It’s common for longtime US expats to consider the pros and cons of renouncing US citizenship. The annual filing requirement can take a toll on both nerves and patience, leading many to question why, exactly, they maintain their US citizenship. Contrary to popular belief, however, renouncing is a time-consuming process rife with bureaucratic hurdles.

To present an accurate overview of the options, below we review the main pros and cons of this life-changing decision.

Why is American citizenship so controversial for US expats?

The US is one of only two countries in the world (Eritrea being the other) that has a citizenship-based tax system.1 This form of taxation makes all American citizens and permanent residents subject to US tax on their worldwide income, regardless of whether or not they are currently living there.

When an American citizen’s or permanent resident’s income reaches the minimum reporting requirements, they must file a tax return and pay income taxes. These thresholds are typically start at $14,600 for single filers or just $400 in self-employment income. While there are many IRS provisions to provide relief for US expats, the complexity of filing from abroad is exponentially higher than doing so domestically.

Pros of renouncing US citizenship

It’s common for US expats to commiserate over how unfair the citizenship-based taxation model is. After all, they’re not benefiting from many of the services that those taxes fund. As a result, some of these expats become involved in lobbying for change, such as by joining American Citizens Abroad2 or the Association of Accidental Americans.3 These groups are very clear-eyed about the pros and cons of renouncing – and there are many considerations.

Below, we look at some of the most common benefits of renouncing US citizenship.

No more filing an annual tax return with the IRS

The biggest reason people choose to renounce their citizenship is usually because it means they no longer have to file a federal US tax return or pay US-based income taxes.

Often, US expats have to file two sets of tax returns: one for the country they live in, and another for the US. As mentioned previously, filing from abroad requires the strategic application of IRS provisions that protect expats from being double-taxed (up to a point). Two common provisions used for this purpose are the Foreign Tax Credit or the Foreign Earned Income Exclusion. And yet, they do require a working knowledge of which types of income they apply to.

Renouncing your US citizenship allows expats to avoid the complex and time-consuming process of staying up-to-date with IRS tax provisions.

It becomes easier to open and manage foreign bank accounts

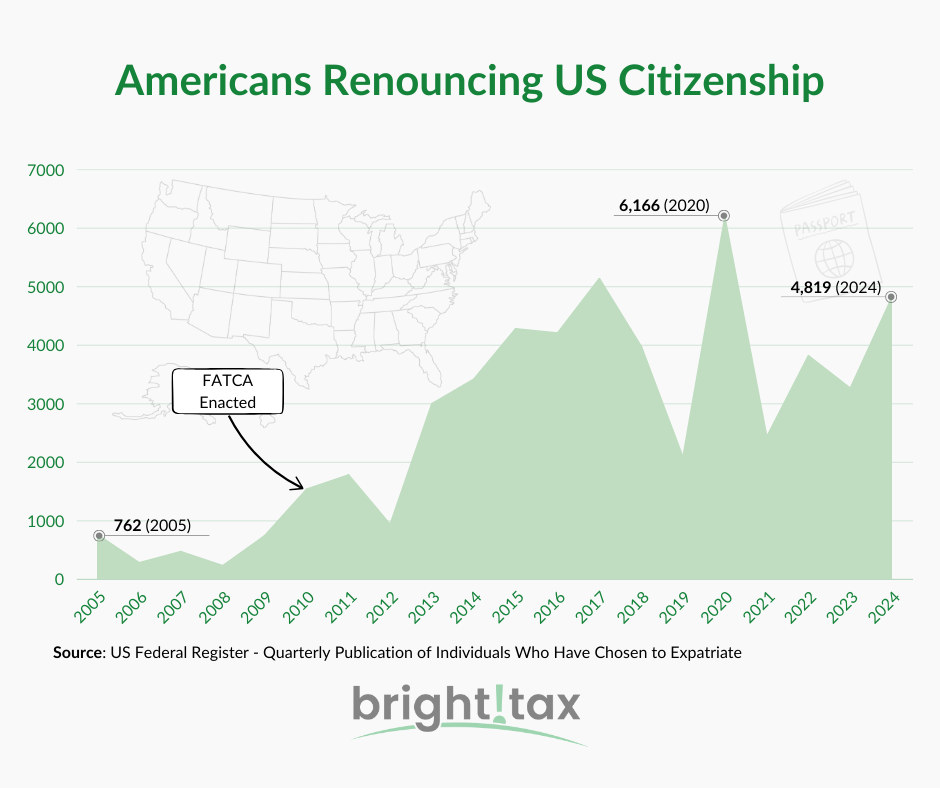

The Foreign Account Tax Compliance Act (FATCA), passed in 2010, was drafted to prevent overseas tax evasion. It requires foreign financial institutions to share information on any Americans who may hold accounts with them, or face steep fines. As a result, some foreign banks won’t allow US citizens or permanent residents to open accounts with them at all.4 Others have abruptly closed accounts held by US citizens or permanent residents.

