You may already know that Americans who own rental property in the United States can claim depreciation to reduce their tax liability. What you may not realize, though, is that US expats can also claim depreciation on rental property based abroad. While foreign rental property depreciation has some unique nuances, we’re here to walk you through taking advantage of the deduction step by step.

Read on to learn what exactly foreign rental property depreciation is, how it can reduce your tax liability, what you need to do in order to claim it, and more.

What is foreign rental property depreciation?

Before we go into foreign rental property depreciation in particular, let’s start by defining depreciation in general.

The longer you own certain items — like a car, laptop, or for the purposes of this article, rental property — the more maintenance they require. Often, this is due to ordinary wear and tear. Almost inevitably, a car’s tires will wear down, a laptop will slow to a crawl, and a building will require a new roof.

The Internal Revenue Service (IRS) allows those who own properties for the explicit purpose of renting to offset the costs associated with that building through depreciation. When claiming depreciation on a rental property, you spread the cost of the building over its useful life to account for the aforementioned wear and tear.

This can help you recover some of the lost value and offset the cost of maintenance.

How to calculate depreciation

The framework for calculating depreciation for US tax purposes is called the Modified Accelerated Cost Recovery System, or MACRS. The MACRS offers two different ways to calculate depreciation:

Domestic rental properties: General Depreciation System (GDS)

The standard depreciation method is called the General Depreciation System, or GDS. Note that when it comes to calculating rental property depreciation, you will only use the GDS for properties based in the US.

When calculating depreciation for rental properties based in the USGDS applies a straight-line depreciation method, evenly spreading the depreciation over the property’s useful life of 27.5 years for residential properties.

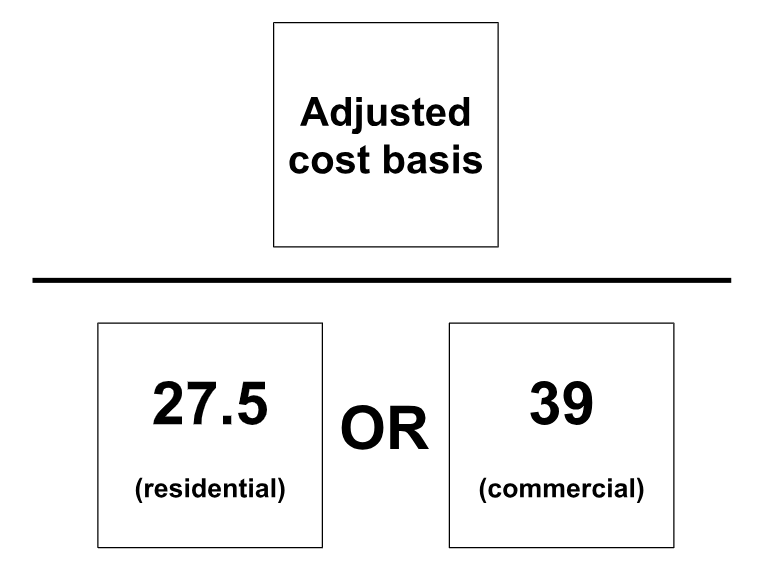

To calculate depreciation, you’ll first look at the adjusted cost basis (ACB): the cost of the building (excluding land) plus certain acquisition costs and capital improvements.

Some eligible acquisition costs may include:

- Title insurance

- Survey fees

- Appraisal fees

- Legal & attorney fees

- Transfer taxes

- Real estate broker’s commissions

- Engineering fees

- Inspection fees

- Improvements required to bring a building up to use (e.g. repairs necessary to satisfy safety codes or zoning requirements)

Capital improvements, on the other hand, refer to repairs or improvements that increase the value or useful life of a property (e.g. remodels done for aesthetic purposes).

Note:

Capital improvements depreciate over time separately, if they are distinct from the original property at the time of purchase. We’ll go into more detail on this later.

After you calculate ACB, you’ll divide it by the property’s useful life, which depends on the property’s purpose:

- 27.5 years for domestic residential properties

- 39 years for domestic commercial properties

The depreciation formula for rental property located within the US is as follows:

Note:

A rule called the half-year convention stipulates that property owners must halve their annual allowable deduction for the first and last year that the property is in service. In some situations, mid-quarter or mid-month conventions may even kick in.

