What if we told you there was a three-page tax form that could potentially save you tens of thousands of dollars on your US tax bill? While it may sound too good to be true, it’s not. Qualifying expats can use IRS Form 2555 to claim a couple of major tax breaks, allowing them to reduce their tax bill by up to $24,000.

While this form may seem complex, we’re here to walk you through it every step of the way. Read on below to learn who can benefit from Form 2555, how to complete it, when to submit it, and more.

What is IRS Form 2555?

IRS Form 2555: Foreign Earned Income is the tax form you must fill out to claim several major expat tax breaks, including the:

Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion (FEIE) is one of the most important tax breaks for Americans living abroad. It allows qualifying expats to exclude a certain amount of their foreign earned income from federal income taxes. For tax year 2024 — the taxes you’ll file in 2025 — expats can exclude up to $126,500 from taxation.

The FEIE limit increases slightly each year to account for inflation. In tax year 2025, for example, you can exclude up to $130,000 under the FEIE.

Keep in mind that the FEIE applies only to active income (e.g. salary, wages, tips, commissions, bonuses) earned abroad. It does not extend to passive income (e.g. dividends, interest, capital gains).

The FEIE also doesn’t exclude eligible income from all taxation — just from US income taxes (aka the tax rates from 10% to 37% that the US government levies on ordinary earned income).

For example, you can’t avoid paying US Social Security taxes through the FEIE. You may, however, be able to avoid paying US Social Security taxes if a) you pay Social Security taxes in your country of residence and b) your country of residence has signed a US totalization agreement.

To qualify for the FEIE, you must:

- Be a US citizen or permanent resident

- Have foreign earned income

- Meet at least one of two tests:

- The Physical Presence Test requires you to be physically present in a foreign country or countries for 330 full days — consecutive or not — in a 365-day period overlapping the tax year

- The Bona Fide Residence Test requires you to have been an official resident of a foreign country or countries for an uninterrupted period that includes at least an entire tax year.

- Note: Those living abroad for a temporary work assignment generally do not qualify for the Bona Fide Residence Test

Meeting either the Physical Presence Test or Bona Fide Residence Test will also qualify you for the Foreign Housing Exclusion (FHE) and the Foreign Housing Deduction (FHD).

Note:

The FEIE may not be right for everyone. In some tax situations — such as if you live and work in a high-tax country, or if a large amount of your worldwide income is passive — it may be a better idea to claim the Foreign Tax Credit (FTC). Other times, you may be able to claim the benefits of an income tax treaty. Before making a decision, consult a licensed tax professional.

Foreign Housing Exclusion (FHE)

The FHE allows US expats to exclude a portion of their foreign earned income based on their qualifying foreign housing costs. The FHE is available on top of the FEIE, allowing expats who earn above the FEIE limit to further reduce their taxable income.

A few common foreign housing expenses that qualify for the FHE include:

- Rent

- Utilities

- Necessary repairs

- Property & renters’ insurance

- Occupancy taxes

- Residential parking

- Furniture & accessory rental

However, the FHE doesn’t cover all foreign housing costs. A few notably excluded items are lavish or extravagant expenses, most costs associated with owning or purchasing property, unnecessary improvements (e.g. remodeling done for aesthetic purposes), and housekeeping expenses.

Note that only US expats working for an employer (domestic or foreign) can claim the FHE.

Foreign Housing Deduction (FHD)

Fortunately, self-employed US expats have a similar tax break to the FHE available to them: the FHD.

The main difference between the FHD and the FHE is that the FHD is a deduction, while the FHE is an exclusion. Exclusions allow you to exclude a portion of your income from taxation, while deductions allow you to deduct a portion of income from your overall taxable income. As such, the FHE and FHD are calculated slightly differently.

IRS Form 2555 instructions, step-by-step

With that preface out of the way, let’s dive right into how to complete IRS tax Form 2555.

Up top, you’ll simply enter your name and Social Security Number (SSN).

Part I: General Information

In Part I, you’ll enter basic information like your address, occupation, employer, tax home, and whether or not you have filed Form 2555 in the past.

Part II: Taxpayers Qualifying Under Bona Fide Residence Test

Note that Part II is only for US expats who qualify for the FEIE through the Bona Fide Residence Test. If you qualified under the Physical Presence Test, skip this section and go to Part III.

Important: Whether you fill out Part II or Part III, you must fill out all of the required information. If it doesn’t apply to you, enter “N/A.” Leaving any items blank may result in the denial of your claim.

For lines 10-13b, you’ll answer some simple questions such as:

- When your bona fide residence began (typically, the day you moved to the country with the intention of making it your primary residence) and, if relevant, ended

- What type of home you live in

- Whether your family lives with you

- Whether you must pay income tax in your country of residence

If you were present in the US for any part of the year, you must complete columns (a) through (d) in line 14 detailing when you arrived, when you left, how many days you were there for business purposes, and how much income (if any) you earned as a result.

In line 15, you’ll respond to some additional questions about your employment details, your visa, whether you maintained a home in the US while abroad, and if so, what you did with it.

Note:

While you don’t have to attach proof of your bona fide residence to Form 2555, it’s helpful to have some on hand in the event of an audit. Residence permits, foreign income tax returns, and housing contracts can all help back up your claim of bona fide residence.

Part III: Taxpayers Qualifying Under Physical Presence Test

Part III is only for US expats who qualify for the FEIE through the Physical Presence Test. If you qualified under the Bona Fide Residence Test, skip this section and complete Part II instead. Again, you must fill out all of the requested information — even if that means just entering “N/A” — to avoid having your claim denied.