By renouncing your US citizenship, you will no longer be considered American. This frees foreign banks from their obligation to report your information to the US government. In turn, they won’t have the same hesitations about letting you open an account with them.

Filing obligations will no longer include FBAR, Form 8938

Beyond filing a federal US tax return, many Americans living abroad also encounter additional reporting requirements. Another tenant of FATCA is that it compels Americans with over $10,000 across foreign accounts — such as bank accounts, retirement accounts, pensions, etc. — to file a Foreign Bank Account Report (FBAR).

Meanwhile, Americans abroad with foreign assets totaling more than $200,000 at the end of the tax year, or more than $300,000 at any point during the year, must file Form 8938.

Those who have renounced their US citizenship, however, no longer have to file these annual reports.

Business relief from not having to file Form 5471

Many officers, directors, and shareholders of foreign corporations are required to file Form 5471: Information Return of US Persons With Respect To Certain Foreign Corporations. This is a complicated form that often takes over 30 hours to file. Those who must file include:

- Officers and directors of foreign corporations that are at least 10% US-owned at any time in the year

- Americans who own at least 10% of a foreign corporation that is more than 50% US-owned (also called a Controlled Foreign Corporation, or CFC)

- Officers or directors of foreign corporations that are at least 10% US-owned, if there is any increase or decrease of stock ownership of at least 10% in a year

- Americans who control more than 50% of a foreign corporation for at least 30 days in a year

- Americans who marry a foreigner who owns at least 50% of a foreign corporation

Form 5471 rarely affects your actual tax liability. However, it does carry steep penalties for those who don’t complete it accurately or on time. But again, those who have renounced their US citizenship will not be obligated to fill it out.

No reporting obligations or financial penalties for foreign mutual funds

The tax and reporting requirements for Americans with shares in a Passive Foreign Investment Company (PFIC) — i.e., a foreign-based fund of pooled investments with 75% of its gross income coming from passive income or 50% of its assets held to produce passive income — can be cumbersome. PFICs include not just stock and managed funds but also foreign pension plans, insurance plans, and virtually any other foreign-based pooled investment fund.

Any American that receives distributions or makes dispositions from a PFIC must report it via Form 8621. This is an infamously complex form best handled by an expat tax accountant. PFICs are also taxed more heavily than US-based mutual funds.

Upon renouncing your citizenship though, you’ll no longer be compelled to fill out Form 8621 or pay the burdensome taxes that the US government levies on American PFIC shareholders.

Other pros associated with renouncing US citizenship

A few other advantages of renouncing your US citizenship include:

- Changes to the US tax laws will no longer affect you

- In some cases, investment planning in the US is simplified; you can plan to earn capital gains and/or interest income (which is typically not taxed in the US)

- Relief from crossborder planning and tax planning costs

Cons of renouncing US citizenship

Of course, there are drawbacks to renouncing US citizenship as well. However, when approaching this section, it’s important to keep in mind your particular circumstances. While we’ve written this to encapsulate a broad range of considerations for all expats, it’s possible that some of the listed drawbacks won’t apply to you. With that in mind, please see below for an overview of the cons of renouncing US citizenship.

You may have to pay an exit tax, depending on if you’re a covered expatriate or non-covered expatriate

On top of the costs mentioned above, certain US expats — called “covered expatriates” — are subject to a pricy exit tax. A covered expatriate is someone who:5

- Has had an average income tax of more than $210,000 over the past five years, OR

- Owns more than $2 million in worldwide assets, OR

- Doesn’t certify that they’ve been tax-compliant over the five years prior to renouncing.

Those who do meet these criteria have an exit tax of 23.8% levied on the fair market value of their combined global assets, excluding the first $821,000. Those who do not meet these criteria are considered non-covered expatriates and are not subject to exit tax.

Note: Being labeled a covered expatriate upon renouncing US citizenship may seriously impact your ability to give gifts to US citizens.6

Ease of entry into the US is dependent on your new passport

After renouncing your citizenship, you will no longer be guaranteed automatic entry into and free movement throughout the US.

