If you’re wondering how to amend a tax return, don’t worry — you’re far from alone. Filing US taxes from abroad can be complex.

It’s not uncommon for US expats to make errors, only to realize it after they’ve already submitted their return. Fortunately, that’s what an amended US individual income return (Form 1040-X) is for.

Below, we’ll go over all of the essentials of filing an amended tax return. Topics covered include when to do so, how to fill out the form, where to send it, and more.

When to file an amended tax return

So how do you know when to file IRS Form 1040-X?

Before diving in, let’s back up and review some context around filing an amended tax return. If you only made a simple mathematical error when calculating tax liability, there may be no need to file an amended return. This is because the IRS automatically can detect and correct simple miscalculations.

That said, it’s extremely important to ensure you pay any additional balance to the IRS to avoid interest and/or penalties. If someone misstates their income or miscalculates tax, not taking action could result in financial consequences.

Ultimately, if you’re unsure about the accuracy of your US tax return, it’s best to have it reviewed by an expert in US expat taxes.

Form 1040-X is primarily filed when you need to provide additional information, change your filing status, or file additional forms.

A few situations in which expats typically file Form 1040-X include when they need to do the following.

Report additional or amend existing income

A return should be amended if you incorrectly reported your income. All US citizens and permanent residents must report their global income to the IRS. This applies regardless of income type (i.e. earned or unearned) or where in the world it comes from. So even if you, say, earn rental income from a property that you own in France, you must include that on your tax return.

File or correct additional forms

Filing taxes in the US often involves more than just the main Form 1040, particularly for US expats.

US expats with a foreign business registered abroad, for example, may need to file Form 5471. Meanwhile, those residing abroad with foreign financial assets valued at over $200,000 on the last day of the tax year — or over $300,000 at any point in the tax year — must declare them on Form 8938.

Neglecting to file required forms in your initial tax return is grounds to file an amended one. Similarly, submitting one of these forms with incorrect or outdated information necessitates an amended filing as well.

Some forms can attract high penalties for omission. Therefore, you may want to explore submitting an amended return under a procedure such as the Streamlined Procedure or the Delinquent International Information Return Procedures.

Claim or amend additional credits or deductions

If it comes to your attention that you could have filed a previous tax return in a more tax-efficient manner, you can submit an amended return. You will want to ensure that you submit the appropriate supporting documentation to support your amended return.

Expat parents, for example, sometimes don’t realize that they’re eligible for the refundable Child Tax Credit. Fortunately, the process to correct this oversight and retroactively claim the CTC is relatively straightforward. It involves filing:

- Form 1040-X with information about their minor child (or children)

- Schedule 8812, which allows them to claim up to $1,600 per qualifying child for the 2023 tax year.

On the other hand, if you mistakenly claimed a tax break that you weren’t eligible for on your tax return, you can file an amended tax return to rescind the claim.

Change filing status

Form 1040-X can also be used to update your filing status. Newlywed US expat couples, for example, may not realize the significant tax benefits associated with filing jointly as a married couple. (This applies as long as they are married on the last day of the tax year.)

A note on the amended form verbiage:

Although the title of Form 1040-X is the Amended US Individual Income Tax Return, “individual” is not synonymous with the “single” filing status. Those who are married filing jointly, married filing separately, heads of household, or qualifying widows/widowers can file it as well, as long as they check the appropriate filing status (more on that later). However, you cannot amend a return that was filed “Married Filing Jointly” to be filed as “Married Filing Single.”

Pay additional tax

If there was any reason you underpaid your tax bill (besides a simple mathematical error, as mentioned earlier), filing an amended tax return may allow you to correct the issue and avoid interest, fines, or other penalties.

Of note:

A common filing requirement that often dogs expats is the FBAR. However, catching up on this administrative filing requirement is not done via Form 1040-X, but via the Delinquent FBAR Streamlined Procedures.

How long do you have to amend a tax return?

The typical due date to amend a federal tax return is within three years of filing your original return, or within two years of paying the corresponding tax — whichever is later. This period of time where your return remains open for amendment is referred to as the statute of limitations.

That being said, we recommend amending a tax return as soon as you realize it’s necessary. You don’t want to forget to file or rush through it as you approach the deadline.

How long does it take to amend a tax return?

As many things US tax-related, the answer is that it varies. Form 1040-X is only a couple of pages long. However, gathering additional documentation, verifying the accuracy of your information, and updating all of the other pages of your tax return all add time to the process.

Once you’ve submitted your return, the government takes some time to process it as well, typically about 16 weeks. So again, the sooner you get started, the better.

How to file an amended tax return: Turbotax and DIY tax-filing software challenges for expats

DIY tax filing software is often the go-to method for US taxpayers. However, free or inexpensive tax software doesn’t tend to account for nuances or include expert review. So, in complicated circumstances, you’re usually better off consulting a US expat tax professional.

⚠️ Record-keeping is essential:

Filing an amended return may result in an audit, so it’s important (as always) to retain documented proof of any material changes made.

Form 1040-X Instructions

So, how do you fill out Form 1040-X, exactly? Let’s walk through it step-by-step from top to bottom.

