Thinking about spending your golden years surrounded by the lush landscapes and vibrant culture of Colombia? You’re not alone. More than ever, Americans are discovering the perks of retiring in Colombia—from an affordable cost of living to high-quality healthcare and a mild climate.

In this updated guide, we’ll explore the visa requirements and application process, cost-of-living tips, and tax considerations you need to know in 2025 to make retiring in Colombia a smooth transition.

📋 Key Updates for Retiring in Colombia in 2025

- Colombia’s healthcare system is high-quality and low-cost compared to the US. Proposed reforms in 2025 may tweak public healthcare enrollment requirements.

- In 2025, consider building an extra buffer of 10%–15% into cost of living projections for possible peso devaluation or economic shifts.

- For retirees who continue to earn income in a part time capacity, the Foreign Earned Income Exclusion amount is $126,500 for the 2024 tax year, increasing to $130,000 in 2025.

The allure of Colombia for Americans

Americans have long been captivated by Colombia, both for its positive attributes, such as world-renowned coffee, and its challenging past, including the cartel activity and high crime rates of the 80s and 90s.

Encouragingly, Colombia has undergone a transformation over the past two decades. Government efforts to establish peace with guerilla groups, reduce crime, and improve infrastructure have been largely successful. In turn, violent crime has fallen dramatically.

For years, Colombia has been recognized as a haven for backpackers. However, the country’s push to innovate in the past few years has also boosted Medellin’s international standing, winning over many foreigners due to its innovative spirit, cultural scene, and award-winning public transportation.

Given Medellin’s past as the epicenter of the country’s cartel activity, its progress is both significant and commendable. Moreover, as Colombia becomes a more popular travel destination, it is also attracting more long-term expats, including retirees.

Benefits of retiring in Colombia

Retirees are drawn to Colombia for several reasons, including:

Cost of living: Several estimates put Colombia’s cost of living at about 60% less than that of the United States

Climate: Low-lying areas of Colombia generally have a warm, tropical climate, while elevated regions enjoy mild weather year-round

Welcoming environment: Colombia is well-known for its friendly locals, while a robust expat scene facilitates integration into the community

Beauty: From pristine beaches to the Andes Mountains to lush rainforests, there’s no shortage of awe-inspiring sites in Colombia

Healthcare: Colombia has an excellent healthcare system that offers high quality at low costs

Culture: A diverse population and fascinating history result in a rich culture known for its art, music, and dance

Travel: Colombia is a great base to travel out of, with international airports in 13 cities

Time Zone: Colombia’s geographic location puts it within the US central time zone, making it easy to stay in touch with friends and family back home

Best places to retire in Colombia

While Colombia boasts numerous captivating cities and towns, here are a few top suggestions for Americans considering retirement.

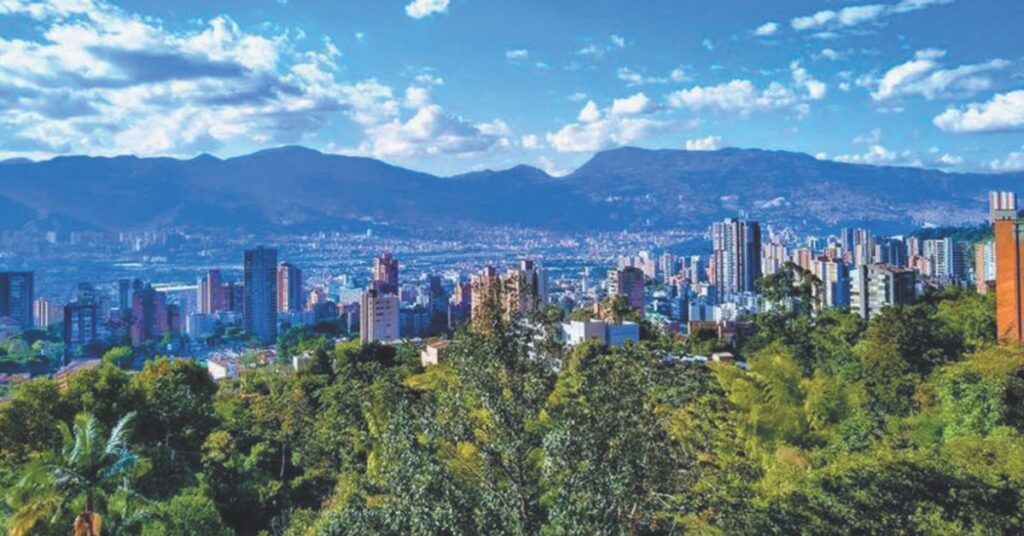

Retiring in Medellin: A lively and cosmopolitan city

Colombian cities, especially Medellin, once had a negative reputation. Today, however, Medellin is a hub for innovation and creativity. Residents of Colombia’s second-largest city enjoy temperate weather year-round, earning it the nickname the “City of Eternal Spring.”

