Navigating the tax implications of retirement savings across borders can be a daunting task. Whether you’re an American expat who has worked in the UK or you’ve moved to the US after building up a workplace pension in the UK, understanding the tax laws of both countries is crucial for optimizing your retirement strategy.

At Bright!Tax, we specialize in helping clients around the globe, including those with UK pensions residing in the US, file their US taxes accurately, on time, and in the most tax-efficient manner possible. One key opportunity for tax efficiency involves the US-UK Pension Tax Treaty, which allows for tax-free withdrawals of up to 25% from UK pensions under certain conditions, a benefit that can significantly impact your retirement planning.

Key Updates and Insights for 2025

- The UK’s Lump Sum Allowance (LSA) permits up to 25% of pension funds to be withdrawn tax-free, capped at £268,275.

- The UK’s annual pension contribution limit is £60,000 for the 2024/25 tax year.

- The US-UK tax treaty allows for tax-free pension withdrawals in the UK to be exempt from US taxation.

Taxing Pension Withdrawals in the UK vs. US

Whether you’re an American citizen, a British expat, or an individual who has worked in the UK and built up a pension, the tax implications of withdrawing your pension funds can be significant. Before delving into the specifics of tax-free lump-sum pension withdrawals, let’s first examine how the UK and the US tax pension withdrawals:

How the UK Taxes Pension Distributions

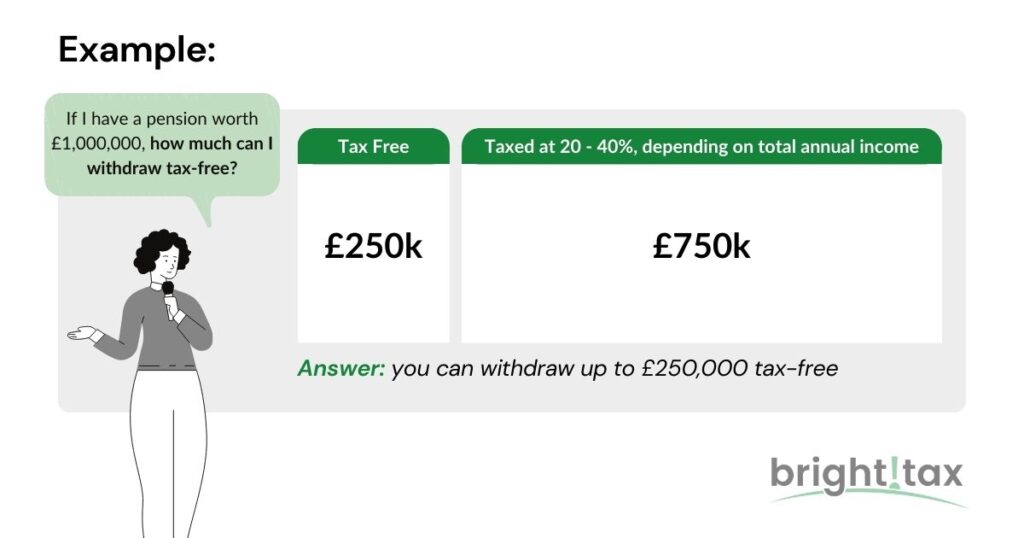

Let’s dig into one of the biggest tax benefits the UK offers. The UK grants pensioners a one-time tax-free withdrawal of up to 25% on pensions, up to £1,073,100. This is known as Pension Commencement Lump Sum (PCLS). After this withdrawal, the pension administrator withholds taxes on the remaining pension at standard rates.

The UK tax authorities will then tax the remaining 75% at the standard personal income tax rate, which ranges from 20% to 45%, depending on your total annual income, upon distribution.

⚡️ Pro tip:

If your annual income is less than £125,140, you can also exclude up to £12,570 from UK taxation as part of your personal allowance.

How the US Taxes Pension Distributions

US Taxes on Distributions From Domestic Pensions

In the US, the taxation of domestic pension (or retirement) income varies depending on its source:

- Traditional 401(k)s, traditional IRAs, pensions/annuity distributions, short-term capital gains, bond income, non-qualified dividends: Ordinary income rate (between 10% and 37%, depending on total annual income)

- Roth IRAs, Roth 401(k)s, qualified distributions: Tax-free, since contributions came from post-tax income

- Social Security: Up to 85% of the benefit is taxed at ordinary rates (between 10% and 37% depending on total annual income); the remaining 15% is tax-free

- Long-term capital gains, qualified dividends: Long-term capital gains rate (between 0% and 20%, depending on the total of gains realized)

💡 Pro tip:

An additional 3.8% net investment income tax may apply in some cases.

US Taxes on Distributions From Foreign Pensions

The US’s citizenship-based taxation system means that all American citizens and permanent residents are subject to federal income taxes. This is even the case for those who live and work abroad. So, by extension, pensions owned by US taxpayers that are based in other countries are still subject to US taxes.

The US does not consider most foreign pensions as qualified. Meaning they don’t recognize the tax-deferred treatment of the pensions like the foreign country does. This means, by default:

- You pay tax on the income you contribute to pensions — so even if the foreign country doesn’t tax the income that you put into a pension account, the US will.

- As your pension accumulates, you must pay taxes on any investment gains or earnings that contribute to the account’s growth.

- If you fail to report pension contributions and growth as income properly, the IRS will tax you on the distributions.

In such cases, the US taxes foreign pension distributions at ordinary income rates (between 10% and 37%, depending on annual income) unless they have a tax treaty with that country that specifies a different tax treatment.

The Role of International Tax Treaties

So what exactly is a tax treaty, and why are they so important?

Again, Americans who live abroad may be subject to taxation by the US and the country where they reside. To eliminate or reduce the risk of double taxation, the US has signed a number of different international tax treaties.

