After years of saving for retirement, if you hold qualified US retirement accounts, you’ll need to take required minimum distributions (RMDs) at some point. While the rules around RMDs and RMD taxation are complex — especially if you live outside of the United States — they’re also essential to understand when retirement planning in order to minimize your tax burden.

Below, we’ll explain in detail what RMDs are, how RMDs are taxed, ways to mitigate RMD income tax, and more.

Understanding RMDs: The basics

Starting at a certain age, those with certain tax-deferred retirement accounts must withdraw a minimum amount each year. This is the case even for those who don’t have a need or desire to take withdrawals. The goal of RMDs is to ensure that the money in these accounts — which consists of pre-tax dollars and investment growth — is eventually subject to tax.

RMD timing

The age at which you must begin taking RMDs depends on your birth year. Up until 2022, account beneficiaries were required to take RMDs once they reached age 72. Before 2020, the RMD age was 70.5. Today, the RMD age is 73 for those born from 1951-1959 and 75 for those born in 1960 or later.

There is an exception, however, for people who reach the RMD age but are still working. In that case, they can postpone taking RMDs from their most recent employer-sponsored plan as long as they don’t own more than 5% of the employer business.

Typically, you must take your RMD within the calendar year of reaching the relevant age of required distribution. For your first RMD, however, you have until April 1 of the year following the year you reach the RMD age. You’ll still have to make the second annual distribution within the same calendar year, though. From then on, you must take an RMD for every calendar year.

Example: Cynthia is a US expat living in France. She turned 73 on October 10, 2024. She has until April 1, 2025 to take her first RMD. She must take her second no later than December 31, 2025.

Note:

Those with a 403(b) who made contributions prior to 1987 may have a different RMD age than others.

Accounts subject to RMDs

Accounts that trigger RMDs include all employer-sponsored retirement plans, such as:

- 401(k)s

- 403(b)s

- 457(b)s

- Profit-sharing plans

They also apply to certain IRAs and IRA-based plans, such as:

- Traditional IRAs

- Simple IRAs

- SEPs

- SARSEPs

Some types of IRAs and retirement accounts — like Roth IRAs and Roth 401(k)s — are not subject to RMDs while the owner is alive. This is because the money in these accounts has already been taxed. However, there are exceptions for beneficiaries once the account is inherited.

Inherited IRAs

Beneficiaries who inherit an IRA after the original account owner’s death are subject to different rules, depending their relationship to the owner and beneficiary type. For example:

- Designated beneficiaries (those specifically named by the original owner) must generally withdraw the entire IRA balance within 10 years of the original owner’s death. They are not required to take annual RMDs within this period, except in cases where the account owner had already reached their RMD age.

- Eligible designated beneficiaries are exempt from the 10-year rule and may choose to take RMDs over their own life expectancy. An eligible designated beneficiary must fall into one of the following categories:

- The surviving spouse of the original account owner

- A minor child of the original account owner (until reaching the age of majority, at which point the 10-year rule applies)

- Individual with a disability

- Chronically ill individual

- A beneficiary who is no more than 10 years younger than the original account owner

- Non-designated beneficiaries may need to withdraw all funds within five years of the original account owner’s death

- Surviving spouses have additional flexibility. They may roll the inherited IRA into their own IRA or wait to begin taking RMDs until the year the original owner would have turned the RMD age, or they may take RMDs based on their own life expectancy.

These are just a few general guidelines, however — the rules around inheriting an IRA are complex. If you inherit one, it’s best to reach out to a financial advisor and a tax professional for guidance.

How to calculate RMDs

To calculate your RMD, you’ll divide the account balance on December 31 of the previous year by a distribution period in an IRS-provided table.

The exact table you will use will depend on your circumstances:

- Uniform Lifetime Table: For unmarried IRA owners, married owners with spouses who are no more than 10 years younger, and married owners whose spouses are not the sole beneficiaries

- Table I (Single Life Expectancy): For beneficiaries who are not the spouse of the original account owner

- Table II (Joint Life and Last Survivor Expectancy): For owners whose spouses are more than 10 years younger and are sole beneficiaries