Gorgeous mountain views, architecture, and street art make it a visual treat, while local markets, excellent museums, and world-class restaurants ensure you have plenty to do.

Retiring in Santa Marta: A quiet coastal option

If you prefer a laid-back vibe over the hustle and bustle of the big city, Santa Marta might be just the place for you. White sand beaches with calm, crystal-clear waters lend this port city a relaxed, coastal, and authentically Caribbean feeling. The historic city center, on the other hand, offers beautiful colonial architecture and lively streets, while the nearby Tayrona National Park provides an idyllic natural retreat.

Retiring in Cartagena: A vibrant coastal option

A popular and lively expat destination, Cartagena is a favorite choice for US citizens looking to lean into an established retired expat community. The city is bursting with color and things to do, thanks to an established tourism scene that entices expats and travelers alike with sunset boat rides, food tours, and, of course, salsa dancing. Due to its geographic location, Cartagena is also extremely accessible for US citizens in Florida, with flights from Miami and Fort Lauderdale taking only two hours.

Retiring in Cali: The destination for Colombian culture aficionados

Cali exudes energy and passion, which makes sense given its status as the salsa capital of the world. Whether you’re walking through the city streets or in a bar, you’ll hear salsa music and see salsa dancing just about anywhere you go. Add to that a tropical climate, an abundance of greenery, and a burgeoning culinary scene, and it’s no wonder that Cali has become a go-to retirement destination for expats.

Retiring in Salento: Where a love of natural beauty fosters expat community

With rolling green hills, world-renowned coffee, and old-world charm, Salento draws travelers and expats the world over. This small but colorful town tucked in the Central Cordillera mountain range boasts walkable neighborhoods, safety, and a tranquil pace of life. Still, you can spend hours exploring the cozy cafés, craftwork vendors, and bustling central plaza.

Ask anyone who lives there, though, and they’ll say the people are the best thing about Salento. If you want to live in a place where locals and expats form one tight-knit community, you’d be hard-pressed to find a better destination than Salento.

Colombia retirement visa for US citizens

Americans seeking to retire in Colombia will likely find the Pensionado visa to be the best visa pathway.

Pensionado visa

While Colombia’s former TP-7 pensionado (pensioner’s) visa was only valid for one year, the current M-11 pensionado visa lasts three years. And the pensionado visa requirements are fairly lax — to qualify for it, all you have to do is:

- Earn at least 3x the minimum wage of 1.4 million pesos — about $970 USD total — per month in passive income, which includes retirement distributions, investment income, and any other income you don’t receive from actively working

- Dependents may require additional income; contact your nearest consulate or embassy to learn more

- Have a clean criminal record

- Provide a health certificate proving reasonably good health

- Purchase health insurance for the duration of your time in Colombia

After five years of living in Colombia with an M visa, you can apply for residence.

Note: While Ecuador is known for its accessible retirement visa, Colombia’s Pensionado visa presents a compelling and potentially even more affordable alternative.

How long does it take to get a visa to live in Colombia?

Typically, it takes about a month to hear a response after submitting your visa.1 Keep in mind, though, that you should factor in some additional time to gather the required application documents before submitting and receiving the physical visa afterward.

Healthcare in Colombia for US expats

Retirees thinking about moving to Colombia will be encouraged to hear that healthcare in Colombia is excellent. They have the best hospitals in South America, and on an international scale, their healthcare system ranks as one of the world’s best.2 Of course, like most other countries, larger cities like Bogota, Cali, and Medellin tend to have better healthcare than rural areas, so individual health needs should be considered a major factor when selecting a Colombian city or region for retirement.

While residents and citizens have access to government-funded universal healthcare, M visa holders must purchase private health insurance for the duration of their visa. Private Colombian plans start at about $150 USD per month,3 although you can also choose from nomad health plans that cover you in multiple countries — such as SafetyWing — if you plan on traveling a lot.

Health precautions in Colombia

Every country has its health risks. In Colombia, these include:4,5

- Illnesses spread by mosquitoes (Dengue fever, Zika virus, malaria, yellow fever) or animals (rabies, Hantavirus)

- Illness from contaminated food or water (typhoid, leptospirosis, Hepatitis A)

- Respiratory illnesses (tuberculosis, diphtheria)

As such, it’s important to stay up-to-date on your vaccines, talk with your doctor, and research preventative care measures before visiting Colombia.

How much does it cost to retire in Colombia?