Example: In 2024, Celia — a US expat living in Singapore — began renting out a single-family home she bought in her hometown of San Antonio, Texas for $300,000 in 2023. The portion of the property attributed to the building’s value was $240,000, and the land value was $6000. Her other acquisition costs totaled $10,000, bringing her ACB to $250,000.

Because the rental property is residential, it has a 27.5 year useful life. Celia divides her $250,000 ACB by 27.5 years to calculate her annual depreciation deduction. For every whole year that the property is rented out, Celia can deduct about $9,091.

Note:

When calculating depreciation, you generally round up to the nearest dollar.

Due to the half-year convention, Celia can only deduct $4,546 during the first year the rental property was in service in 2024 and the last year it is in service (2051 by the latest).

Foreign rental properties: Alternative Depreciation System (ADS)

Foreign rental properties, on the other hand, will always use the Alternative Depreciation System (ADS) to calculate depreciation.

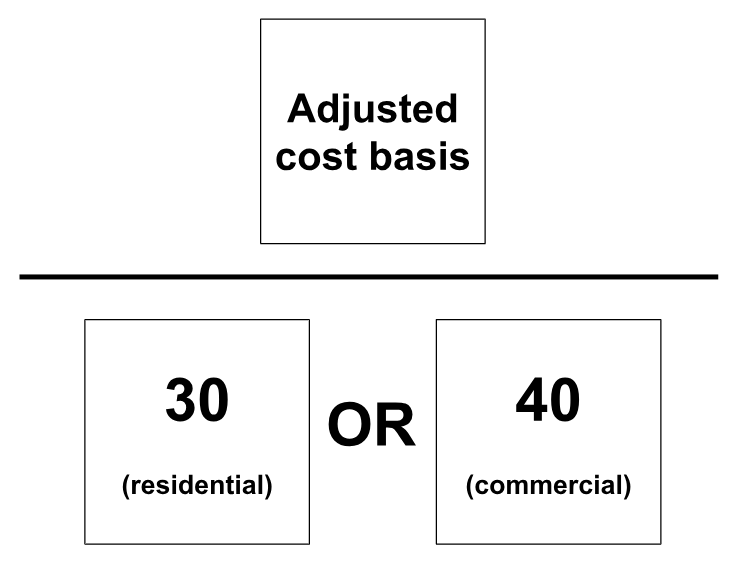

Like the GDS, the ADS uses a straight-line method to calculate depreciation for a foreign rental property evenly over its useful life. Under the ADS, however, foreign rental properties have longer useful lives than domestic rental properties do under the GDS:

- 30 years for foreign residential properties

- 40 years for foreign commercial properties

As a result of their longer useful lives, depreciation deductions for foreign rental properties are slightly smaller than they are for domestic rental properties. The depreciation formula for owners of rental property located outside of the US is as follows:

Tip:

When calculating the ACB for a foreign property, you must always convert the value into USD taking the historical change rate into account.

Example: Ju-won is a US expat living in Canada who has been renting out a 1-bedroom apartment in suburban Toronto since late 2020. When he first purchased the property on May 8th, 2020, the value of the building was $800,000 CAD (equal to about $572,614 USD at the time), while his acquisition costs totaled $50,000 CAD (~$35,788 USD). In total, his ACB was $850,000 CAD (~$608,402 USD).

After dividing the ACB by the foreign residential rental property’s 30-year useful life, Ju-won’s annual depreciation deduction is $20,280 USD.

Note:

The half-year convention also applies to foreign rental properties. As such, Ju-won can only deduct $10,140 during the first year and last year the rental property is in service (2050 at the latest).

Additional factors to take into account

Capital improvements

As we mentioned earlier, while you can claim depreciation on capital improvements, they depreciate separately.

Example: Let’s say Ju-won renovated the kitchen and bathroom of his Toronto property in April 2023 for $50,000 CAD (~$37,120 USD). Ju-won must depreciate them over a separate 30-year useful life at a rate of about $1,237 USD ($37,120÷30) per year.

The half-year convention would apply for the first and last years of the renovations’ useful life as well. As such, Ju-won would only claim about $619 USD for the renovations in the first year of the renovations’ useful life (2023) and the last (2053).

The value of the renovations will also be included in the property’s ACB if Ju-won sells the property, which will be relevant for calculating depreciation recapture and the capital gain on the sale.

