First things first – US citizens living abroad must file a tax return and declare their worldwide income. That’s because the United States is one of the only countries that apply citizenship-based taxation, which leaves many expats wondering if they’ll have to pay taxes twice on the same income. Thankfully, the Foreign Earned Income Exclusion […]

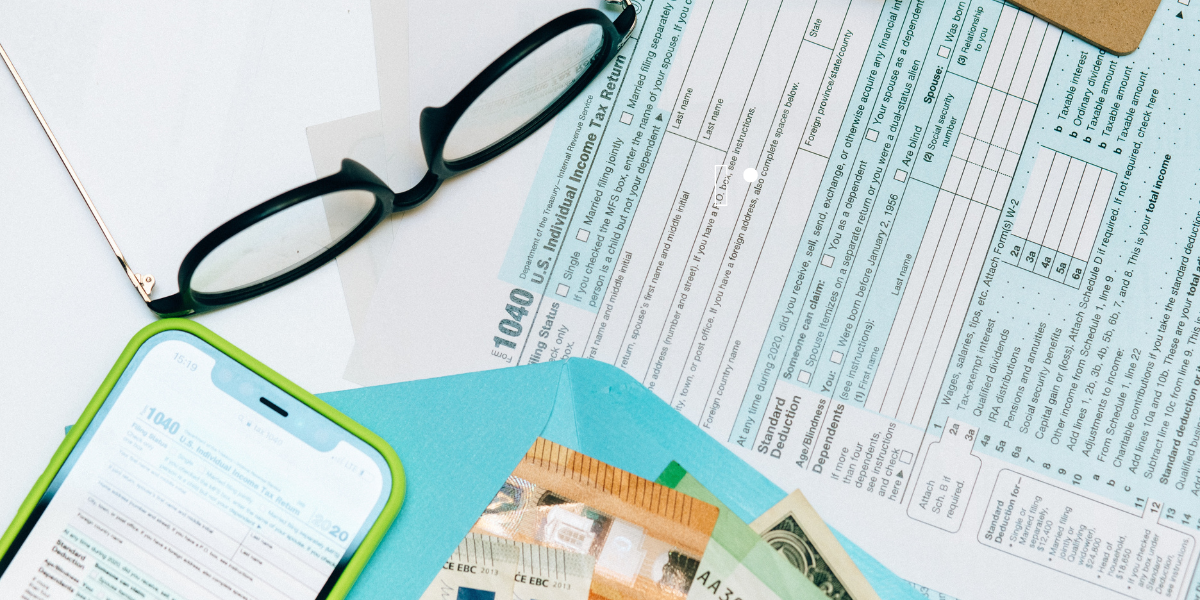

How to Complete Form 1040 With Foreign Earned Income (A Step-By-Step Guide!)

10/06/2025