First things first – US citizens living abroad must file a tax return and declare their worldwide income. That’s because the United States is one of the only countries that apply citizenship-based taxation, which leaves many expats wondering if they’ll have to pay taxes twice on the same income.

Thankfully, the Foreign Earned Income Exclusion (FEIE) allows expats to exclude up to $130,000 of their foreign-earned income from US taxes (2025). To claim it, however, expats must meet one of the tests the IRS uses to determine whether they’re living abroad and attach Form 2555 to Form 1040 when filing.

Let’s take a look at the specific steps needed to complete both forms (while also reducing your US tax liability!)

Key Updates for 2025

- The Foreign Earned Income Exclusion (FEIE) has increased to $130,000 per qualifying individual.

- The standard deduction for married couples filing jointly has risen to $28,000, for single filers to $14,000, and for heads of household to $20,800.

- The automatic filing extension for expats remains June 15, but any taxes owed are still due by April 15 to avoid interest.

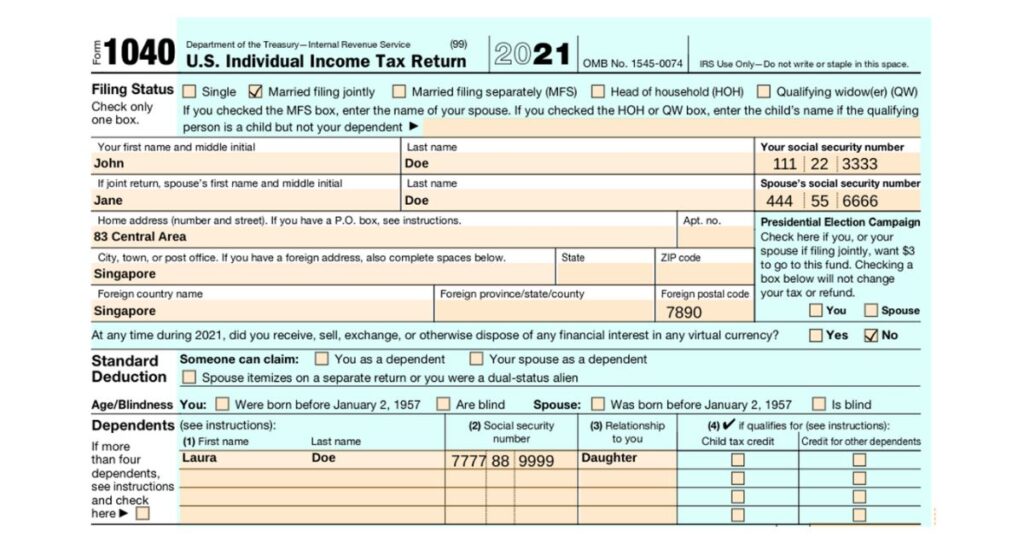

Setting the stage: Meet John & Jane, expats in Singapore.

To help you better understand how to complete Form 1040, we’ll use the example of John Doe and Jane Doe. They’re a married expat couple with an 8-year-old daughter named Laura, and they have lived in Singapore since January 2021.

John works in Singapore as an IT Project Manager for a tech company. He earns an income of $100,000 per year from his job.

Outside work, the Doe family also owns a house in Bali, Indonesia, which generates $6000 in rental income each year. In addition, they hold a savings account that generated $500 in interest last year.

Let’s follow their journey in filing Form 1040.

How to complete Form 1040: Four simple steps:

Step 1: Fill out your personal information

The first half of Form 1040 focuses on your personal details. This information includes:

- You and your spouse’s names (if you decide to file jointly)

- Your mailing address

- You and your spouse’s social security number

- Dependents’ (children, grandparents, etc.) names & social security numbers

- Whether your dependents qualify for child tax credits.

In our case, John and Jane decided to file Form 1040 jointly and claim their daughter, Laura, as a dependent. John and Jane can claim the Child Tax Credit – even while living abroad! However, because they spent less than six months in the US last year, they cannot claim the advanced monthly payments or expanded version.

