Thinking about selling your foreign property but unsure where to start? Imagine wrapping up the sale of your home abroad with confidence, knowing you’ve navigated the tax implications and legal requirements like a pro. While the process might feel complex at first—currency conversions, tax filings, and endless paperwork—we’re break it down into straightforward steps.

In this guide, we’ll walk you through everything you need to know about selling foreign property as a U.S. expat, including key tax considerations like capital gains, foreign tax credits, and reporting requirements. By the end, you’ll feel empowered to handle the process with ease. Let’s begin with an overview of one of the most important topics: capital gains.

📋 Key Updates for Selling Foreign Property in 2025

- Capital gains tax rates and brackets, relevant to property sold in 2024 have been increased for inflation. The 15% rate applies to single filers with more than $47,025 of taxable income, and the 20% rate applies to those with more than $518,900.

- The IRS thresholds for primary residence exclusions remain $250,000 for single filers and $500,000 for joint filers in 2025.

- Use IRS-approved 2024 exchange rates to report sales transactions accurately in USD on your tax return, but be sure to apply rates relevant at the time of transaction when calculating cost.

How Capital Gains Are Calculated and Reported When Selling Foreign Property

Capital gain refers to the profits or income earned from the sale or disposition of a capital asset, such as real estate. A gain is calculated based on the increase in the property’s value from when when you became the owner of the property (its “basis”) to when you sell it.

In mathematical terms:

Sales Price – Basis = Capital Gain

Your basis in a house, for example, at the time of sale is generally calculated as its original costs plus the value of any improvements made to it after it was bought. Examples of improvements may include replacing the roof, repairing windows, or installing an air conditioning system—but not routine maintenance like painting, landscaping, or minor repairs such as fixing a leaky faucet.

That said, the calculation of basis becomes more complex when dealing with gifted or inherited foreign property, as the rules for these situations differ—something we’ll explore in more detail shortly.

Factors that affect capital gains tax calculation

The tax rate for that applies when calculating capital gains depends on the following:

- The amount of taxable income (including the capital gain amount)

- The tax filing status of the seller/taxpayer and

- The classification of capital gains, whether short-term (property held for less than a year) or long-term (property held for a year or more).

Most capital gains on property are long-term, for which the following tax rates apply.

Long-term capital gains taxes, 2024 tax year (filed in 2025):

| Fling status | 0% | 15% | 20% |

|---|---|---|---|

| Single | $0 to $47,025 | $47,026 to $518,900 | $518,901 or more |

| Married filing jointly | $0 to $94,050 | $94,051 to $583,750 | $583,751 or more |

| Married filing separately | $0 to $47,025 | $47,026 to $291,850 | $291,851 or more |

| Head of household | $0 to $63,000 | $63,001 to $551,350 | $551,351 or more |

For short-term capital gains for property held less than a year, the tax rate is the same as the seller’s ordinary income tax rates. These are between 10% and 37%.

Now that we’ve established a baseline understanding of capital gains let’s contextualize this within two examples: selling a gifted home and selling an inherited foreign property.

Tax implications of selling a gifted house

The IRS defines a gifted home as one that is transferred to you for nothing in return or a sum less than its fair value. This means someone transferred ownership of a home to you, and you gave them nothing, or less than market value in return for the transfer.

Selling a property you received as a gift has tax implications, which you’ll want to carefully consider so that you can maximize your profit when it’s time to sell.

First, keep in mind that you usually carry over the basis value of a gifted home from the donor’s original basis, known as a “carryover” basis. As a result, if you sell the property, you will calculate the taxable gain or loss based on the basis of the property held by the person who gifted it to you.

This may be lower than the current fair market value (FMV) and can result in a higher taxable gain and potentially more capital gains tax liability compared to inherited property.

Secondly, when you sell a gifted house, you’ll generally need to pay capital gains tax on the profits. Refer to the table above to understand at what point you become liable for capital gain tax.

Now, let’s take a look at a the tax implications of selling an inherited foreign property.

Tax implications of selling an inherited foreign property

There is one major difference between selling a gifted home and selling an inherited foreign property. Rather than using the donor’s original basis like in gifted property, when calculating the capital gain on an inherited property you generally “step up” the basis value to the fair market value (FMV) of the property at the time of the decedent’s death.

This means you adjust the property’s basis to its FMV, which typically results in a substantially lower taxable gain, and therefore income tax bill, when tax time comes around.