Depreciation recapture

Upon selling a rental property, the IRS may tax you on a portion of the depreciation you have previously claimed. This depreciation recapture happens when the sales proceeds exceed the ACB.

In such cases, the IRS taxes you on a portion of the gain attributable to the depreciation taken or allowed at your ordinary income tax rate or 25% (whichever’s smaller). The remaining gain is taxed according to standard capital gains rates.

This essentially reduces the property’s ACB by the total depreciation claimed up to that point and ultimately, increases the sale’s taxable gain.

Example: Let’s say Ju-won sells his Toronto property in January 2030 for $1,700,000 CAD (~$1,224,000 USD according to projected exchange rates). By that time, Ju-won has claimed $189,945 USD in total depreciation: $182,521 USD for the building, and $7,424 USD for the renovations.

To get his ACB, he must:

- Take the initial investment he made in his property (~$608,402 USD)

- Add the value of the capital improvements (~$37,120 USD)

- Subtract the value he claimed in depreciation (~$189,945 USD)

In total, his ACB is $455,577 USD ($608,402 + $37,120 – $189,945). Since the sales proceeds (~$1,224,000 USD) exceed the ACB, Ju-won will be subject to depreciation recapture. Assuming the top rate of 25%, Ju-won must pay $47,486 USD ($189,945 x .25) in depreciation recapture.

The total gain is equal to the sales price ($1,224,000 USD) minus the ACB ($455,577 USD), or $768,423 USD. After subtracting the amount depreciated ($189,945 USD), the remaining gain is $578,478 USD. Assuming a top capital gains tax rate of 20%, Ju-won must pay about $115,696 USD in capital gains taxes.

In total, the tax implication of this sale would be $163,182 USD: $47,486 in depreciation recapture, and $115,696 in capital gains taxes.

Reporting foreign rental income & depreciation

There are two forms US expats who rent out foreign real estate must typically file along with their US tax return:

- Form 4562: For calculating depreciation & amortization

- Schedule E (Form 1040): For reporting rental income & claiming expenses related to rental properties

Form 4562 is a two-page form consisting of six parts:

- Part I – Election To Expense Certain Property Under Section 179: For deducting the cost of qualifying business property (e.g. laptops, machinery, office furniture) immediately instead of recovering the costs over time through depreciation

- Part II – Special Depreciation Allowance & Other Depreciation: For claiming bonus depreciation on certain types of qualified property and reporting depreciation on business assets that don’t fall under Section 179

- Part III – MACRS Depreciation: For calculating annual allowable depreciation according to the GDS or ADS

- Part IV – Summary: For summarizing the information in Parts I – III and totaling allowable depreciation and expenses

- Part V – Listed Property: For claiming depreciation and expenses for listed property, or assets used for both business and personal purposes (e.g. cars, laptops, etc.)

- Part VI – Amortization: For claiming amortization, which is essentially, depreciation for intangible assets (e.g. patents, copyrights, trademarks, etc.)

Schedule E is a two-page form consisting of five parts:

- Part I – Income or Loss From Rental Real Estate & Royalties: For sharing information on your property, reporting income, claiming expenses (including depreciation), and calculating net income or losses

- Part II – Income or Loss From Partnerships & S Corporations: For sharing details on any partnerships or S corporations you hold interest in and reporting income, claiming expenses, and calculating the total income or loss associated with them

- Part III – Income or Loss From Estates & Trusts: For sharing details on any estates or trusts you hold interest in and calculating the total income or loss associated with them

- Part IV – Income or Loss From Real Estate Mortgage Investment Conduits (REMICs)—Residual Holder: For residual interest holders of a niche investment called REMICs to share details on their investments and report their income or loss

- Part V – Summary: For totaling your income and loss among all of the previous sections

Other ways to reduce taxes associated with foreign rental property

A few other ways to mitigate foreign rental taxes might include:

Deducting expenses

The IRS allows property owners to deduct a variety of expenses associated with owning and maintaining property, including:

- Mortgage interest

- Property taxes, including foreign property taxes

- Insurance premiums, including homeowner’s insurance and landlord liability insurance

- Repairs, such as fixing a leaky faucet, replacing the roof, and retrofitting the foundation

