All Americans whose income exceeds certain thresholds must file (and potentially pay) United States taxes. Due to the US’s system of citizenship-based taxation, this is true even for American citizens and resident aliens living abroad. But no matter what currency their income is issued in, US expats must report it in US dollars (USD) — which is where IRS exchange rates come in.

Whether your income is in euros, pounds sterling, or yen, you’ll need to enter the US dollar equivalent on all of your tax forms using IRS-approved foreign exchange rates. But what exactly are these exchange rates, where can you find them, and how do you use them? We’ll answer all of these questions and more in the article below.

Why should expats care about IRS exchange rates?

Your income serves as the basis for your taxes, so reporting it accurately is essential. Failing to convert your income into USD using the correct exchange rate will render your entire tax return inaccurate.

Some US expats may unknowingly use unreliable exchange rates, while others might not convert their currency at all, thinking that reporting it in its original currency will suffice. However, errors like this can lead to significant tax problems.

If exchange rate mistakes result in you reporting more income than what you actually earned, you risk erroneously increasing your tax liability. If you report less than what you actually earned, you risk facing IRS penalties for underreporting and interest on the amount you owe.

Filing an amended return may allow you to correct past mistakes, but it takes additional time and effort — and won’t necessarily absolve you of fines and penalties. As with many things in life, it’s much simpler and more beneficial to report your income accurately the first time than correct it later. And to do that, you’ll need to use IRS-approved exchange rates.

What is the current IRS exchange rate?

The IRS doesn’t issue official exchange rates that expats must use when reporting their income1. Rather, they accept any posted exchange rate that is used consistently.

“When valuing currency of a foreign country that uses multiple exchange rates, use the rate that applies to your specific facts and circumstances.”

- IRS website

That said, the IRS does issue yearly average currency exchange rates. You can use these exchange rates to convert certain items of income into USD — namely those that you receive regularly throughout the year2. For other types of income — typically one-off transactions — you may need to use monthly or daily averages.

Generally, you can use the IRS average exchange rates for income like:

- Salary

- Wages

- Social Security benefits

- Pension payments

- Steady rental income

- Steady financial interest income

- Steady dividend income

- Steady self-employment income

On the other hand, you’ll use monthly and daily exchange rates for income like:

- Capital gains

- One-off dividend income

- Settlements

- Bonuses

- Gifts

- One-off self-employment income

- Lump sum interest income

Steady vs. one-off income

The steady vs. one-off distinction can be a bit tricky, so let’s go over an example with self-employment income.

Example: Felix is a US expat and digital nomad working as a freelance graphic designer. In 2024, he had two clients — Client A and Client B — both based in the European Union (EU).

Felix has a monthly retainer agreement with Client A. They pay him €5,000 per month for 20 hours of work per week. Because Felix receives regular payments from Client A, he will convert that income using yearly average exchange rates.

In contrast, Felix completed just one large project for Client B when they hired him to refresh their visual brand. They agreed on a project-based fee of €7,000. Client B paid half (€3,500) upfront when he started the project on February 12th, 2024, and the other half (€3,500) after he submitted the final assets on May 28th, 2024.

Because Client B only made two payments that won’t recur, Felix can convert the €3,500 he received on February 12th using the average exchange rate on that day or the monthly average exchange rate for February 2024. Likewise, he can convert the second €3,500 payment using either the daily average exchange rate for May 28th, 2024, or the monthly average for May 2024.

Examples of average IRS exchange rates

To give you a better idea of average annual exchange rates, here are examples of how different countries’ foreign currencies have converted into USD over the past calendar years:

| Country | Currency | 2024 | 2023 | 2022 | 2021 | 2020 |

| Australia | Dollar | 1.516 | 1.506 | 1.442 | 1.332 | 1.452 |

| Canada | Dollar | 1.37 | 1.35 | 1.301 | 1.254 | 1.341 |

| Euro Zone | Euro | 0.924 | 0.924 | 0.951 | 0.846 | 0.877 |

| Japan | Yen | 151.353 | 140.511 | 131.454 | 109.817 | 106.725 |

| Mexico | Peso | 18.33 | 17.733 | 20.11 | 20.284 | 21.466 |

| New Zealand | Dollar | 1.654 | 1.63 | 1.578 | 1.415 | 1.54 |

| Switzerland | Franc | 0.881 | 0.899 | 0.955 | 0.914 | 939 |

| United Kingdom | Pound | 0.783 | 0.804 | 0.811 | 0.727 | 0.779 |

You can visit the IRS’ foreign currency exchange rates page to see exchange rates for dozens of other forms of currency.