In this section, you’ll share information like:

- The start and end dates of the relevant 365-day period

- The main country you worked out of during the tax year

- Details of which countries you stayed in, how long you stayed in them, how many days you were in the US for business purposes, and how much US-source income you earned as a result

Part IV: All Taxpayers

In this section, you’ll share details on your 2024 foreign earned income, including:

- How much you earned in wages, salaries, bonuses, commissions, etc.

- How much noncash income you earned (e.g. value of lodging, meals, company car, etc.)

- How much you received in allowances, reimbursements, or expenses from your employer (if any)

At the end, you’ll total your foreign earned income in 2024.

Important: If you received your foreign earned income in any other currency than US dollars, you must convert it into USD using a reliable calculator. Wise offers a great online currency converter with historical exchange rates.

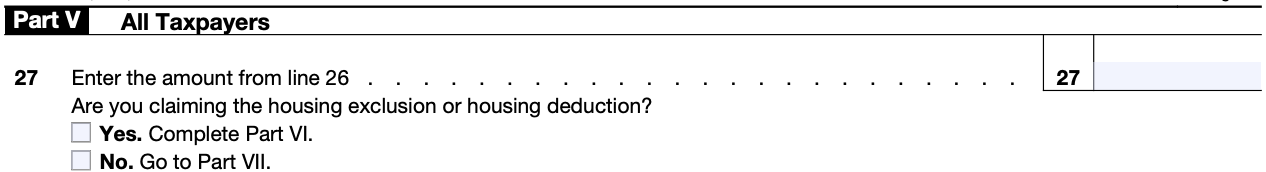

Part V: All Taxpayers

In this brief section, you’ll simply indicate whether or not you plan on claiming the FHE or FHD. If so, you must complete Part VI. If not, you will skip to Part VII.

Part VI: Taxpayers Claiming the Housing Exclusion and/or Deduction

Again, this section is only for those who plan to claim the FHE or FHD. To complete it, you’ll share information like:

- Your total qualified housing expenses

- Note: In most cases, these expenses may not exceed 30% of the FEIE limit, or $37,950 for 2024. However, certain locations with a higher cost of living will have a higher allowable exclusion amount — refer to the Determination of Housing Cost Amounts Eligible for Exclusion or Deduction for 2024 for details

- Where you incurred the expenses

- How many days of your qualified period fell within the 2024 tax year

At the end, this section will walk you through how to calculate your allowable housing exclusion step by step.

Part VII: Taxpayers Claiming the Foreign Earned Income Exclusion

This section will walk you through how to calculate the total amount you can claim under the FEIE. To do so, you’ll need to enter the FEIE maximum (again, $126,500 in 2024), share the number of days in your qualifying period that fell in the 2024 tax year, and perform some basic calculations.

Part VIII: Taxpayers Claiming the Housing Exclusion, Foreign Earned Income Exclusion, or Both

This section walks you through how to claim your total allowable exclusion by factoring in your allowable exclusion under both the FEIE and FHE, as applicable.

Part IX: Taxpayers Claiming the Housing Deduction

This section is for those who will be claiming the FHD. It walks them through how to calculate their total allowable FHD step by step.

Note:

You may need to include some of the information found on Form 2555 on other parts of your tax return, such as Form 1040 and Schedule 1.

Form 2555 filing tips & deadline

There are a few different ways to file Form 2555, but in all cases it should be attached to your Form 1040, which is submitted by:

- Printing & mailing

- Electronic filing

- Note: Some e-filing platforms do not allow Americans to file their tax returns from abroad

Whichever way you choose to file Form 2555, make sure you attach it to the rest of your tax return. Typically, your primary tax form will be Form 1040. The deadline for Form 2555 will be the same as it is for your main tax return.

While most Americans think of April 15th as the tax deadline, expats receive an automatic two-month filing extension until June 15th. You can extend this even further to October 15th by filing Form 4868 or even to December 15th by writing a letter to the IRS.

Note:

If any of these dates fall on a weekend, the deadline automatically changes to the next business day afterwards.

Although expats receive a filing deadline extension, they unfortunately don’t get an extension on their tax payment deadline. If you need to make an estimated tax payment, you must do so by April 15th regardless of when you file your tax return to avoid interest, and by June 15 to avoid failure to pay penalties.

If you don’t file Form 2555, the IRS won’t penalize you — but not filing it can cause you to miss out on some major tax breaks. That said, errors on Form 2555 could result in underpayment or accuracy-related penalties, so it’s best to have a professional tax preparer review it before filing.

Get expert assistance with Form 2555 & beyond

Form 2555 is essential if you want to claim the FEIE, FHE, or FHD. If you meet the Bona Fide Residence Test or Physical Presence Test, you may want to exclude foreign income through one of the aforementioned tax benefits. However, only a qualified tax professional can confirm whether or not it’s the right tax strategy for you.

Resources:

FAQs

-

Does filing Form 2555 affect state taxes?

Unfortunately, most states do not recognize federal expat tax breaks like the FEIE and Foreign Housing Exclusion/Foreign Housing Deduction. If you’re on the hook for state taxes, Form 2555 is unlikely to reduce your state tax liability.

-

What’s Form 2555-EZ?

For several years, taxpayers who qualified for the FEIE and met certain conditions were able to file a simplified version of Form 2555 called Form 2555-EZ. In 2019, however, the IRS retired this form. Today, the only form you can use to claim the FEIE and FHE/FHD is the full-length Form 2555 — IRS form 2555-EZ no longer exists.

-

Can I claim the Foreign Earned Income Exclusion retroactively?

Yes! If you qualified for the FEIE in the past but didn’t realize it when filing, you can claim it retroactively by filing an amended return. To do so, you’ll file Form 1040-X for the year in question and attach a Form 2555 along with it.

Connect on LinkedIn

Connect on LinkedIn