Mathematically speaking, we can estimate the capital gain on an inherited foreign property by calculating the following:

Sales price – Fair market value at the time of decedent’s death = Capital gain

When selling an inherited property as an expat, you will also need to consider how best to comply with foreign tax laws in the property is located in, and potentially the country you reside. Many expats find it worthwhile to collaborate with a tax professional or a qualified international tax attorney, and/or an international estate planner.

Tax implications of foreign real estate sales – additional examples

Example 1: Selling a primary residence

If the property was your primary residence and you lived there for 24 out of the last 60 months, you’re eligible for a capital gains tax exclusion. The IRS specifies in Section 121 that you can exclude up to $250,000 in capital gains from taxation. If you’re married and file a joint tax return, this increases to $500,000.

Let’s say you’re a US expat who lived abroad in Iceland for the past three years in a home you purchased in 2019. If this home is your primary residence and you have lived there for at least two out of the last five years, you can qualify for this exclusion. So, if you bought the house for $300,000 and sold it for $450,000, your profit (read: capital gains) would be $150,000. This profit is less than the capital gains exclusion, so you would not report your home sale on your US tax return.

There are some exceptions that still allow you to take the capital gains exclusion (or part of it) if you don’t meet the 24/60 month rule, however.

If you had to sell your house because of unforeseen circumstances, you may still be able to claim a partial or full exclusion. A few examples of unforeseen circumstances include a divorce, change of employment, or change in health.

Example 2: Selling a rental property

If you owned the property for less than one year, the IRS considers this a short-term capital gain. To report this, complete Section I of Schedule D. The IRS would tax you at your ordinary tax bracket, meaning the rate that applies to other types of ordinary income, such as your wage or interest income.

Capital gains on rental properties owned for more than one year are treated a little differently. In order to figure out the tax on the sale of a rental property, you’ll need to:

- Determine your cost basis, which includes the original purchase price, purchase expenses (like title and escrow fees), improvements or renovations

- Adjust for the accumulated depreciation you reported (or should have reported) on all tax returns filed during your ownership of the property

As a reminder, these numbers together are considered the tax basis on your property.

Next step: subtract the tax basis from the proceeds of the sale. If the resulting number is positive, it means you profited or generated a gain on the sale. Thus, you may owe the US capital gains tax. In this case, you would be taxed partly on the amount you earned on the sale and partly on the amount of depreciation you claimed on the home. This is called a “depreciation recapture.”

If the number is negative, you did not make a profit. In that case, you would not owe any capital gains tax because the sale resulted in a loss. Your loss may be deductible to offset other income you have on your tax return.

Example 3: Selling another type of property

There are, of course, other ways to own property aside from a primary residence or a rental property, such as a vacation home or an investment property.

If you own a property for more than one year, it was not your primary residence, and you did not rent it out, you could owe the long-term capital gains tax. This ranges from 0-20%. However, you are only eligible for a tax deduction when you sell the property for a loss and if it was considered a capital asset, not a personal use asset (e.g., a vacation home).

How to report the sale of foreign real estate

The way you’ll report your home sale to the US depends on the location and country of the property. Another factor is whether the money from the sale was deposited into a US bank account. If you received foreign currency for the home sale, for instance, you would have to use the foreign exchange rates associated with the different key figures (for example, date of purchase, date of renovation, sale date) and report in US dollars on your tax return.

Tax forms associated with selling a foreign property

You may need to file three tax forms if you sell a gifted house.

- FBAR

FBAR is an acronym for Foreign Bank Account Report. Any American, including expats, with at least $10,000 in a foreign financial account must comply with FBAR by filing FinCEN Form 114 (1). It’s important to note that you must file an FBAR when the aggregate balance across all foreign accounts exceeds $10,000, which may occur at any point in the year.

If you sell a gifted property, you’ll likely need to file an FBAR if you deposit the sales proceeds in a foreign bank account.

