income level. You cannot make more than $1,350 (2022) per month and retain eligibility.

Supplementary Benefits (EL)

Funded through taxation from the Federal and Cantonal governments, supplementary benefits help fund maternity leave, military pay, and cases where pensions and other income do not cover the minimum cost of living.

Contributions to the Swiss State Pension Provision

Pillar 1 is a mandatory state pension insurance in which both you and your employer make contributions. These contributions are automatically deducted from your salary, similar to US social security.

Conditions triggering mandatory contributions

| Age | Condition |

| 18 | Employed2 |

| 20 | Unemployed3 |

The requirement to contribute to the Swiss State Pension ends at full retirement age (64 for women, 65 for men).

As of January 2022, the contribution4 rate is 10.6%, split between you and your employer each contributing 5.3%.

Pro tip: There is a key difference between US social security contributions and contributions to the Swiss State Pension. US social security contributions are capped with wages above $160,200 (2023). However, there is no wage cap on Pillar 1 contributions.

You and your employer will continue to pay 5.3% on all earned income. (Unlike in the US, there is no limit or cap in Switzerland.) However, some income is not considered for this calculation, such as your Swiss family allowance.

US Social Security and the Swiss State Pension – key differences

The main difference between the Swiss and US Social Security systems is how each country approaches taxation throughout the contributions and distributions period.

How Swiss State Pension contributions are taxed

In Switzerland, pension contributions reduce your taxable income, and therefore your overall Swiss tax liability. However, your pension distributions are taxed as income in retirement. Thus, when you retire and receive distributions, they will be fully taxed at your ordinary income tax rate. The applied tax rate is often lower than it would be at the time you made the contributions, as your overall income may be lower in retirement.

In the US, social security contributions do not reduce your taxable income and therefore are fully taxable. When you retire and receive distributions, up to 85% of your US distributions may be taxable, leaving 15% or more as tax-free income.

Retirement and distribution of the Swiss State Pension

The current retirement age in Switzerland is age 64 for women and 65 for men. However, at the end of 2022, the Federal Council agreed to equalize the retirement age to 65 for everyone by 2028.5

Those nearing retirement age can elect to receive distributions as early as two years before the official retirement age. If you elect to retire early, benefits are first calculated to the standard retirement age, and then future benefits are permanently reduced by 6.8% for each year of early pension payments.

Conversely, you may also elect to defer distributions for up to five years. This choice to defer will result in a higher benefit in future years.

In any case, in order to begin receiving your distributions, you must apply to begin receiving them.

The retirement age in the US has been slowly increasing over the years and currently stands at age 67 for both men and women. You can receive early distributions starting at age 62, or defer until age 67. The same rules apply, as early distributions permanently reduce future benefits, and deferring results in a higher future benefit.

Implications of early retirement in Switzerland VS the US

In Switzerland, if you choose to retire more than two years prior to reaching full retirement age, you will still be required to make AHV/AVS contributions while you are not employed. The required contributions can range from CHF 41.90 to CHF 2,095.80 per month. The exact amount you need to contribute is uniquely calculated based on your net worth and other income sources.

In the US, the minimum contribution period to qualify for distributions is 40 quarters (or 10 years). If you stop working, you are not required to continue making contributions but will receive a reduced benefit upon retirement.

How Switzerland and the US handle pension distributions

As of January 1, 2022, the minimum Swiss social security annuity is CHF 1,195 per month, and the maximum is CHF 2,390 per month. For married couples, the maximum benefit is CHF 3,585 per month. These distribution amounts are based on “complete contributions,” which means you made contributions for the entire contribution period (43 years for women, 44 years for men). For each missed year, there will be a reduction in the distribution.

In the US, the maximum amount of Social Security distributions an individual could receive at the current full retirement age (age 66 and 2 months in 2022) is $3,345. A married couple who both meet the requirements for a maximum distribution does not receive a reduction in the amount received.

Taxpayer protections: US-Swiss Social Security Totalization Treaty

The US and Switzerland have a totalization treaty6 in place, which is intended to protect individuals who work between the two countries. It allows you (and your employer) to avoid mandatory contributions to both pension systems. However, it’s important to note that this does not apply to US Medicare coverage, as it was not included in this treaty.

Additionally, the US requires retirees to have worked in the country for at least ten years in order to receive US Medicare benefits. If you do not meet this requirement, you will need to purchase additional health insurance coverage.

What if you spent your career working in both the US and Switzerland?

There is a high likelihood that your US social security distributions will be reduced. This is due to the Windfall Elimination Provision (WEP). This does not apply to any distributions received through the Swiss pension system, as it is not reduced in this provision.

Calculating your distributions

You can use an online calculator7 to figure out your potential distributions for Switzerland; the resource will provide a decent estimate. If you have worked at least one full year in Switzerland and otherwise qualify, you will not receive a reduction in distributions.

For the United States, you can create an account to view your US Social Security Statement on the US Social Security Administration website.8 This statement is helpful for those looking to learn about their future Social Security benefits9 and earnings history. An important note here is that you are required to have a valid US address in order to create an account.

If you are living abroad and do not have a US address, you can request a social security statement through IRS form SSA-7004.10

A reduction in US social security distributions due to WEP is not included in the above statement. The Social Security Administration (SSA) provides a WEP Calculator,11 which can help determine this reduction.

Understanding the implications of contributing to the Swiss State Pension

Spending your career working in both the US and Switzerland can be an extremely rewarding adventure. However, as you can see, working between the two countries requires additional, careful planning when it comes to retirement. Due to the differing contribution periods, Windfall Elimination Provision, and US-Switzerland Totalization Treaty, there are numerous factors to consider when calculating your expected benefits. You may also want to consider requesting a pension forecast12 at some point. Make sure to speak with your financial planner and US tax advisor, as optimization revolves around your unique experiences.

References

- Pillar 1 – Swiss Pension System

- Credit Suisse – Private Banking

- Non-employed contributions to Old-Age and Survivors’ Insurance (OASI), Disability Insurance (DI) and Income Compensation Insurance (IC)

- Switzerland contribution rate

- New Retirement Age for Women in Switzerland to Go Into Effect

- Totalization Treaty: US and Switzerland

- Online calculator for contributions

- SSA website

- What is the maximum Social Security benefit?

- Request for a Social Security Statement (SSA-7004)

- WEP Calculator

- Pension Forecast

Connect on LinkedIn

Connect on LinkedIn