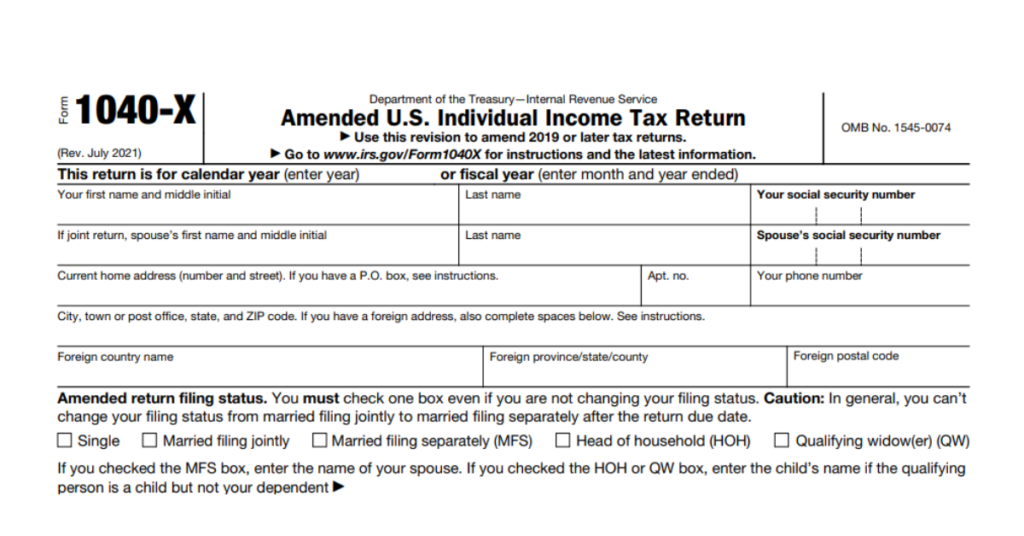

Basic details

In the first field, state the calendar or fiscal year of the return you’re amending. Note that expats filing amended returns for multiple years must file a separate Form 1040-X for each year they wish to amend.

In the fields below, you’ll fill in personal information like your name, address, Social Security Number, etc.

In the section labeled “Amended return filing status,” check the box of the filing status that applies to you (even if it isn’t different from what you included in the original return).

Lines 1-23

The next portion of the form contains 23 different lines broken into four different sections: “Your Income and Deductions,” “Tax Liability,” “Payments,” and “Refund or Amount You Owe.” Note that for each line, you must enter figures in three separate columns.

The figures from your original tax return go in column A; the updated, correct figures go in column C; and the difference between the two goes in column B. Even if these numbers haven’t changed since your original return, you must enter figures in all three columns for each line.

Part I: Dependents

In this section, which comprises lines 24-30, you’ll disclose details on which dependents you have (if any) and what kind of dependents they are. In lines 24-29, you’ll indicate the number of dependents you have across several different categories.

Note that this section has three separate columns as well. The number of dependents you entered in your original return goes in column A; the updated, correct number of dependents goes in column C; and the difference between the two goes in column B.

Under line 30, you will share your dependents’ first and last name, social security number, and relationship with you, and indicate whether they qualify for the Child Tax Credit or Credit for Other Dependents.

Note that those with more than four dependents will need to check the box on the left and attach an additional statement containing their information.

Part II: Presidential Election Campaign Fund

Indicate whether or not you or your spouse now want to contribute $3 to the Presidential Election Campaign Fund for the year your return was originally filed.

Part III: Explanation of Changes

Use this section to share why you’re filing a 1040-X and give a high-level overview of the changes you’re making. Make sure to attach any supporting documents, the complete revised tax return, and additional or updated forms or schedules to corroborate your statement.

Signature & Paid Preparer Details

In the “Sign Here,” section, make sure to sign and date the document as well as enter your occupation. If you will be filing jointly as a married couple, your spouse will need to fill out this information as well. It may seem like nothing more than a formality, but the form will not be processed if you leave it blank, so double-check to make sure that you’ve properly completed it.

You can, however, leave the section labeled “Paid Preparer Use Only” blank. Only tax preparation specialists you’ve hired to assist you need to fill it out.

Where to mail 1040-X

Americans living in another country should address Form 1040-X to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

1040-X electronic filing

For many years, those filing amended returns had no choice but to submit them via snail mail. In August 2020, however, the IRS announced that 1040-X forms amending returns from 2019 or later could be filed electronically. That said, as we mentioned earlier, attempting to DIY your amended tax return with tax filing software may not be the best fit in complex situations like filing an amended return.

We encourage expats to consider partnering with an expert in US expat taxes to ensure your electronically filed tax return is correct and to your best advantage.

How to check on an amended tax return

Within three weeks of filing Form 1040-X, you should be able to check the status of your amended return using the IRS’s online tracker.

Catching up with historical tax returns

Note that amending a tax return is not the same as catching up on past tax returns. Amending a return specifically refers to correcting a return you have already submitted, while catching up on historical tax returns refers to filing outstanding tax returns for the first time.

Fortunately, there is a way to catch up on past-due tax returns without additional penalties or fines called the Streamlined Filing Compliance Procedures. As with filing an amended tax return, you can file the Streamlined Filing Compliance Procedures on your own, but many expats choose to hire a professional tax preparer instead to lighten the load, verify accuracy, and ensure a sound tax strategy.

References

- Newlyweds: 6 Money-Saving Tips for Filing Your Tax Return

- Where’s My Amended Return?

- Where to File Addresses for Taxpayers and Tax Professionals Filing Form 1040-X

- Now available: IRS Form 1040-X electronic filing

IRS Form 1040-X for Expats - FAQ

-

How easy is it to amend a tax return?

Filling out the amended tax return form isn’t necessarily very difficult in itself, but it can be challenging to gather the necessary documentation, verify its accuracy, and ensure that you’re leveraging the right tax strategy. Because of this, it’s often a good idea to consult a tax professional when amending a tax return rather than trying to tackle it manually or with DIY tax software.

-

How long can you wait to amend a tax return?

You generally have a maximum of three years after the date you filed the original return, or two years after you paid the corresponding tax bill (whichever is later), to submit an amended tax return. However, you should get started as soon as you realize you’ve made an error, as it can take some time to amend a return in the most accurate, tax-advantageous way possible.

Connect on LinkedIn

Connect on LinkedIn