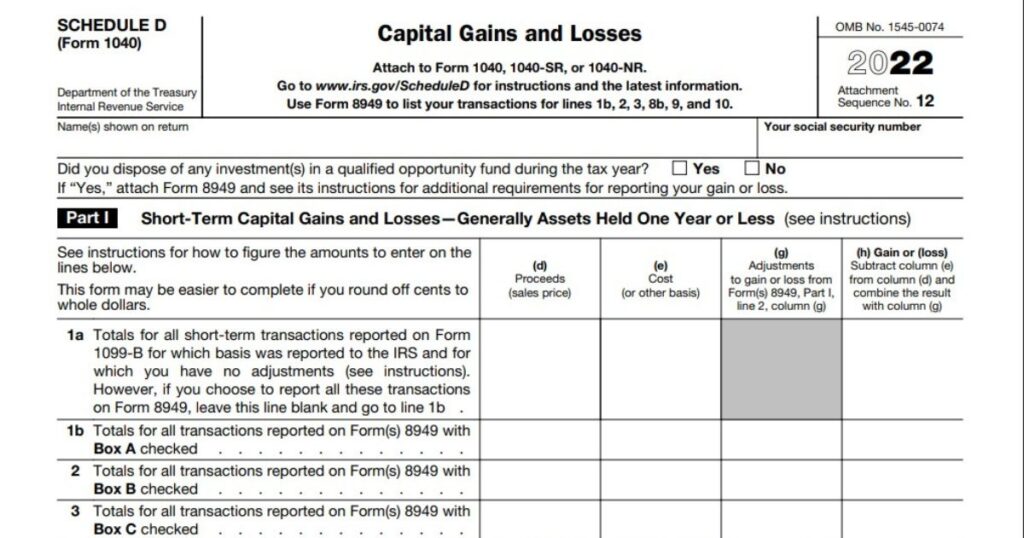

- Form 8949 “Sales and Other Dispositions of Capital Assets”

Anyone who sells a house, gifted or not, must file Form 8949 (2) and report any capital gains. - Schedule D (3)

This is where you summarize all the capital gains you put on Form 8949.

Note: Whether you’re selling a gifted home, a foreign property you inherited, or another type of foreign property, there will always be foreign tax considerations for expats, too.

Navigating taxation treaties and double taxation agreements

US taxation treaties with foreign countries play a crucial role in determining the tax implications of selling a house abroad for American expats. These treaties aim to prevent double taxation and promote cross-border trade and investment by establishing mutually agreed-upon tax rules.

American expats need to understand the specific provisions of the treaty in effect between the US and their country of residence. These provisions may impact the calculation of capital gains tax and the reporting of foreign assets.

The following is a brief overview of US taxation treaties with common expat destinations and the benefits they offer to American expats.

Common US tax treaties with other countries

- Canada: The US has a tax treaty with Canada, the aim of which is to prevent double taxation. Unfortunately, the “Savings Clause” permits the US to tax its citizens as if the treaty did not exist, which significantly erodes its benefits. The solution is for American expats residing in Canada to take advantage of the Foreign Tax Credit.

- United Kingdom: The US has a tax treaty with the UK. The treaty defines which country has “first” taxing rights and “sole” taxing rights. Similarly, the treaty aims to prevent double taxation between the two countries. Since the UK is a higher tax jurisdiction than the US, those who utilize Foreign Tax Credits may entirely offset all their US tax obligations or find themselves with significant tax credits.

- Australia: The US-Australia tax treaty specifies the favorable treatment of retirement income and states that a company will be taxed where it is registered. However, taking advantage of the Foreign Tax Credit remains the best option for those who want to avoid income tax-related double taxation, including capital gains tax.

- France: The US has a tax treaty with France that provides for the exchange of information and defines where income is taxed. However, as with the other treaties, the best way to avoid double taxation is by taking advantage of the Foreign Tax Credit, especially since France has higher tax rates than the US.

- Germany: At 48.1%, Germany has the second-highest tax rates (4) of all OECD countries—after Belgium’s 52.6%. There is a tax treaty between the US and Germany that spells out which taxes are to be paid and to whom.

How tax treaties can affect the tax consequences of selling a foreign property

As a result of the Savings Clause found in many tax treaties, they are usually not an effective tool when selling a foreign property.

And without tax treaties in your toolkit, you may need to report your capital gain on the property you’ve sold—both in the US and the country where the particular property is located.

Usually, where the tax treaties can be helpful is to allow you credit for the tax paid to one country and offset the other’s tax bill – thereby eliminating double taxation

Tips for minimizing tax liability on the sale of a foreign property

In this section, we explore options you can use to minimize your tax liability when selling a foreign property.

How to avoid capital gains tax on foreign property

These are the ways you can avoid capital gains tax or reduce your liability.

