For US expats living in the UK, the phrase “capital gains taxes” is likely familiar. Just like in the US, capital gains taxes in the UK are levied on the proceeds arising from the sale of certain assets. This includes, in some cases, residential property.

Of course, the specific ways that capital gains taxes on the sale of residential property function differ slightly in each country. This makes it important for Americans residing in the UK who plan on selling residential property to read up on the corresponding tax implications.

The rules regarding UK capital gains taxes on residential property disposals can be complex. But, that’s what we’re here for! Below, we dig into who pays the UK capital gains tax on residential property disposals, what the rates are, how to mitigate the costs, and more.

Key Updates for 2025:

- The Capital Gains Tax (CGT) annual exemption has been reduced to £3,000 for the 2025/26 tax year.

- The rates of CGT that apply to residential property disposals remain at 18% for basic rate taxpayers and 24% for higher rate taxpayers.

- From 6 April 2025, the CGT rate for Business Asset Disposal Relief and Investors’ Relief has increased to 14%, with a further increase to 18% scheduled for 6 April 2026.

Understanding British tax terminology: What is the meaning of property disposal?

First things first, let’s clarify what exactly “property disposal” means. Essentially, it refers to the process of transferring control or ownership of a property from one owner to another. This transfer may occur as a transaction or arrangement.

Most often, it occurs through a sale. However, property disposal could also be done through a transfer, gift, trade, or by receiving compensation for it. An example of the latter would be receiving an insurance payout for your home after being destroyed by a fire.1

Who pays capital gains tax (CGT) in the UK?

Generally, you will be subject to capital gains taxes on residential property disposals if you meet the following criteria:

- The property is located in the UK or you are a UK resident (or were a temporary non-resident and later returned)2

- The property has appreciated in value since you first acquired it, to the point where the gains of the disposal exceeded the personal capital gains tax allowance for the year in which you sold it3 (£6,000 per person for the 2023-2024 tax year)4

- The property has not been your main residence throughout the period of ownership.

Take note:

You may be required to report UK property disposals to HMRC.

If you are resident at the date you sell a UK property, you will be required to complete an online property return to report the disposal to HMRC, if you need to pay capital gains tax.

If you are non-resident on the date you sell the UK property, you will be required to complete an online property return to report the disposal to HMRC. This requirement is irrespective of whether capital gains tax is payable or not.

You must report the disposal and pay the capital gains tax within 60 days of the completion date.

CGT rates on residential property in the UK

Capital gains tax rates levied on residential property gains are progressive and depend on your level of income.

The first £6,000 of gain will be exempt from CGT. However, this will be reduced to £3,000 in the 2024/25 tax year.

If your income levels are above £50,270, the gain less the exemption will be taxed at 28%.

If your income levels are below £50,270, the gain less the exemption will be taxed at 18% up to £50,270. Any gain in excess of £50,270 will be taxed at 28%.

Note: if the asset you dispose of is owned jointly with someone else, you will only pay CGT on your portion of the gain.5

How is the CGT on UK property calculated?

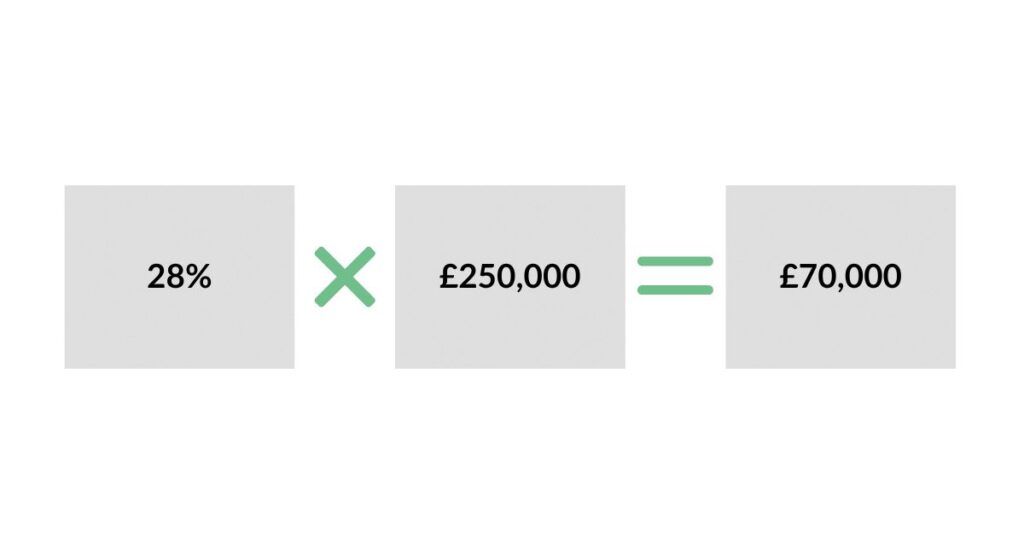

Capital gains taxes on UK property are calculated by multiplying the capital gains tax rate you qualify for by the profit you made from disposing of the property. Review the following graphic to understand where to enter which numbers to figure out the total CGT bill.

Let’s say, for example, that you earn £85,000 per year, putting you into the higher rate income band. This would require you to pay a 28% rate in capital gains taxes. Imagine that you purchased an apartment for £250,000 in 2010. In 2023, you sold it for £500,000 for a profit of £250,000. In this scenario, you would end up paying £70,00 in capital gains taxes.