B!T note:

You can find additional exchange rate tools and websites listed on the IRS website, like Oanda, Xe, and X-Rates.

How do I convert foreign currencies & assets to US dollars with the IRS?

So, how exactly can you use these exchange rates to convert your income and assets into USD? Read on for our step-by-step breakdown.

Converting foreign currency

IRS currency conversion is pretty simple, even if math isn’t your strong suit. Just use the following formulas:

Foreign currency to USD

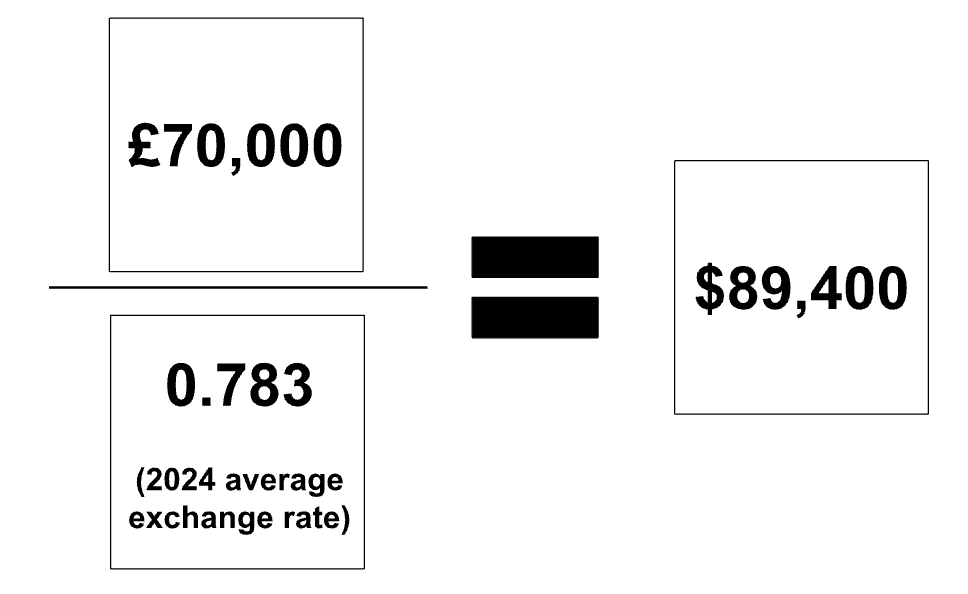

Let’s use pounds sterling (GBP) as an example, converting £70,000 into USD:

B!T note:

When converting foreign currency into US dollars, you will always round to the nearest dollar amount, up or down. So even though the more precise result for the example above is $89,399.75, you must round up the figure to $89,400 on your tax return.

USD to foreign currency

Now, let’s try the inverse of the previous example — converting $70,000 into GBP:

Converting foreign assets

On top of declaring their worldwide income, Americans may also need to report their foreign financial assets. There are two main reports that require foreign asset conversion:

Foreign Bank Account Report (FBAR)

Filing the Foreign Bank Account Report (FBAR) becomes mandatory when the maximum value of all your different foreign financial accounts exceeds $10,000 at any given point in the year. This includes foreign accounts like:

- Checking & savings accounts

- Brokerage accounts

- Mutual funds

- Business accounts

- Cryptocurrency accounts on foreign exchanges

- Insurance policies with a cash value

When this occurs, you must file FinCEN Form 114.

Example: Let’s say that you have a Mexican checking account that contained 50,000 MXN (~$2,728 with the 2024 average exchange rate) at its peak, and a Japanese savings account containing ¥1.5 million (~$9,911 with the 2024 average exchange rate) at its peak.