Home Sale Tax Exclusion

If you’re selling your primary residence, which the IRS defines as a house you’ve lived in and owned for two of the preceding five years, you can exclude up to $250,000 from capital gains. If you’re married and filing jointly, the exclusion amount doubles to $500,000.

But you must not have claimed a home sale exclusion within the prior two years.

1031 Exchange (5)

Also known as a like-kind exchange or a tax-deferred exchange, a 1031 Exchange is an IRS provision that allows individuals and businesses to defer paying capital gains taxes on the sale of certain types of properties if they reinvest the proceeds into another similar property. There are several complex conditions to meet, however. The chief callout here is that this option is only available for investment and business properties, not for individual taxpayers’ personal residencies. When in doubt, connect with your expat tax accountant to strategize before embarking on a 1031 exchange.

Avoid Short-term Capital Gains

This strategy reduces taxes because the IRS taxes short-term capital gains at marginal income tax rates (10% – 37%), unlike long-term capital gains. So, hold on to a property for more than one year if your situation allows.

Apply the Foreign Tax Credit (6) to reduce US tax liability

The Foreign Tax Credit (FTC) allows US expats to avoid double taxation by permitting those with a foreign income tax bill to set it off against their US tax bill.

Here’s how it works.

If Emma, a resident of Montreal but a US citizen, sells a house in Toronto. She earns a profit of $100,000 on the sale. Both the US and Canada will require her to report the capital gains and pay capital gains tax.

However, Emma can offset her US tax liability by the amount she owes the Canadian Revenue Authority—dollar for dollar.

References

- Report of Foreign Bank and Financial Accounts (FBAR) | Internal Revenue Service (irs.gov)

- About Form 8949, Sales and other Dispositions of Capital Assets | Internal Revenue Service (irs.gov)

- 2022 Schedule D (Form 1040) (irs.gov)

- https://www.oecd.org/tax/tax-policy/taxing-wages-brochure.pdf

- Like-Kind Exchanges – Real Estate Tax Tips | Internal Revenue Service (irs.gov)

- Foreign Tax Credit | Internal Revenue Service (irs.gov)

Frequently Asked Questions

-

Do I have to pay US taxes when I sell a foreign property?

Yes. As a US citizen or green card holder, you’re required to report and potentially pay capital gains tax on the sale—even if the property is overseas.

-

How is capital gain calculated on foreign property sales?

Capital gain = Sales price – Adjusted basis. Your basis is typically the purchase price plus the cost of major improvements (but not routine repairs).

-

What’s the capital gains tax rate on foreign property?

Long-term capital gains (held 1+ year) are taxed at 0%, 15%, or 20%, depending on your income. Short-term gains are taxed at your regular income tax rate (10%–37%).

-

Can I exclude any capital gains from tax?

Yes—if the property was your primary residence for at least two out of the past five years, you may exclude up to $250,000 of gains ($500,000 if married filing jointly).

-

What happens if I inherited or was gifted the property?

Inherited property usually gets a “step-up” in basis to its value at the decedent’s death—minimizing taxable gain. Gifted property typically retains the donor’s original basis, which may result in a larger taxable gain.

-

What forms do I need to file with the IRS?

At minimum, you’ll file Form 8949 (sales detail), Schedule D (summary of gains/losses), and possibly FinCEN Form 114 (FBAR) if sale proceeds hit foreign bank accounts.

-

Do I have to report the sale in local currency or USD?

All figures must be reported in US dollars, using exchange rates on the date of purchase, improvement, and sale.

-

What’s the Foreign Tax Credit and how does it help?

If you paid capital gains tax in the country where the property is located, you can typically use the Foreign Tax Credit to offset your US tax bill—avoiding double taxation.

-

Can I use a 1031 exchange to defer capital gains?

In some cases, yes—but only for investment or business properties (not personal residences), and strict rules apply. Speak to a tax professional before attempting this.

-

What if I sell the property at a loss?

If the property was an investment or rental, you may be able to deduct the loss. If it was personal use (e.g., a vacation home), losses generally aren’t deductible.

-

When is the best time to sell to reduce taxes?

Selling after one year qualifies you for lower long-term capital gains tax rates. If you’ve lived in the property for two of the past five years, consider timing the sale to qualify for the home sale exclusion.

Connect on LinkedIn

Connect on LinkedIn