Of note here is that citizens of Canada and Bermuda can typically stay in the US for up to 180 days without a visa.7 Additionally, citizens of countries in the Visa Waiver Program can stay for business or tourism purposes for up to 90 days.

⚠️ Proceed with caution:

US expats must ensure that they are a citizen of another country prior to completing the process of renouncing their US citizenship — otherwise, they effectively obtain refugee status. Stateless persons do not have any government protection and often encounter severe global mobility restrictions. Additional hardships include challenges owning or renting property, working, marrying, receiving medical or other benefits, and enrolling in education programs. Essentially, until you are a dual citizen or have the opportunity to obtain citizenship in another country and revoke US citizenship in so doing, renouncing US citizenship is not a viable option. All other passport holders, however, must apply for a visa to enter the US.

Ability to get a job in the US is severely curtailed

When you renounce your citizenship, you give up your right to live and work in the US. If you decide to return to the US, finding a job will become much harder. This is because you will require visa sponsorship from any prospective employer. Given the time and effort that it takes, many companies prefer hiring domestically.

Loss of voting rights in US elections

Those who renounce their citizenship are no longer able to vote in US elections, whether federal, state, or local.

US-sourced income as a non-resident alien is often taxed less favorably

If you choose to move back to the US at some point and live there as a non-resident alien, your US-sourced income will likely be taxed less favorably than it was as a citizen. There are several deductions and expenses that you may not be able to claim to lower your taxable earned income, while passive income is typically classified as Fixed, Determinable, Annual, Periodical (FDAP) Income, which is generally taxed at a flat rate of 30%.8

Associated expenses

Renouncing your citizenship requires a one-time administrative fee of $2,350 (although the US announced plans to to reduce that fee to $450 in the future). Given the complexity and bureaucratic nature of the renunciation process, many US expats also pay for professional assistance from tax and legal experts.

Permanence of the decision to renounce

After successfully renouncing your citizenship, you can rarely get it back. Some of the very few cases in which you may be able to regain citizenship are if you renounced it before you turned 18 or did so while psychologically impaired or under duress.9 In these cases, you would likely need to hire an attorney, and your petition is not guaranteed success.

Other cons associated with renouncing US citizenship

- Inability to pass US citizenship onto your children,

- Loss of access to US consular services abroad, and

- Potential complications associated with US-based properties and investments.

Is renouncing your US citizenship the right choice for you?

Whether it’s worth renouncing US citizenship depends entirely on each expat’s circumstances and motivations.

Renouncing US citizenship may make sense for a US expat who:

- has moved abroad permanently

- has citizenship from a foreign country

- is up to date with their US tax filing but wants to avoid the future hassle

- has no ties or close family in the US.

Whatever your circumstances, it’s always worth consulting a US expat tax specialist who can offer professional advice and a personalized strategy.

Streamlined Filing Procedures

Many expats think renouncing their US citizenship is the best option if they’re behind on their taxes. However, before you can even begin the renunciation process, you must be fully caught up and compliant with your US taxes. So, renouncing is not a way to dodge your obligations — quite the opposite, in fact.

The good news is that expats who are behind with their US tax filing may be able to catch up without facing penalties via the Streamlined Procedure.

- The Different Income Tax Systems Worldwide

- Americans Abroad – Tax Advocacy

- Lawsuit Against State Department – Association of Accidental Americans

- Americans Renounce Citizenship to Escape FATCA

- Tax Inflation Adjustments for Tax Year 2023

- Gifts from a Foreign Person – IRS

- Citizens of Canada and Bermuda

- How US Taxes NRA Income After You Expatriated (Non-US Person)

- Restoring Lost US Citizenship

- Renunciation of US Nationality Abroad

Pros and Cons of Renouncing US Citizenship - FAQ

-

If I renounce my US citizenship, can I get it back?

According to the IRS webpage that discusses renouncing US citizenship abroad, “… those contemplating a renunciation of U.S. citizenship should understand that the act is irrevocable, except as provided in section 351 of the INA (8 U.S.C. 1483), and cannot be canceled or set aside absent a successful administrative review or judicial appeal.” (10)

-

Will my children be American if I renounce US citizenship?

Even if you abandon your US citizenship, your children are American citizens if they acquired US citizenship at birth.

If you have a child after you have completed the renunciation of your US citizenship, then you will not be able to give that child US citizenship. Instead, they will need to obtain it either by birth on US soil or from their other US citizen parent.

Connect on LinkedIn

Connect on LinkedIn