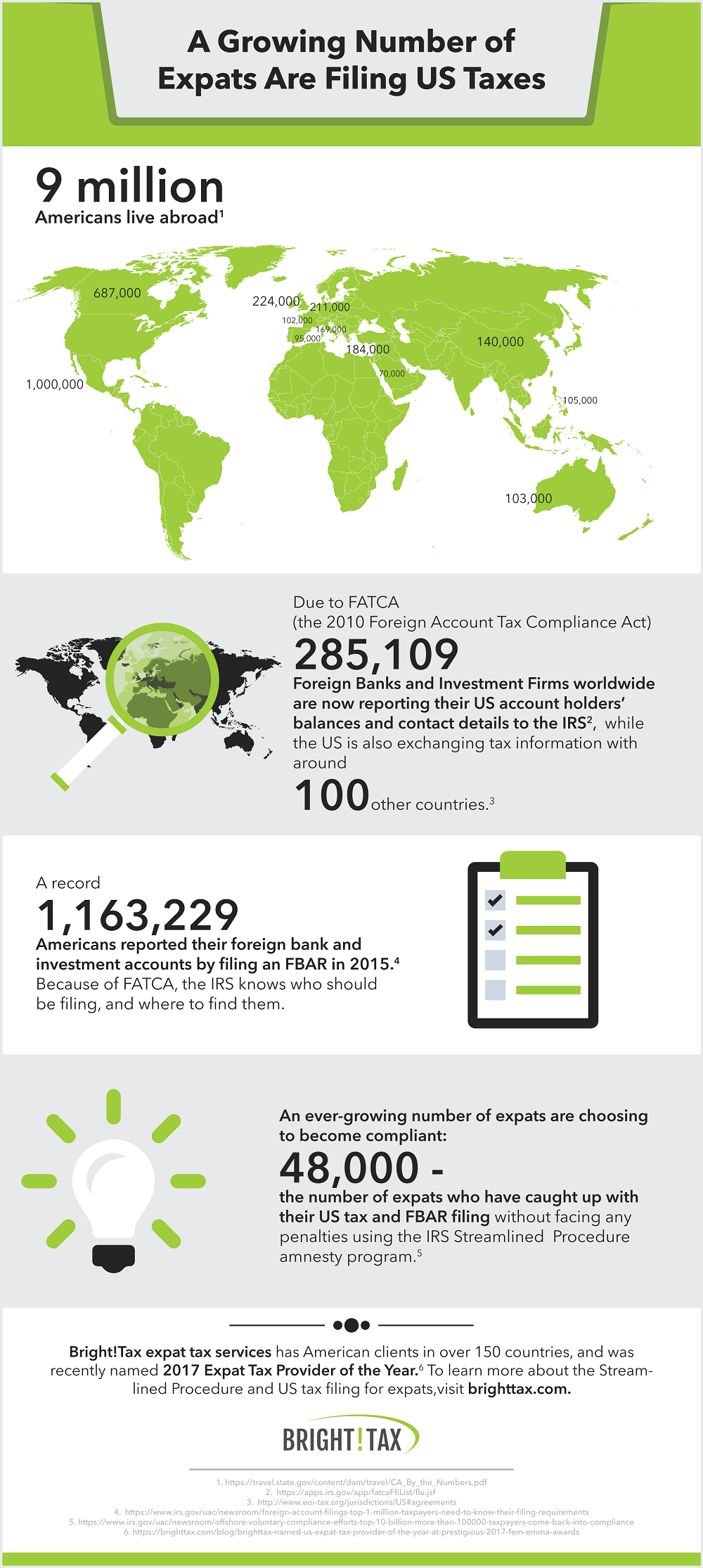

Living abroad is the adventure of a lifetime, however American expats are still required to file a US tax return reporting their worldwide income, as well as complying with the tax rules in their country of residence. Furthermore, there are extra US tax filing requirements that only apply to expats, such as filing an FBAR, […]

Currency Exchange Rates For US Expat Tax Returns Guide

10/02/2017