Given that the average income in Colombia ($22,248 USD) is much lower than in the US ($77,463 USD), it’s logical that the cost of living is also reduced. US retirees can generally live comfortably on $1,500 to $2,000 USD per month or even less depending on their lifestyle and location.6

Most retirees open a bank account in Colombia, although digital banks like N26 and Ally are catching on in popularity. If you retain ties with US financial institutions, you’ll want to look into a currency conversion platform like Wise to quickly and conveniently transfer money between international accounts.

Retiring in Colombia on Social Security: Considerations

The average Social Security check is about $1,780 USD per month,7 making it possible for retirees to live off of their Social Security income alone in Colombia (although a little extra per month can provide some additional creature comforts). What’s more, recently passed legislation allows tax residents to exempt the first ~$10,076 USD in pension income from taxation.8

Do Americans pay tax in Colombia?

Because there’s no tax treaty between the US and Colombia, Americans living in Colombia as retirees are subject to taxes by both the Colombia and US governments. Don’t worry too much, though — that doesn’t necessarily mean you’ll face double taxes on the same income.

Colombia Taxes

Colombia considers anyone who spends 183 days or more in the country to be a tax resident. You’ll likely have to file a tax return (Declaración de Renta) as well if you meet any of the following conditions:*

- Earned more than 59,377,000 COP (~$14,110 USD)

- Spent/charged more than 59,377,000 COP (~$14,110 USD) to credit cards

- Deposited/invested more than 59,377,000 COP (~$14,110 USD)

- Had a net worth of more than 190,854,000 COP (~$45,353 USD) by the end of the year9

*All figures as of October 2023

Income tax rates in Colombia as of 2023 are as follows:10

| Taxable Income Band (COP) | Taxable Income Band (USD) | Marginal Tax Rate |

|---|---|---|

| 0 – 1,090 UVT | ~$0 – $10,249 | 0% |

| 1,090 – 1,700 UVT | ~$10,250 – $15,985 | 19% |

| 1,700 – 4,100 UVT | ~$15,986 – $38,547 | 28% |

| 4,100 – 8,670 UVT | ~$38,548 – $81,512 | 33% |

| 8,670 – 18,970 UVT | ~$81,513 – $178,336 | 35% |

| 18,970 – 31,000 UVT | ~$178,337 – $291,391 | 37% |

| 31,000+ UVT | ~$291,392+ | 39% |

Additional Colombian taxes you may encounter include:10

- Property taxes: 0.5% to 1.2%

- Capital gains taxes: 15%

- VAT: 19%, with select items at 5% or 0%

US Taxes

All US citizens and permanent residents, including those residing abroad, must pay taxes on their global income if they meet the minimum income thresholds. There are tax breaks that can offer relief for expat retirees, however, such as:

- Foreign Tax Credit (FTC): The Foreign Tax Credit allows US expats to essentially subtract what they have paid in income taxes to a foreign government from what they owe to the US government (though as with all things US-tax related, it’s not quite that simple)

- Keep in mind, too, that:

- Withdrawals from post-tax retirement accounts, like Roth IRAs and Roth 401(k)s, are tax-free on your US tax return

- Only up to 85% of your social security payments are subject to taxation in the US

References:

- Colombia Retirement Visa: Ultimate Guide 2025

- Overview of Colombia Healthcare System

- THE EXPAT GUIDE TO COLOMBIAN HEALTH INSURANCE PLANS: EPS, PRIVATE, GLOBAL

- Colombia – Traveler’s view

- Colombia – Fit for Travel

- Retire in Colombia: Future Expats Guide 2025

- Social Security 2023: What’s the Average Benefit at Every Age?

- Colombia – Individual – Taxes on personal income

- Colombia – Individual – Tax administration

- Colombia – Individual – Other taxes

Retiring in Colombia - FAQ

-

Can a US citizen retire in Colombia?

Yes! In fact, Colombia offers a dedicated retirement visa called the pensionado visa. To qualify, you just have to earn about $830 USD in passive income per month, have a clean criminal record, be in reasonably good health, and purchase private health insurance.

-

What currency is used in Colombia?

Colombia uses the Colombian peso (COP). As of this writing, $1 USD is equal to about 4,250 COP.

-

Are there reasons not to retire in Colombia?

If you plan to retire in Colombia, pros and cons should be weighed against one another. While there are many positives to living in Colombia, it may not be right for everyone for a few reasons: (6)

- While violent crime has fallen dramatically in recent years, petty crime like pickpocketing and theft is not unheard of (although common-sense precautions will reduce your risk)

- While major cities have modern infrastructure, many rural areas’ infrastructure is limited

- Speaking Spanish can be a deterrent for some retirees, although others enjoy the challenge and English is more widely spoken in tourist and expat hotspots

Connect on LinkedIn

Connect on LinkedIn