As you can see above, capital gains taxes can take a pretty significant bite out of your earnings. Fortunately, you can employ a few strategies to help reduce the amount you’ll end up paying in taxes.

Annual allowance

As we mentioned earlier, everyone can claim an annual capital gains tax allowance. While it’s £6,000 for the 2023-2024 tax year, this will be cut to £3,000 beginning in 2024.

Spousal transfers

Properties gifted to your husband, wife, or civil partner are typically capital gains tax-free.6 This can be particularly beneficial if your spouse or partner has a lower income than you. The reason for this is that they may qualify for a lower capital gains tax rate.

There may be inheritance tax implications for gifts between a UK citizen and a US citizen and therefore, tax advice should be sought before making the gift.

Emma McDermott, Founder & CEO of Global Tax Consulting

Charitable gifts

Similarly, properties that are gifted to charities are typically not subject to taxation. This makes gifting property to a charity a strategic option. By so doing, an owner would in turn be able to claim part of that donation as a tax deduction.

Principle Private Residence relief

Providing that the property has been your main residence and has been physically occupied at some point during ownership, private residence relief will be available which will reduce the taxable gain.

In effect, if the property has been your main residence and physically occupied throughout the full period of ownership, private residence relief will reduce the gain to nil. Therefore, no capital gains tax will be payable.

There is an additional provision. Providing that the property has been your main residence and physically occupied at some point during ownership, the last nine months of ownership always qualify for private residence relief under the deemed occupation rules.

To provide some context, imagine you are planning to move to the UK from the US. If you currently own a family home in the US that has been your primary residence and occupied by you until the moment you relocate to the UK, there’s good news for you. As long as you manage to sell the property within nine months of your relocation, you won’t have to be concerned about UK capital gains tax. This exemption occurs because of private residence relief, which applies whether the occupation is physical or deemed, and effectively reduces the gain from the sale to zero.

Deemed occupation

Certain periods of absence can be treated as occupation, providing that the period of absence is preceded and followed by a period of physical/actual occupation. The three periods of absence that will qualify, are as follows:

- Absences of up to three years for any reason

- Absences where you were living and working overseas

- Absences of up to four years where you were either a) required by your employer to live somewhere else or b) worked too far from your property to live there.

Pro tip:

The rules for PPR and deemed occupation can get complicated, so when in doubt, consult with a UK tax professional.

How residency status can affect how much you pay on a UK property sale

As mentioned earlier, capital gains taxes related to residential property disposals are typically levied on a) UK residents and b) those who dispose of UK-based properties. This applies whether or not they’re UK residents.

If you are a non-resident and dispose of a UK property, only the gain from 6 April 2015 is taxable. There are various methods to calculate the gain as a non-resident. However, typically, your base cost (acquisition cost) is rebased to the value of the property on 6 April 2015.

How this tax is calculated (and the most beneficial method for you) will depend largely on your circumstances.

References

- Capital Gains Tax – HMRC

- Capital Gains Tax for Individuals Not-Residents in the UK

- Who Pays Capital Gains Tax?

- Capital Gains Tax Rates and Allowances – HMRC

- CGT Relief Allowances and Exemptions

- Capital Gains Tax – What you pay it on, rates and allowances – HMRC

Frequently Asked Questions

-

Do I need to report the sale of my UK property to HMRC if I’m a non-resident?

Yes. Non-residents must report UK property disposals to HMRC within 60 days of completion, even if no CGT is owed. This applies whether you’re a UK resident or not at the time of sale.

-

What is the Capital Gains Tax (CGT) exemption for 2025?

For the 2025/26 tax year, the annual CGT exemption is £3,000 per person — down from £6,000 in 2023/24. If you jointly own a property, both parties may claim the exemption.

-

What are the current CGT rates on residential property in the UK?

For 2025:

-

18% for basic rate taxpayers (annual income below £50,270)

-

24% for higher rate taxpayers (income above £50,270)

These rates apply to gains after deducting the exemption.

-

-

If I lived in the property, do I still owe capital gains tax?

Possibly not. If the property was your main residence and was physically occupied, you may qualify for Private Residence Relief, which can reduce or eliminate the CGT owed.

-

What if I lived abroad for part of the ownership period?

Some absences may still qualify as “deemed occupation,” including:

-

Up to 3 years for any reason

-

Time spent working abroad

-

Up to 4 years due to employment in another location

These periods won’t count against you if they’re bookended by actual occupation.

-

-

What if I sell a UK property but I’m no longer a UK tax resident?

You’ll only be taxed on gains accrued since 6 April 2015, and there are multiple calculation methods. The best approach depends on your circumstances, so professional advice is recommended.

-

Can I transfer property to my spouse to reduce CGT?

Yes, transfers between spouses or civil partners are generally CGT-free. This strategy is often used to allocate gains to the lower-income spouse, potentially lowering the CGT rate.

-

How can I reduce my CGT liability?

Besides the annual exemption and spousal transfers, strategies include:

-

Timing the sale to qualify for Private Residence Relief

-

Donating property to charity

-

Offsetting eligible expenses (legal fees, broker fees, improvements)

-

-

Do I also need to report the property sale to the US?

Yes. As a US citizen, you must report the property sale on your US tax return, even if you’ve already paid CGT in the UK. You may be able to claim the Foreign Tax Credit to offset some or all of the US liability.

Connect on LinkedIn

Connect on LinkedIn