- Maintenance, such as repainting, landscaping, and cleaning the gutters

- Utilities, such as water, gas, and electric bills

- Professional services, such as accounting, property management, and legal services

- Advertising, such as placing an ad in a newspaper or on a real estate website

- Travel expenses, such as mileage or other travel costs directly related to managing or maintaining the property

- HOA fees, or other fees associated with communal property upkeep and services

- Cleaning/maintenance supplies, such as paint, tools, and cleaning products

- Tenant screening costs, such as background checks and credit reports

- Losses due to casualty, like damage due to a storm, fire, or natural disaster not covered by insurance

Make sure to carefully track your expenses on an ongoing basis and keep receipts and invoices for at least three years in case of an audit. Accounting software or property management software may make recordkeeping easier.

Claiming the Foreign Tax Credit (FTC)

All US citizens and permanent residents who earn above a certain threshold must report (and potentially pay taxes on) their worldwide income. When they rent out foreign property, they typically also face taxation in the country in which the property is located. As such, they run the risk of paying taxes on the same income to two different countries.

To help US expats avoid double taxation, the IRS offers them a couple of dedicated tax breaks. One of these is the Foreign Tax Credit (FTC), which gives Americans dollar-for-dollar US tax credits for any foreign income taxes they pay — including taxes on rental income. Essentially, this allows you to subtract your foreign income tax bill from your US income tax bill.

In foreign countries with higher tax rates than the US, the FTC often not only erases your US tax liability, but also gives you surplus credits to use in the future. To qualify for the FTC, taxes must be legal, paid, based on income, and charged in your name. You can claim the FTC by filing Form 1116.

Looking into income tax treaties

The US has income tax treaties with dozens of countries around the world. These agreements aim to eliminate the risk of double taxation, at least in theory. Unfortunately, almost all of these agreements contain saving clauses, which reserve (or “save”) the US government’s right to tax you as if the treaty didn’t exist.

The good news? Almost every treaty with a savings clause carves out exceptions to the savings clause. The US/UK tax treaty, for example, contains a provision for retirees that survives the savings clause. It allows Americans living in the UK to make a one-time, tax-free lump-sum withdrawal of up to 25% on pensions worth up to £1,073,100 (~$1,367,666).

If your country of residence has signed a US income tax treaty, it’s worth seeing whether it contains any provisions that could reduce your rental property tax liability. To claim the benefits of a tax treaty, you must file Form 8833.

Get expert help with foreign rental depreciation & beyond

Depreciation is one of the most valuable tax deducations foreign rental property owners have at their disposal. To calculate it, you’ll divide your adjusted cost basis by the property’s useful life — which for foreign properties, is either 30 years (residential) or 40 years (commercial). To claim depreciation, you’ll need to complete Form 4562 and Schedule E (Form 1040).

Pairing foreign rental property depreciation with other strategies, such as maximizing deductions, claiming the FTC, and leveraging income tax treaties may reduce your tax liability even further.

Before taking any of these steps yourself, though, it’s best to consult a US expat tax professional. Depreciation calculations can be complex, and certain tax optimization strategies can be more beneficial in some situations than others.

Resources:

- Depreciation: Definition and Types, With Calculation Examples

- Modified Accelerated Cost Recovery System (MACRS): Explanation and Types

- General Depreciation System (GDS): What it is, How it Works

- Home Purchase Costs You Can’t Deduct or Add to Tax Basis

- Depreciation & recapture 4

- MACRS – Half-year convention

- What Is Depreciation Recapture?

- 2023 Form 4562

FAQs

-

What happens if I don’t claim depreciation?

While claiming depreciation on rental properties isn’t mandatory, it is highly beneficial in reducing your tax liability. Failing to claim depreciation on a foreign rental property means you’re essentially leaving money on the table.

-

Can I deduct foreign rental property expenses even if the property shows a loss?

Yes! In fact, deducting expenses becomes especially important in this case, as you don’t have net income to offset the expenses.

-

Can I claim depreciation for a property I use partially for personal use?

Yes, you can still claim depreciation on properties that you use partially for personal use — but only for the time the property was in service as a rental property. Personal use days are excluded from the depreciation calculation. Schedule E (Form 1040) provides instructions for calculating and reporting depreciation for mixed-use properties.

Connect on LinkedIn

Connect on LinkedIn