These treaties often include several common elements, such as:

- Residency determination

- Permanent establishment criteria

- Treatment of certain types of income (e.g., wages, gifts, bonuses, capital gains, etc.)

- Withholding tax rates on dividends, interest, and royalties

- Procedures for dispute resolution/tie-breaker rules

- Savings clause

To claim the benefits of a treaty like this, you must meet particular requirements. The specifics vary from treaty to treaty, but generally, you must be a tax resident of both the US and the country in question.

Unfortunately, most of these treaties contain a savings clause. This states that the US government reserves the right to tax its tax residents as if the treaty didn’t exist. However, this doesn’t preclude you from claiming benefits under the treaty. The savings clause typically includes a list of exceptions to which it does not apply. In other words, provisions that survive and remain enforceable in a legal context.

Pro Tip:

Plan pension withdrawals to align with tax years in both countries to optimize tax benefits.

The US-UK Tax Treaty

(Bear with us, we’re about to get technical.)

The UK is one of the countries with which the US has a tax treaty. The treaty covers a wide variety of topics, but a few of the most noteworthy provisions include:

- Avoiding double taxation on certain types of income

- Income taxes and capital gains taxes between the two countries

- Measures designed to combat tax evasion

For the purpose of this article, however, we’re going to focus primarily on the US-UK pension tax treaty provision: Article 17. Two components of Article 17 are of particular interest to those with UK pensions:

- Article 17(1)(b) states that distributions from pensions based in one country are exempt from taxation in the other

- Article 17(2) states that lumpsum withdrawals are only taxed in the country in which the pension is based

While the US-UK tax treaty includes a savings clause that negates Article 17(2), Article 17(1)(b) is not affected. It is acknowledged that interpretations of these clauses can vary among professionals.

Nonetheless, at Bright!Tax, we assert with confidence that because Article 17(1)(b) remains effective, we can rely on the reciprocity provision. This key provision mandates that any tax exemption granted by the UK government is to be mirrored by the US government.

In practical terms, this means that a lump-sum withdrawal from a UK-based pension, if it constitutes 25% or less of the total value, remains tax-free in both the UK and the US. This interpretation aligns with the savings clause’s directive for the US to honor UK’s tax-free treatments.

Our analysis of the treaty is both extensive and meticulous, grounding our position and ensuring that our clients fully leverage every exemption available to them. Further, we have actively validated this interpretation through consultations with numerous external financial and legal experts, confirming the exemption of such withdrawals from taxation in both jurisdictions.

Practical Considerations of Lump-Sum Pension Withdrawals

Making a tax-free withdrawal of up to 25% from your UK pension can be a great way to minimize your tax liability and jump-start your retirement with a comfortable cushion of liquid assets. However, it may not necessarily be appropriate for everyone. Keep in mind that:

- The typical minimum age at which you can make a withdrawal is 55, but it may vary between plan administrators.

- Tax exemption applies to one-time lump sums only.

- Any withdrawal exceeding 25% of the pension’s total value will be subject to ordinary UK tax rates unless you hold certain lifetime allowance protections.

- You may not transfer funds from US-based pre-tax accounts such as traditional 401(k)s or traditional IRAs into a UK pension since that would result in you not paying taxes on that income at any point.

If you do decide to capitalize on the US-UK pension tax treaty provision — or claim other benefits of the overall US-UK tax treaty — you must file Form 8833 along with your federal tax return.

FAQs: US-UK Pension Tax Treaty & Tax Implications for Expats

-

Can I take a lump-sum withdrawal from my UK pension without paying US taxes?

Yes, under Article 17(1)(b) of the US-UK tax treaty, a lump-sum withdrawal of up to 25% from a UK pension is tax-free in both countries. This aligns with the UK’s Pension Commencement Lump Sum (PCLS) rules. However, any withdrawal beyond the 25% threshold is taxable under standard UK rates. You must file Form 8833 with your US tax return to claim this exemption.

-

How are UK pension distributions taxed in the US and UK after the lump sum?

After the 25% tax-free withdrawal, the remaining 75% is taxable in both countries. The UK withholds tax at standard personal income tax rates (20%–45%), while the US classifies foreign pensions as ordinary income (10%–37%). You can offset UK taxes paid using the Foreign Tax Credit (FTC) to avoid double taxation.

-

If I’m a US expat in the UK, how does the US treat my UK pension contributions?

The US does not recognize UK pensions as “qualified” retirement accounts. This means:

- Contributions to UK pensions are taxed by the US, even if they are tax-deferred in the UK.

- Investment growth inside UK pensions is taxable under US law.

- You must report gains and contributions annually, even if you don’t withdraw funds.

If you’re eligible, some employer-sponsored pensions (like UK SIPPs) may qualify for tax treaty exemptions—consult a tax expert to confirm.

-

Can I roll over my UK pension into a US IRA or 401(k)?

No. The US and UK do not allow direct pension rollovers. Transferring funds from a UK pension to a US-based tax-deferred account would mean skipping taxation entirely, which neither country permits. You can, however, withdraw your UK pension and invest the funds separately in a taxable or retirement account in the US.

-

Do I need to report my UK pension on my US tax return?

Yes. If you are a US citizen or green card holder, you must report your UK pension on your US tax return. Key reporting requirements include:

- Form 8938 (FATCA) if your foreign financial assets exceed $200,000 at year-end ($300,000 at any point).

- FBAR (FinCEN 114) if your foreign accounts hold over $10,000 in total at any time during the year.

- Form 8833 if you’re claiming treaty benefits on lump-sum withdrawals.

Not filing these forms can result in significant penalties.

Connect on LinkedIn

Connect on LinkedIn