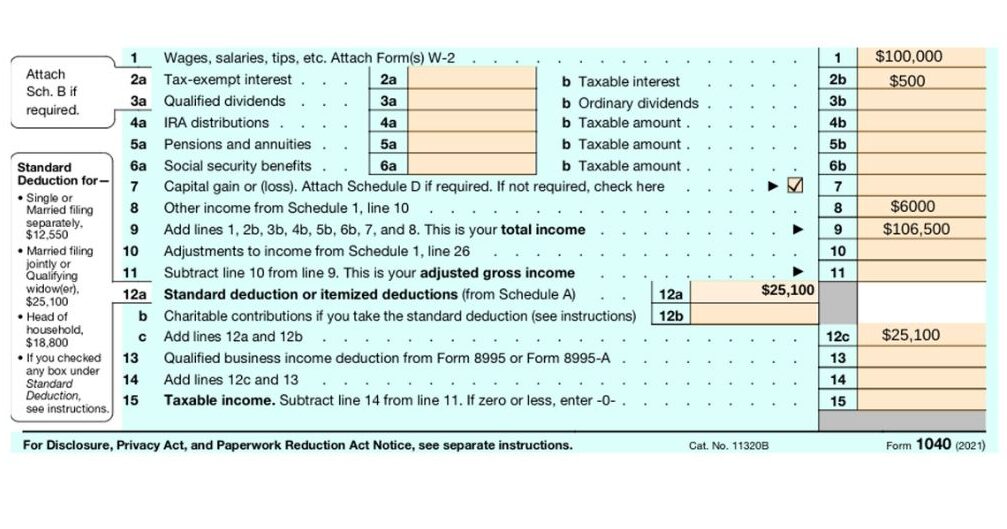

Step 2: Report your earned income

Next, you must report all income throughout the year. Some examples of different types of income you will need to include in Form 1040 are:

- Wages

- Retirement income from pensions, social security income, IRS, and 401(k)

- Taxable interest

- Rental income from properties

- Unemployment income

- Business or self-employment income (or loss)

- Capital gains (or losses)

- Other gains (or losses)

In our example, John will list his $100,000 per year salary on line 1 for “wages, salaries, tips, etc.” Because of the interest they earn from their savings account, The Doe family includes the $500 interest on Line 2b, “Taxable interest.”

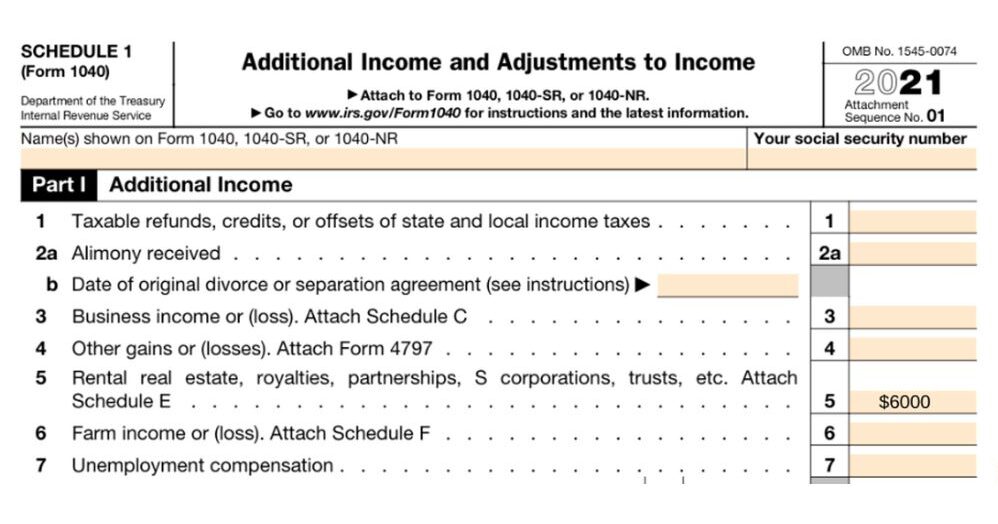

John and Jane will also have to declare the $6000 per year rental income they earn with their property in Bali. To do this, they also attach Schedule 1 to their Form 1040 to declare their earnings:

Step 3: Claim your deductions

Next, it’s time to claim your deductions on Form 1040, starting with the standard deduction, which is allowed for each taxpayer depending on their filing status. Some examples of other deductions include:

- Medical expenses

- Business expenses

- Educator expenses

- Paid alimony

Since John and Jane are filing jointly as a married couple, they automatically benefit from a standard deduction of $25,100.

Step 4: Calculate how much you owe in taxes.

On the second page of Form 1040, you’ll have to calculate how much you owe in taxes.

In the case of John, his total income amount, when considering his wage, rental income, and interest, adds up to $106,500. Since he makes more than $100,000 per year, he’ll have to use the worksheet on page 77 of the IRS’s Instructions for Form 1040.

How to Complete Form 2555 to Claim Foreign Earned Income

To claim the FEIE, you must attach Form 2555 to Form 1040. Here’s how to do it:

Step 1: Fill out your personal information

Like with Form 1040, you start by completing Form 2555 with your details. You must include your name and full foreign address, city or town, state or province, country, and ZIP or foreign postal code.