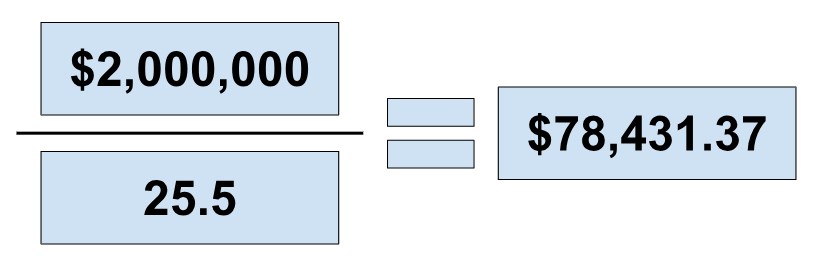

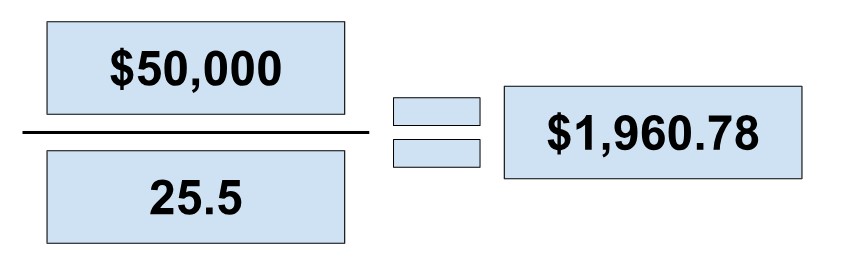

Example: Francesca is a 74-year-old US expat married to Henry, a 76-year-old US expat. Using the Uniform Lifetime Table, she sees that her distribution factor is 25.5. She has two retirement accounts that are subject to RMD rules: a 401(k) and a traditional IRA. The 401(k) was worth $2 million on December 31, 2023, while the IRA was worth $50,000.

First, Francesca calculates the RMD for her 401(k):

Then, she calculates the RMD for her traditional IRA:

Francesca must take $78,431.37 from her 401(k) and $1,960.78 from her IRA, for a total amount of $80,392.15.

Note:

Most retirement plan administrators will calculate RMDs for you. Reach out to the financial institutions that administer your retirement plan in advance to confirm whether or not they do so.

Aggregation rules

Generally, you must take the RMD calculated for each account separately. In some situations, though, you may be able to aggregate your RMDs from different accounts and take them from a single account. You can generally aggregate RMDs across traditional, rollover, SEP, and SIMPLE IRA accounts.

For 401(k) plans and 457(b) plans, however, you must calculate and take the RMD from each individual account. You can aggregate RMDs for 403(b) plans, but only with other 403(b) accounts.

Example: Ali has three different retirement accounts: a traditional IRA, a rollover IRA, and a 401(k). The RMD for his traditional IRA is $10,000, while the RMD for his rollover IRA is $20,000. Ali can make these withdrawals separately, or take the full IRA RMD of $30,000 from one account: either the traditional IRA or the rollover IRA.

However, he must take his 401(k) RMD of $40,000 separately — he cannot aggregate it with his IRA RMDs.

Taxation of RMDs

RMDs are included in your taxable income and taxed at ordinary rates (10% to 37%, depending on your overall taxable income). Your retirement plan administrator should give you a copy of Form 1099-R detailing your withdrawals over the tax year, which you’ll then report on Form 1040:

- IRA distributions will go on line 4a (gross distributions) and line 4b (taxable amount)

- Pensions, annuities, and 401(k) plans will go on line 5a (gross distributions) and line 5b (taxable amount)

If you’ve made any post-tax contributions to a traditional IRA, you can use Form 8606 to calculate which parts of your distributions are and are not taxable.

Expat-specific tax implications

For Americans living abroad, RMDs may be subject to income taxes in their country of residence as well. Each country has different tax laws, of course, so you’ll need to understand the rules specific to your situation.

However, many countries do not tax the foreign-sourced income — including retirement income — of non-tax residents. Others — like Greece — may specifically offer tax breaks or exemptions for foreign retirement income under certain conditions, even for tax residents.

Late RMDs & penalties

Failing to withdraw RMDs in a given tax year can lead to penalties. The IRS levies an additional 25% tax on each dollar that should have been, but was not, withdrawn. Previously, the tax was 50%; however, the 2022 SECURE 2.0 Act cut it in half.

If you make up for the missed RMD quantity within two years, the penalty decreases to 10%. To do so, you must file Form 5329 for each year you failed to take an RMD.

Strategies to optimize RMD taxation

A few different strategies you can employ to minimize your RMD tax burden include:

Roth conversions

Because Roth accounts are not subject to RMDs, converting traditional IRA funds into a Roth IRA can help you lower your RMDs — and the taxes associated with them — in the future. This can be particularly beneficial if you expect your tax rate in retirement to be higher than your current tax rate.

