US mutual funds are a popular investment vehicle stateside and are frequently recommended as an affordable and convenient way to diversify investment portfolios. With that commonplace advice in mind, many expats consider investing in mutual funds based outside the US.

Investing in foreign mutual funds, however, isn’t quite as straightforward as investing in a US-based mutual fund. Compared to their US-based counterparts, international mutual funds are classified, taxed, and reported differently in the eyes of the IRS.

Below, we’ll do a quick rundown on the implications of investing in foreign mutual funds for US expats. Read on to learn what exactly foreign mutual funds are, how they’re reported, the risks they carry, and more.

What is a foreign mutual fund?

A mutual fund is a financial vehicle that allows a group of investors to pool their money together and, in turn, invest that capital in a variety of stocks, bonds, and other funds.1 By spreading this capital across different funds, you mitigate the risk of having too many eggs in one basket.

And because that capital is pooled together, you receive many of the same benefits that larger investors get — such as diversifying your investments and paying lower fees for actively-managed funds — while individually contributing as much or as little money as you want.

And how do you determine whether a mutual fund is US or foreign-based? A quick rule of thumb is that foreign mutual funds do not trade on US markets, and accordingly won’t have a CUSIP number.2 A common misconception occurs where foreign mutual funds trade US stocks and hold within their portfolio US-based investments.3

⚠️ Review the fine print carefully

While the portfolio holdings themselves may be US-based, if the fund is not US-registered then it is still considered a foreign mutual fund.

Taxation of US-based mutual funds is fairly straightforward. Distributions and sale of investment gains in such funds are taxed at the more beneficial long-term capital gains rate — provided that you’ve held the asset for over a year. You’ll report any gains or losses associated with a US mutual fund on Form 1040 and Form 1099-DIV.4

On the other hand, foreign mutual funds are taxed (and reported) much differently than US-based mutual funds.

Foreign mutual funds & PFICs

Foreign mutual funds are classified as what the IRS calls Passive Foreign Investment Companies, or PFICs. A PFIC is a pooled investment registered and regulated outside the US. These typically include many funds such as investment trusts, exchange-traded funds (ETFs), and sometimes even foreign corporations and pension schemes.

To be considered a PFIC, a foreign-based pooled investment fund will have either 75% of its gross income coming from passive income (i.e. from investments), or at least 50% of its assets held to produce passive income.5 As investment vehicles, the vast majority of foreign-based pooled investment funds will fall under this category.

You might be wondering if a US-based investment fund with holdings in international markets is considered a PFIC. The answer is no. It doesn’t matter where the individual investments are based. The key factor in determining PFIC status is where a pooled mutual fund is registered and regulated. So a foreign-based mutual fund could, in theory, hold only US investments, and still be considered a PFIC.

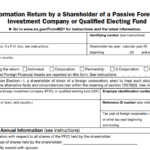

Reporting foreign mutual funds via Form 8621

Both US reporting and US tax liability are more onerous for PFICs, and many expat-specialist investment managers advise expats to avoid foreign mutual funds entirely.6 Both distribution and dispositions from foreign mutual funds are taxed at higher rates than other types of investments.7

Perhaps the most common and most significant investment mistake made by Americans abroad is to buy a foreign mutual fund.

– Creative Planning International

Any year that you receive a distribution (more commonly known as a dividend) or make a disposition from a PFIC, you must report it on IRS Form 8621.8 Keep in mind that this is a complex form to file, however, and is best left to tax professionals. If you elect to complete it yourself, we strongly advise reviewing it with a professional prior to submission.

Foreign mutual fund holders may need to file an FBAR/Form 8938

Foreign mutual funds may carry additional reporting obligations as well, depending on the amount you’ve invested in them. Americans with over $10,000 across foreign financial accounts at any time in a year, for example, must file a Foreign Bank Account Report (FBAR).

The Foreign Account Tax Compliance Act (FATCA), meanwhile, compels American expats with over $200,000 of foreign-registered financial assets on the final day of the tax year — or over $300,000 at any point during the tax year — to report them on IRS Form 8938.

How US expats can become invested in foreign mutual funds without realizing it

Even if you haven’t proactively sought out and invested in a foreign mutual fund, you may have international equity that classifies as a PFIC holding. Almost any pooled investment outside of the US is considered a PFIC, which can include, foreign pension plans, insurance plans, and other managed investment funds.9

What to do if you hold PFICs

If you currently have holdings in a PFIC, you should first review your portfolio with your US tax accountant to be sure you’ve been reporting them properly. Then, a cross-border financial advisor can help evaluate whether or not the funds plus the cost to report them and US tax consequences are positively contributing to your overall investment strategy. If not, an advisor may recommend that you redirect those funds into a different investment vehicle.

Is there a way to safely invest in international funds as a US expat?

There are many different options to invest in international stock, international index funds, international ETFs, international equity funds, and more through US brokerage accounts.10 For example, Charles Schwab and International Brokers are two common options. However, whether or not it’s a good move for you will depend largely on your individual circumstances. So before you take that leap, do some individual research and be sure to speak with a finance professional.

References

- Introduction to Investing – Mutual Funds

- CUSIP Number

- Invesco US Equity Fund (UK)

- Mutual Funds Cost and Distribution

- PFIC definition

- Why Americans Should Never Own Shares in a US Mutual Fund

- Financial and Invesment Information for Americans Abroad

- IRS Form 8621

- How to Invest as an Accidental American

- Investing as an American Expat