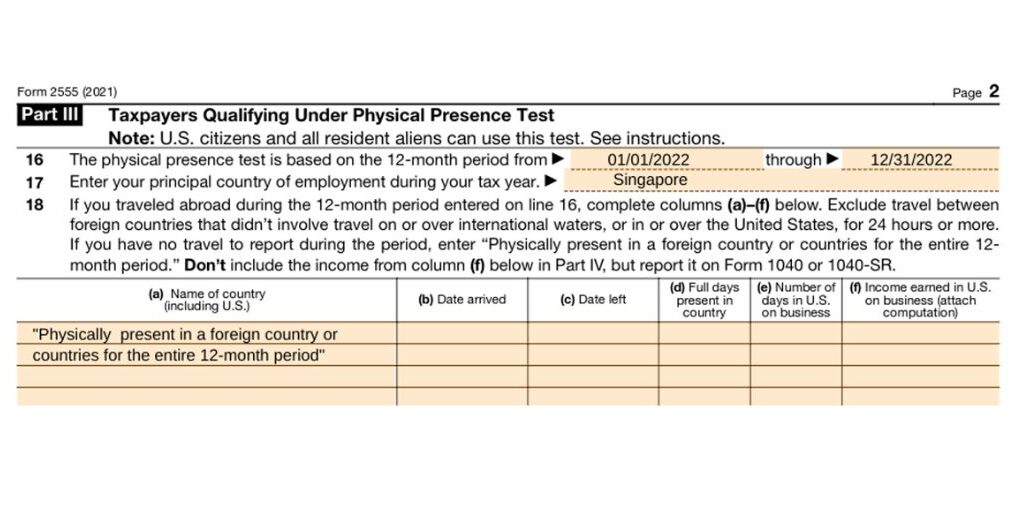

Step 2: Pass the Bonafide Residence Test or Physical Presence Test

You must pass either of these two tests to qualify for the FEIE:

- Bonafide Residence Test: US expats must prove their social and professional ties to their new country & more than 1 calendar year of presence outside the US.

- Physical Presence Test: US expats must prove that they spent at least 330 days outside the US (during any consecutive 365-day period).

If you want to use the Bona Fide Residence, you’ll have to enter the dates of when your Bona Fide Residence began and ended on Line 10 of Form 2555. If you’re still a bona fide resident, you must write “continues” on Line 10 instead.

John and Jane decide to use the Physical Presence Test and must prove that they’ve spent at least 330 days in Singapore. To do so, they added all separate periods they were present in Singapore during the 12 months, as shown on line 16.

Step 3: Include your total amount of foreign-earned income

Part IV of Form 2555 is where you can include all your total foreign earned income that you must convert into USD. If you get any other benefits from your work, such as lodging, meals, or cars, you must include them in this part IV. Your total amount of foreign income is going to be on Line 24.

You can exclude a maximum of $130,000 of foreign-earned income per person (2025). As a result, both John and Jane Doe can exclude their wages from their tax return since they make less than the limit.

FAQ: Filing Form 1040 With Foreign Earned Income

-

Do I have to file Form 1040 if I live abroad?

Yes, all U.S. citizens and permanent residents must file a federal tax return if they meet the income filing threshold, regardless of where they live.

-

What is the Foreign Earned Income Exclusion (FEIE), and how do I claim it?

The FEIE allows you to exclude up to $130,000 of foreign-earned income in 2025 from U.S. taxation. To claim it, you must meet either the Bona Fide Residence Test (proving long-term residence in a foreign country) or the Physical Presence Test (spending at least 330 days in a foreign country in a 12-month period) and file Form 2555 with your Form 1040.

-

Can I exclude all my foreign income under the FEIE?

No, the FEIE applies only to earned income (e.g., salaries, wages, self-employment income). Passive income like rental income, dividends, or interest does not qualify and must be reported on your tax return.

-

Do I need to pay U.S. taxes if I already pay taxes abroad?

Possibly. If you pay foreign income taxes, you can claim a Foreign Tax Credit (FTC) to offset your U.S. tax liability. The FEIE and FTC can sometimes be used together, but you cannot use the same income for both benefits.

-

What additional forms might I need to file as an expat?

- Form 2555 – To claim the FEIE.

- Schedule 1 (Form 1040) – To report additional income (e.g., rental income).

- FBAR (FinCEN Form 114) – Required if you have over $10,000 across foreign financial accounts.

- Form 8938 – If your foreign assets exceed $200,000 (or $300,000 at any point during the tax year).

-

Do I still qualify for deductions and credits as an expat?

Yes. Expats can still claim the standard deduction, Child Tax Credit, and other eligible deductions. However, if you use the FEIE, certain tax credits (e.g., the Additional Child Tax Credit) may be limited.

-

What is the deadline for expats to file their U.S. taxes?

The standard tax deadline is April 15, but expats get an automatic extension to June 15. You can request an additional extension until October 15 using Form 4868. However, any taxes owed must be paid by April 15 to avoid interest charges.

-

Do I have to report my foreign bank accounts?

Yes, if you have more than $10,000 across all foreign financial accounts at any time during the year, you must file FBAR (FinCEN Form 114). If your foreign assets exceed $200,000 at year-end ($300,000 at any point during the year), you must also file Form 8938.

-

Can I still contribute to a U.S. retirement account while living abroad?

It depends. If you earn foreign income but exclude it using the FEIE, you may not be eligible to contribute to tax-advantaged accounts like an IRA or 401(k). However, if you use the Foreign Tax Credit instead, contributions may still be allowed.

-

What happens if I don’t file my U.S. taxes while living abroad?

Failure to file can result in penalties, interest, and loss of tax benefits. If you haven’t filed in previous years, the Streamlined Filing Compliance Procedure may help you catch up without major penalties.

Connect on LinkedIn

Connect on LinkedIn