Because the sum of those assets (~$12,639) exceeds $10,000, you would need to file an FBAR.

Statement of Specified Assets (Form 8938)

Filing the Statement of Specified Assets (Form 8938) becomes necessary when the value of certain foreign assets exceeds $200,000 on the last day of — or $300,000 at any point during — the tax year. These foreign assets may include:

- Bank accounts

- Investment accounts

- Mutual funds

- Stocks & bonds held in foreign exchanges

- Foreign pension funds

- Ownership shares in foreign businesses (corporations, partnerships)

- Foreign trusts

- Foreign real estate when held in a foreign company (not homes or properties held in your name specifically)

Example: Let’s say your foreign financial assets include:

- A German checking account valued at €5,000 (~$5,411 with the 2024 average exchange rate) on the last day of the tax year

- A German savings account valued at €40,000 (~$43,290 with the 2024 average exchange rate) on the last day of the tax year

- A UK-based pension fund containing £120,000 (~$153,257 with the 2024 average exchange rate) on the last day of the tax year

The total of these assets is $201,958 on the last day of the tax year, which exceeds $200,000 — meaning you will need to file Form 8938.

Need help with your US tax return while overseas?

Exchange rates are just one of many factors that complicate tax returns for US expats. On top of that, you also have to consider additional and different reporting obligations, eligibility for US expat-specific tax credits, US tax treaties, and much more.

If you’re feeling overwhelmed by US expat taxes, Bright!Tax is here for you. We’ve helped thousands of clients in hundreds of countries around the world optimize their tax strategies, file their tax returns, and reach full compliance.

Reach out today to schedule a free, 20-minute consultation!

Resources:

- https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates

- https://fr.usembassy.gov/services/internal-revenue-service/

IRS Exchange Rates FAQs

-

What is the difference between monthly and yearly exchange rates?

As their names suggest, monthly exchange rates are daily exchange rates averaged over a one-month period. Yearly exchange rates, on the other hand, are daily exchange rates averaged over a one-year period.

US expats use monthly average exchange rates when converting foreign income received on a one-off basis, like income from capital gains, bonuses, commissions, and lump-sum payouts. For converting regular income, however — such as salary, wages, monthly interest, or quarterly dividends — they will use yearly average exchange rates.

If your income fluctuates significantly throughout the year, it’s important to apply the correct rate based on the income type.

-

Can I use an exchange rate calculator for my tax filing?

Yes, you can use exchange rate calculators or websites to convert foreign currencies into USD as long as the source is regularly updated and consistently used in your country of residence. Some reliable websites the IRS lists include Oanda, Xe, and X-Rates.

When using online exchange rate calculators, make sure that you’re applying the correct daily, monthly, or yearly rate to your different items of income. It’s a good idea to document which exchange rate calculator you used in case the IRS requires this information in the future.

-

Can I use an exchange rate from a different source (e.g., Bank or Forex Rate)?

The IRS links to Oanda, Xe, and X-Rates on their website, making those reliable tools for exchange rate calculations. You can also use any other platform that is consistently used in your country of residence. You’ll typically use these tools to convert one-off income that requires daily or monthly average exchange rates.

However, when it comes to regular income, it’s usually best to use the average annual exchange rates directly published on the IRS website to ensure consistency and avoid errors. If you use another source, make sure to document the name of the platform and the rates/calculations in the off chance you receive an IRS audit in the future.

-

Is there a penalty for using the wrong exchange rate?

Using the wrong exchange rate can result in you erroneously reporting less income than you actually received. This, in turn, can lead to underpayment and accuracy-related penalties or interest on underpaid taxes. Exchange rate errors that result in you erroneously reporting more income than actually received, on the other hand, can increase your tax liability unnecessarily.

-

Can I change the IRS exchange rate I used after I filed my tax return?

You can only change the IRS exchange rate after filing your tax return if you realize it was incorrect. In that case, you would need to file an amended tax return as soon as possible using the correct rates. Keep in mind that the sooner you make these changes, the less interest you will rack up on underpaid taxes.

Connect on LinkedIn

Connect on LinkedIn