To do a Roth conversion, you’ll generally need to:

- Open and fund a traditional IRA (if you haven’t already)

- Contact your plan administrator

- Submit the required paperwork

- Pay taxes on IRA contributions and gains

- Disclose the Roth conversion on Form 8606

Note that this often leads to a significant tax bill, so it’s best to carry out a conversion in a lower-income year or little by little over several years. To avoid a 10% penalty, you’ll need to a) keep the funds in the Roth IRA untouched for at least five years or b) wait to withdraw until age 59 ½ or older.

Qualified Charitable Distributions (QCDs)

If you don’t need the full amount of your required minimum distribution (RMD) for personal expenses, making a Qualified Charitable Distribution (QCD) can be an excellent way to give back while reducing your tax bill. A QCD allows you to transfer up to $100,000 per year directly from your IRA to a qualified charity, bypassing taxable income altogether.

If you’re still making deductible contributions past the age of 70 ½, you must subtract them from your eligible QCD amount. This ensures that you aren’t “double-dipping” — getting a tax deduction on IRA contributions that you then use as part of a tax-free QCD.

Example: Lee is a 75 year old who must take a $120,000 RMD from his traditional IRA. He wants $100,000 of that RMD to go toward a QCD. However, between ages 70 ½ to 74, he made $10,000 in IRA contributions while he continued to work. Lee must therefore subtract the $10,000 he contributed from the $100,000 QCD — allowing him to make a $90,000 QCD.

The remaining $30,000 will be subject to ordinary income tax rates.

Timing

Here’s a more streamlined approach to using timing strategies to reduce the tax burden from Required Minimum Distributions (RMDs)::

- Begin withdrawals early. Starting to withdraw from retirement accounts at age 59½ can help spread taxable income over multiple years, potentially keeping you in a lower tax bracket and reducing the impact of larger RMDs later. This can also allow you to delay Social Security, which can increase your monthly benefit amount over time.

- Note: Be careful not to withdraw so much that it pushes you into a higher tax bracket.

Meet the Deadline to Avoid Penalties. Taking RMDs by the December 31 deadline each year helps avoid the IRS-imposed penalty, which is 25% of the amount not withdrawn (or 10% if corrected promptly under new rules).Strategize the timing of your withdrawals during the year:

- Early in the year

- Pros: May be easier to remember; allows for an IRA conversion later in the year; lets you withdraw before any potential market losses later in the year; gives beneficiaries more time to make an RMD if you pass during the year

- Cons: May miss out on tax-deferred growth throughout the year in a bull market

- End of the year

- Pros: Allows for a longer period of tax-deferred growth; gives you money up front for the following year

- Cons: Funds could be worth less at the end of the year in a bear market; could force beneficiaries to make an RMD in a tight timeframe if you pass; may be easier to forget

- Spread throughout the year

- Pros: Mitigates the risk of taking funds out at an inopportune time in the market; gives you a steady cash flow

- Cons: Can be harder to calculate; may miss out on tax-deferred growth

Each approach has benefits and drawbacks depending on market conditions, personal cash flow needs, and tax planning goals, so consulting a tax advisor can help determine the best strategy for your situation.

Expat tax breaks

Expats have a few different tools at hand that may help reduce RMD tax liability. If you live in a country with a US income tax treaty, you may be able to claim benefits that eliminate the risk of double taxation. That said, saving clauses typically negate most (but not necessarily all) provisions.

You may, however, be able to claim an expat tax break:

- The Foreign Earned Income Exclusion (FEIE): Allows you to exclude up to $120,000 (2023) or $126,500 (2024) of foreign earned income from taxation. While RMDs are not earned income — and are therefore not FEIE eligible — you can exclude other foreign earned income under the FEIE to reduce your overall taxable income

- The Foreign Tax Credit (FTC): Gives those who pass either the Physical Presence Test or the Bona Fide Residence Test dollar-for-dollar tax credits for any foreign income taxes they’ve paid. In countries with higher taxes than the US, this can not only eliminate your US tax bill, but give you surplus credits to use in the future

Before employing any of these strategies it’s imperative to talk to a tax advisor. Only certified tax professionals have the knowledge and experience needed to recommend the right RMD tax mitigation strategy (or strategies) for you.

FAQs

-

Are RMDs included in your adjusted gross income (AGI)?

Yes, RMDs are included in your adjusted gross income (AGI), which may bump you into a higher tax bracket. It can also affect things like whether your Social Security benefits are subject to taxation, how much your Medicare premium is, and which tax breaks you can claim.

-

Connect on LinkedIn

Connect on LinkedIn